In her new Book, Bad Company: Private equality and the death of the American dreamjournalist and wired student Megan Greenwell Chronicles the devastating effects of one of the most powerful yet poorly understood forces in modern American capitalism. Flow with money, mostly unregulated, and constantly focused on profit, Private equality firms Quietly remodeled the US economy, taking over large pieces of industries ranging from health care to retail – often leaving financial ruin.

Twelve million people in the United States are now working for companies owned by private capital, Greenwell writes, or about 8 percent of the entire employed population. Her book focuses on the stories of four of these individuals, including a toy “R” American supervisor who loses the best job she has ever had and a Wyoma doctor who is looking at her rural hospital to cut essential services. Their collective experiences are a scarce story about how innovation is replaced by financial engineering and the ways the change pays from everyone, except those at the top.

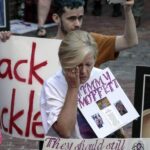

In a review of Bad company For Bloomberg, a longtime private equity executive accused Greenwell of searching for sad stories with inevitably “sad ends. “But the characters Greenwell selected not only sit and watch as private capital destroy their communities.

Greenwell spoke to Wired at the end of last month about what is private capital and not, as it has transformed different industries, and what workers do to recover their power.

This interview was edited for clarity and length.

Wired: What is private capital? How is the business model different from, for example, risk capital?

Megan Greenwell: People confuse private capital and risk capital all the time, but it is quite acceptable that normal people do not understand the difference. Basically, the easiest way to explain the difference is that business capital companies invest money, usually in startups. They basically participate in the company and expect some kind of return over time. They also generally play a significantly longer game than private capital.

But the way private equity works, especially with borrowed purchases, which is what I focus on the book is that they buy companies directly. In risky capital, you enter your money, you entrust it to CEO, and you probably have a board chair. But in the borrowed shopping model, the private stock company really is the owner and checking decision of the portfolio company.

How do private equity companies define success? What kind of companies or companies attracts them?

In Venture Capital, VCs estimate whether to make a deal based only on whether they think that company will succeed. They are looking for unicorn. Will this company be the next Uber? Private capital is looking to raise money through companies in ways that do not really require the company itself to earn money. That’s like the biggest thing.

So it’s less playful.

It is very difficult for private equity firms to lose money on deals. They receive a 2 percent management fee, even if they manage the company to the ground. They are also capable of extracting all these tricks, such as selling the company’s real estate and then load the company to rent on the same land that it used to own. When private equity companies take out loans to buy companies, the debt of those loans is assigned not to the private equity company but to the portfolio company.