XRP beat the resistance barrier as volume hit $300 million during peak institutional purchases, with its bullish charting pattern and landmark legal solutions exacerbating upside bets.

The rally moves technological breakthroughs and the basic narrative of the tokens has undergone significant changes. The SEC solution eliminates years of litigation drag and may release larger institutional participation in the U.S. market.

Price action shows that massive accumulations are above $3.10 and subsequent mergers are above $3.30, suggesting strong beliefs among buyers even after the initial peak. ETF submissions from SBI add parallel demand drivers, positioning XRP as a higher beta move if the blob bitcoin ETF inflow continues.

Technical Analysis Overview

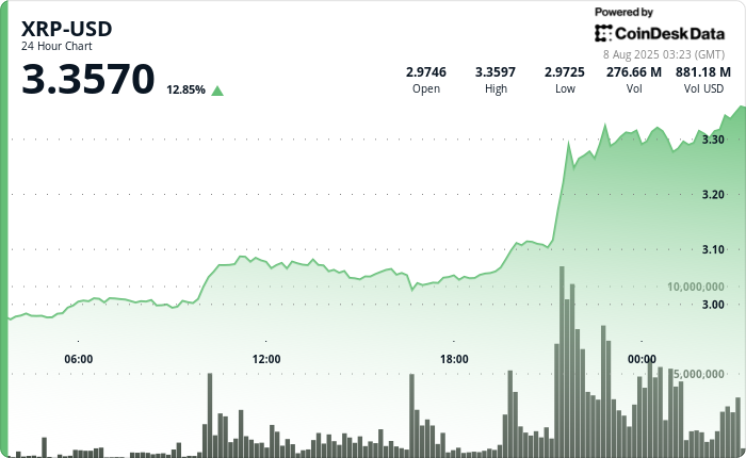

XRP exploded 11% during the 24-hour period ending 24-hour period on August 8, rising from $2.99 to $3.30.

Digital assets accelerate most actively between 19:00 and 22:00, eliminating multiple resistance levels. At 21:00 alone, the trading volume will explode by 300 million.

The conference spans the $0.35 range, from a low of $2.97 to a peak volatility of 12% at $3.33. The new resistor is in the form of $3.33. In the final hours of the meeting, strong demand exceeded $3.10.

News background

The Securities and Ripple Labs jointly ended their appeal in a high-profile XRP lawsuit, ending a years-long legal battle that has been clouding the prospect of tokens since 2020.

In Thursday’s filing, the Second Circuit admitted the filing to the court, and both parties agreed to bear their own expenses and expenses.

“Under today’s vote, the SEC and Ripple formally filed a dismissal of their appeal in the Second Circuit,” Ripple’s chief legal officer Stuart Alderoty said on X.

The resolution eliminates the main regulatory overhang of XRP, along with other bullish developments such as Japan’s SBI Holdings’ application to launch Bitcoin-XRP ETF.

Price action summary

•XRP grew 11% from August 7 to August 8 to August 8 at 00:00, up from $2.99 to $330 dynamite

• Token merge in the $0.04 band between $3.30-$3.33, August 7 at 23:42 to August 8 at 00:41 window

•Legal resolutions to clear the way for institutions to enter

Technical indicator analysis

• Volume exploded at 21:00, which shows that institutions accumulate a large amount of

•Bull Flag Formation points to $8.00-$15.00 for breakthrough targets beyond longer field of view

• Fresh resistor locks to $3.33 and confirms volume

• During the merger, companies in the Key Support Zone held by companies above $3.30

• At night, see multiple resistance breaks between 19:00 and 22:00

• Volume support demand sells for more than $3.10 in the second half of the meeting

What traders are looking at

• Since the litigation risk has been cleared, it will be purchased from the US agency later

• Japan’s ETF approval timetable and potential documents in other markets

• Retest $3.33 resistance and possible breakthroughs to a near-term goal of $3.65

•Retail re-engagement after legal victory headlines