Bitcoin

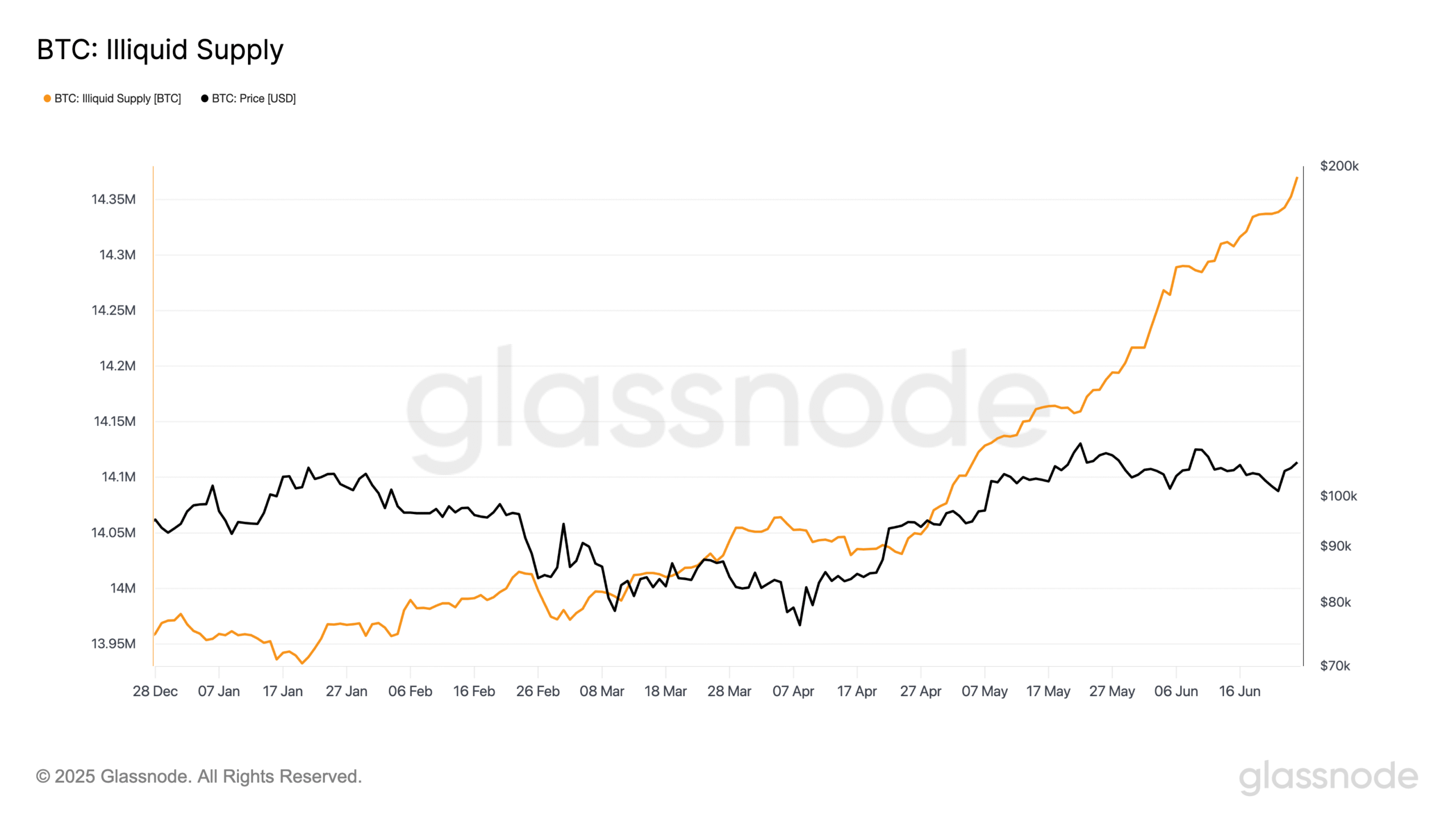

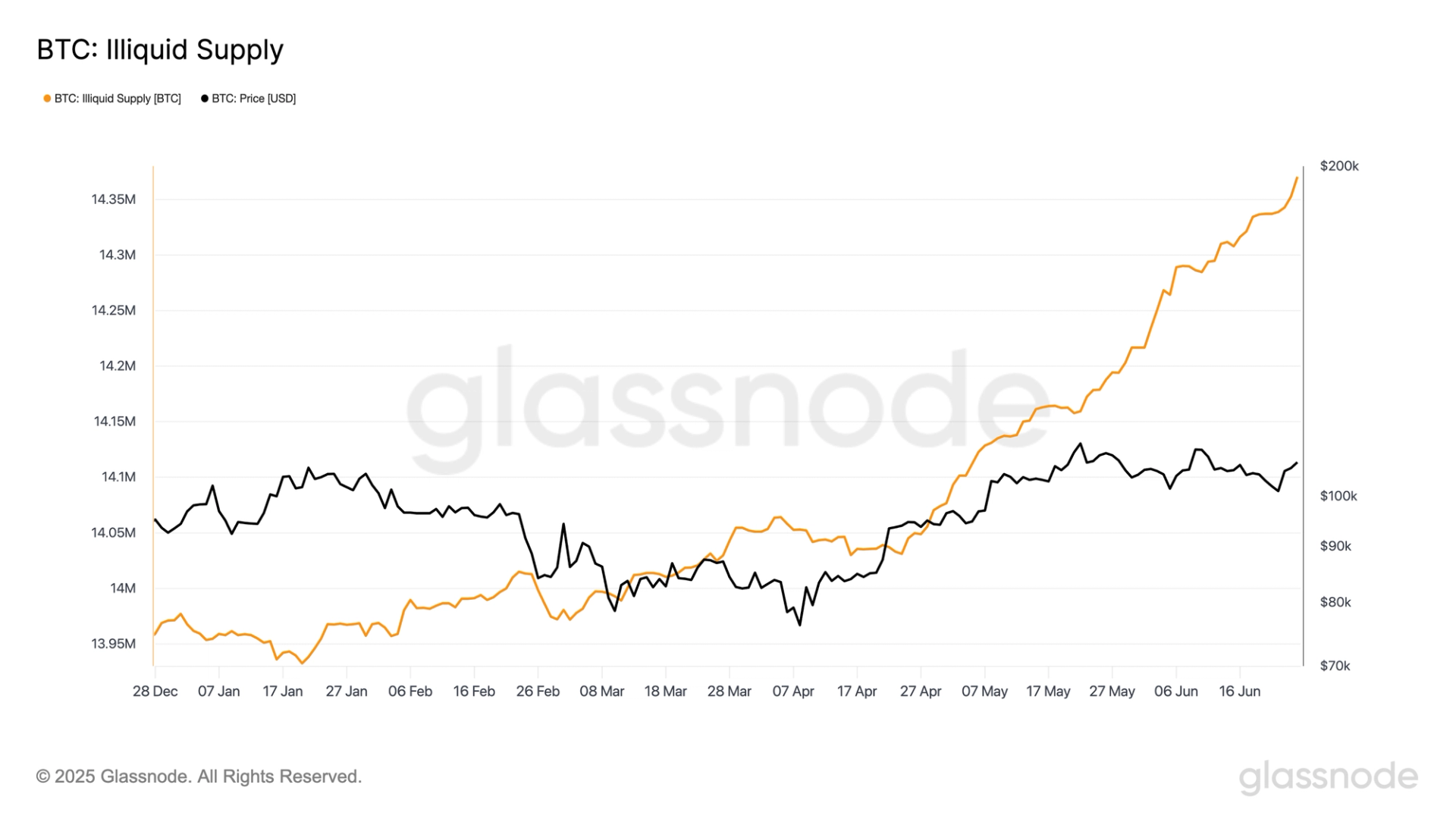

According to GlassNode, the supply of liquidity has soared to 14.37 million BTC, jumping from 13.9 million BTC from the beginning of 2025.

Since Bitcoin’s current revolving supply is about 19.8 million, this means that 72% of all mining BTC is now classified as liquid.

Insufficient liquidity supply refers to the portion of BTC held by entities with minimum spending behavior, such as long-term investors and cold wallet holders. These coins are effectively taken from the market, reducing the amount available for transactions.

As more investors choose to store bitcoin rather than trade it, the liquid portion of the supply shrinks, tightening market availability.

This trend is important because the growing supply of liquidity often reflects an increase in investor confidence and long-term beliefs. It also creates the potential for supply-side shocks, in which the rise in demand meets limited available supply, historically related to bullish price movements.

Bitcoin’s ever-increasing liquidity continues to rise in support of Bitcoin’s narrative as a store of value. If this trajectory exists, it may put pressure on prices to rise, especially in case of increased market interest and decreased miner issuance.

This emphasizes that liquidity analysis is a key indicator of market sentiment and future price action.