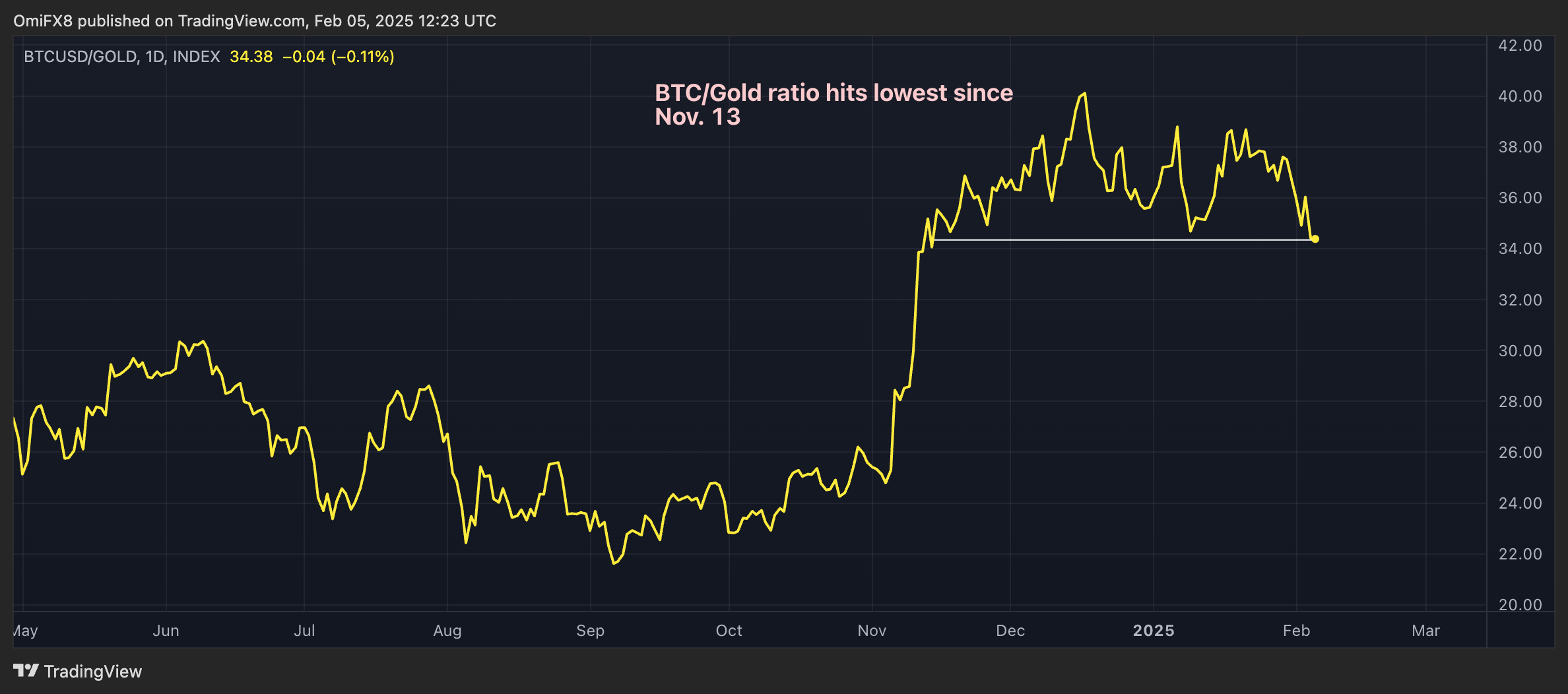

Gold (XAU) is reaffirming its position as a safe haven asset due to ongoing concerns over the U.S.-led trade war, while Bitcoin (BTC) strives to gather upward traction. Dynamically lowers the Bitcoin gold ratio.

The ratio between the price of Bitcoin and the lowest Bitcoin price since November 14 and the price of gold per ounce has dropped to 34, almost at its peak in March 2024, according to the Charting Platform TradingView. . It has dropped 15.4% since reaching a peak of over 40 in mid-December.

According to Reuters, a record price of $2,877 per ounce for gold year-to-date amid the escalation of the U.S.-China trade war.

Tariff threatens the already specialized metal products COSEX futures prices have been significantly higher than spot prices in recent months. This allowed traders to load US-bound aircraft with yellow metal. Investment banking giant JPMorgan Chase plans to provide $4 billion in gold bars to New York this month, the Guardian reported. In addition, China’s demand for gold has Due to the surge in the Spring Festival holiday.

At the same time, according to the 10x study, spot Bitcoin (BTC) ETFs listed in the United States mainly come from traders engaged in BTC non-direction arbitrage bets.

“The purchase of ETFs may be offset by simultaneous sales or futures sales, weakening any significant price impact,” Markus Thielen, founder of 10x research, said in a note to clients on Monday. Since its release, the ETFs on site in the United States Inflation data Three weeks ago.