The Hong Kong subsidiary of the standard charter of the large bank has partnered with the Web3 software company Animoca brand to develop Hong Kong stock stability.

According to Friday announcement From the Animoca brand, the two companies jointly established Anchorpoint Financial Limited Hongkong Apply for local Stablecoin Issuer’s License. The task of a shared subsidiary is to establish a stable business model focused on issuing and advancing licensing.

According to the announcement, Anchorpoint Financial has expressed its formal interest to obtain a Stablecoin license with the Hong Kong Monetary Authority on August 1 New Stablecoin framework By one Six-month transition period There are special rules.

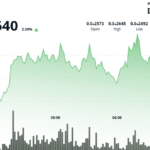

These rules are stricter than many seemingly expected market participants, resulting in large sell-offs of stocks from relevant local companies. According to reports in early August, some Hong Kong Stablecoin-concept Company Stocks fell as much as 20%but experts describe the incident as a health correction after a reality check.

Related: Asia’s OSL Group raises $300 million for Stablecoin and global expansion

Long-term partnership

The partnership between the Standard Chartered Brand and the Animoca brand is not new. They first announced Plans to launch a Hong Kong dollar-backed Stablecoin Back to mid-February.

Nevertheless, the scope of cooperation between the two companies goes far beyond that. In late July 2024, an alliance includes Standard Chartered Bank, Animoca Brand and Hong Kong Telecom It is reportedly participating in the Stablecoin issuer sandbox of the Hong Kong Monetary Authority.

Participation in the Standard Charter is particularly noteworthy. The bank is one of three entities of HSBC and Bank of China (Hong Kong), and is authorized to issue the city’s fiat currency under the supervision of HKMA.

Related: Hong Kong prepares the third batch of token bonds, eyes more products

Hong Kong Stablecoin Competition

Competition to dominate Hong Kong’s Stablecoin market has been further intensified as newly discovered regulatory clarity lifts the industry to a higher level of maturity. It is reported that at the end of July, China-based e-commerce giant JD.com reportedly came to an end of July Registered entities related to potential Stablecoin launchesa few days before Hong Kong’s Stablecoin regulations came into effect.

According to reports Apply for Stablecoin Issuer License in Two Hong Kong and Singapore. These initiatives were previously a subsidiary of JD GoinLink Technology Hong Technology, a subsidiary of JD Technology Group. Announces its planned issuance of 1:1 Stablecoin Link to the Hong Kong dollar in late July 2024.

Magazine: Hong Kong Hose down stablecoin frenzy, Pokémon on Solana: Asian Express