Stay informed with free updates

Simply register Global economy Myft Digest – delivered directly to your inbox.

Three decades ago I was fascinated by the concept of “social silence” – or the idea that was brought up by intellectuals like Pierre Bourdieu that we do what we do not It is more important than what we do.

At the moment, this silence is heavily hanging over the markets. This week there was a cacophony of terrible noise for geopolitical events – embodied by the president Donald Trump’s warning that America is allowed to “or not” attack Israel’s attacks on Iran.

And dark economic data keeps falling out. Last week the World Bank put his prediction on For global growth (to 2.3 percent) and America (to 1.4 percent)-we have “take” global trade in the second half of this year “when the 90-day break from Trump’s so-called” liberation day “tariffs. This week, the Federal Reserve also classified its US growth forecast and increased its inflation forecast. This means stagflation lite.

However, the US stock markets have increased in a quiet increase in the past few weeks and have increased by more than 20 percent since the beginning of April – and recovered from the moment when they were cast after the “Liberation Day” tariff announcement. In fact, they are close to the records. And while the 10-year bond returns are almost one percentage point higher in 4.4 percent than in autumn, they have recently stabilized-if the US financial projections deteriorate.

The big market for “silence” today is not an expression of the escalation risk, but the apparent lack of investors panic.

What is behind this reluctance? An explanation could be in what my colleague Robert Armstrong has referred to as the “Taco” effect – The assumption that Trump always exercises his threats. Another is a second “t” problem: time delays.

The Danish central bank, for example, recently studied How the stock markets have reacted to trading shocks since 1990. Research came to the conclusion that “the” trade policy uncertainty) significant negative effects on economic activity … it takes up to one year for the effects to become the material “.

Similarly, the bank for international settlements warned last week that we were exposed to “a significant negative contribution of uncertainty both for the investment and production growth”. However, it is calculated that the greatest influence on investments in 2026 – indication, not this year – will occur in the USA and Japan in the United States and Japan next year in the United States and Japan.

Regardless of this, a number of research emerged Could violate the American economy. While raids on immigration and customs authority are currently making headlines, the real economic effects have not been seen for several years. Cite such an example: The Peterson Institute expects this If 1.3 million migrants were deported, GDP would reduce this year by “only 0.2 percent”-Jedoch by 1.2 percent in 2028 by 1.2 percent. Hence the time delay problem.

In addition, there is currently a third explanation for the lack of panic: disaster fatigue. In particular, investors are exposed to such an overload of the confusing shock, which they (at best) have (at best) good for dealing with pain, without panic or (in the worst case) that they cannot process it.

If you want, name the problem “Death of a thousand reductions”. At the moment there is not a single shock that is clearly big enough to trigger a market crash. Yes, if oil over 100 US dollars per barrel jumps in the middle of a further escalation of the Middle East War and the closure of the Hormuz street, this would certainly hurt. And this scenario cannot be reduced – most of the time, according to Philip publisher, an energy economist, because when Israel’s first attack on the Iran “oil industry company with low stocks” began, and there were “very large call positions” (ie derivative bets) that could relax, develop, could relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, relax, could relax, relax ,, gave

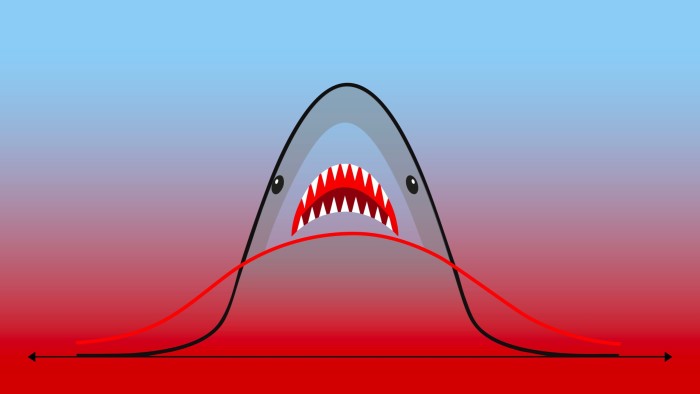

But so far the oil prices are “only $ 75 a barrel. What the investors are exposed today is more of an impending risk of tail than an immediate, material disaster. Or to use another analogy: the markets have not with a single“ heart attack ”dock (as during the covid 19 pandemy), but with an economic cancer in the form of one Metastasis of uncertainty about future injuries. This is not in 2020.

Hence the short explosions of market volatility -measured by the VIX index -that then die. This is also the reason why the message from different asset classes is not consistent. “US shares behave like Trump and follow short-term victories”, ” says Jack Abllin, Chief Investment Officer from Cresset. “Long bonds behave like (Elon) musk, which are fixed on long -term, unpleasant truths.”

And here we come back to the problem of social silence. While investors try to analyze the confusing tail risks, most are with profound doubts – and to an extent to which even skilled workers feel nervous, if not. This means that it may not take much for stock markets to crack; But it also means that nobody knows when (or whether) this can occur. Sometimes it is indeed the silence that screams the loudest.