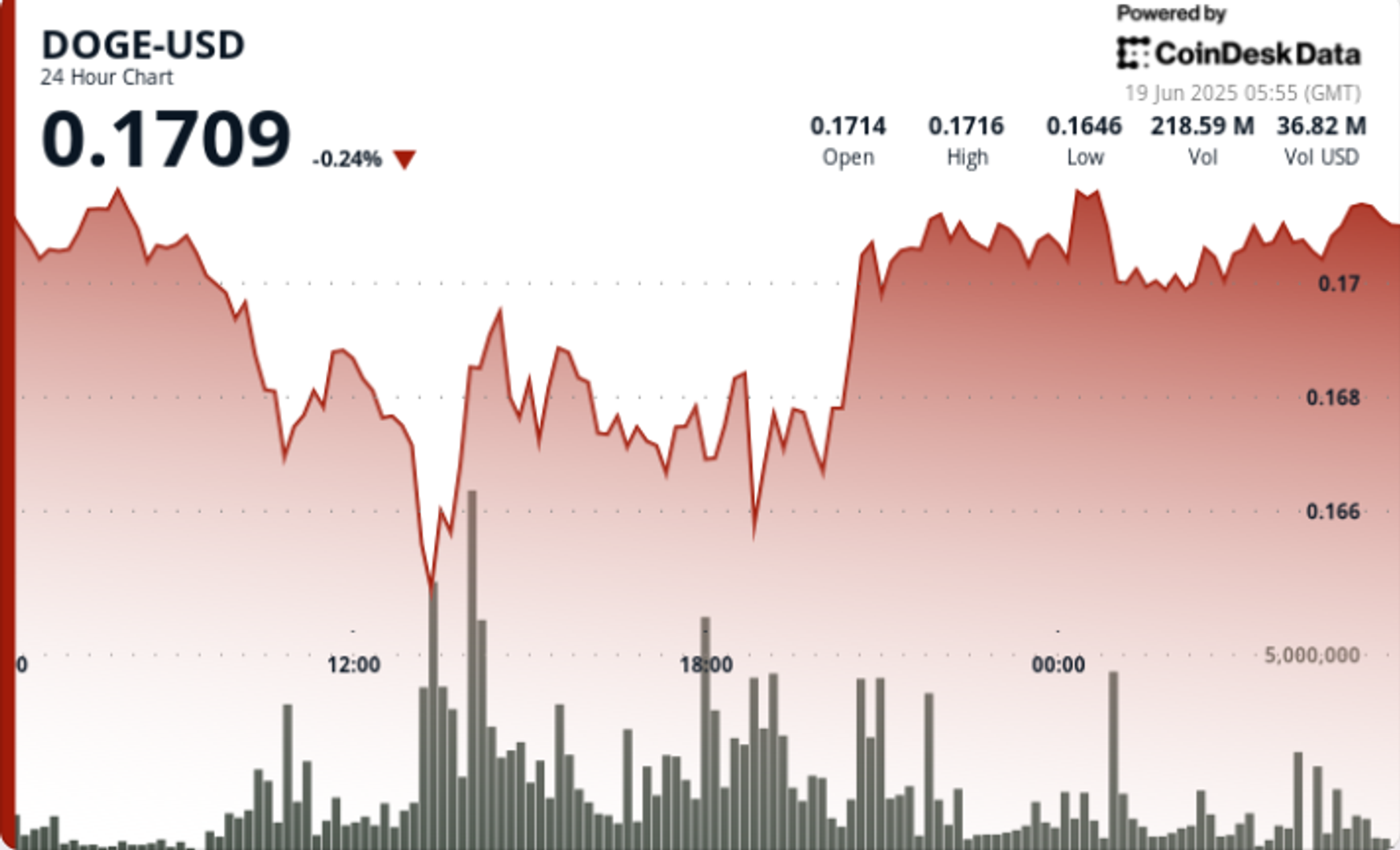

Dogecoin (Doge) recovered from an intraday low of $0.164 to close at $0.171, with its bounce consistent with a wider market weakness of 4.7%. The move shows that institutional buyers may quietly accumulate lower levels as market participants continue to volatility.

News background

- Dogecoin’s rebound comes after geopolitical tensions between Israel and Iran rise to huge sales pressure. The sharp and comprehensive correction that triggered a massive liquidation briefly pushed multiple intradays on Wednesday for more than 7%.

- At the same time, macroeconomic headwinds continue to exist. The U.S. Federal Reserve continues to maintain its restrictive monetary policy, keeping interest rates at 4.25%-4.50%, while actively reducing its balance sheet – a dynamic that has historically been under pressure on risks such as Doge.

- Still, Memecoin is one of the most liquid assets in the cryptocurrency space, with daily turnover close to $1.37 billion and holding a market capitalization of more than $24.7 billion.

- Elsewhere, technical indicators show that Doge has entered oversold territory, and Lunarcrush’s social sentiment data shows that 86% of the positive tone of over 16,000 mentions suggest that even in price fluctuations, the same is true for the community’s ongoing convictions.

Doge’s near-term prospects may depend on regulatory developments, including potential U.S. ETF decisions, and ongoing adoption on DEFI platforms such as Coinbase’s basic network, where packaged Doge is gaining appeal.

Price action

Doge’s decline was the highest in 13:00 hours, falling to $0.164 at 591 million peaks, the highest of the day.

The subsequent powerful bounce delayed the price to above $0.171, while Memecoin found a recent equilibrium.

Since then, price action has merged in a tight band between $0.170 and $0.1696, with smaller bursts indicating lower levels of accumulation.

Technical analysis review

- Doge’s recovery rate was 4.7%, rising from $0.164 to $0.171.

- The major liquidation-driven sell-off occurred at 13:00 and reached a volume of 591m units.

- Quantity-based support is $0.164; resistance is still close to $0.172.

- Recent candles show signs of accumulation, especially during the period 02:00-02:02 (3.4 million volumes).

- RSI’s 33.29 shows that Doge may be approaching oversold territory.

- Prices are consolidating on short-term support of $0.1696.

- If the Doge breaks above $0.1750, the next resistor zone is $0.1820; in a risky environment, it may trigger a retest of $0.1640 or even $0.150.

- The technical pattern points to a descending triangle (usually a bearish signal), but a decrease in volatility indicates stability.

Disclaimer: Some parts of this article were generated with the help of AI tools and reviewed by Coindesk’s editorial team to meet our standards. For more information, see Coindesk’s full AI policy.