During Monday’s stock market, NVIDIA, giant artificial intelligence, lost nearly $ 600 billion, the largest one -day loss For a public company in a record. How could the wealth of one of our leading societies suddenly fit? While some will look for answers promising start-up AI These movements, which are based on China or harass business policy, speak of deeper changes in our financial markets that can be best explained, strangely, re -reworking ancient mythology.

Ouroboros image, a snake that eats their own tail is remarkably a durable and ubiquitous motif. The ancient Chinese, Egyptian, European, and Latin American civilizations seemed to have taken a picture or those they like, symbolizing the cyclical nature of life, the completeness of the universe or fertility. Today, resonant lessons come from Ouroboros autonibalism, which helps us understand the most important financial puzzle of our time.

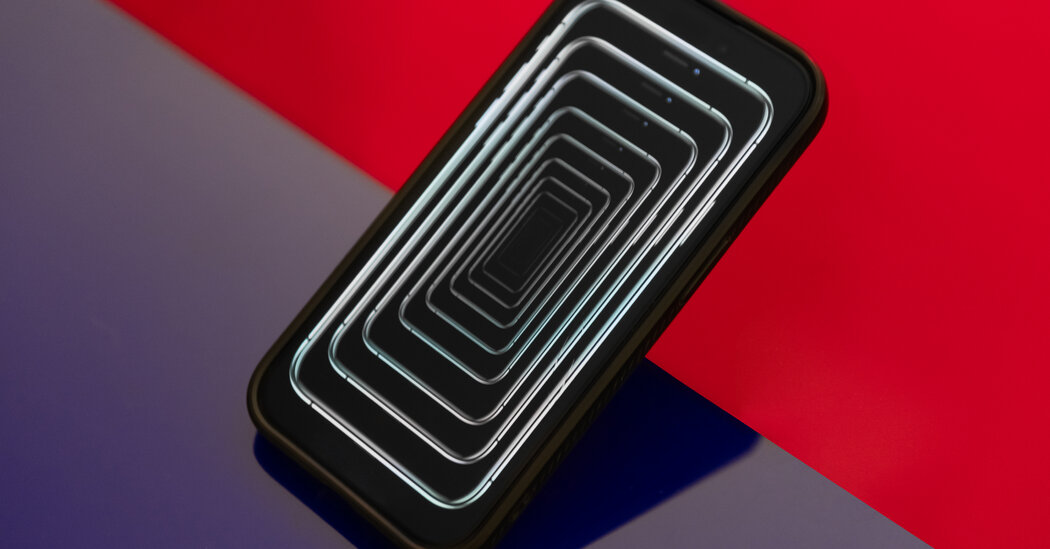

Like Ouroboros, I believe that Big Tech is eating alive and throwing more and more money to invest the investments that are most likely to generate less and less return. Monday’s correction shows that our financial markets – and perhaps your pension portfolio – can begin to reflect this dynamics.

Even after Monday’s dive, disjunction in the Big Tech – sometimes known as the beautiful 7 Microsoft, Apple, Amazon, Nvidia, Tesla, Meta and the alphabet – and the rest of the stock market remains stunning. The Spectacular 7 It still accounts for more than 30 percent of the S&P 500 market capitalization (ten years ago compared to less than 10 percent). If you compare their stock prices with their earnings or selling, a traditional way to measure the share of share, a technical GoliatHS trade in ratios that are two or three times an uncertain 493 prices.

Market observers have discussed whether large technological shares will continue to overcome all others or whether they will catch up with other companies because they use artificial intelligence to become more productive. The Ouroboros myth, however, indicates another possible result.

The first step to understand this analogy is to return to some financial foundations. Stock prices are not always rising because the prospects of companies are improving. They also rise when investors assess certain companies to be a safer bet than others, and do not pay for longer to generate revenues for their money.

While many industry observers have claimed that artificial intelligence will cause the wealth of spectacular 7 to increase, other dynamics are in the game: investors consider these companies a safe bet and thus cease to require significant immediate returns. That is why the prognosis of shares analysts did not hold the pace with a sharp increase in prices of shares of these companies.

Why would investors not expect more for their investment dollars?

I believe that global investors have come to see the shares of these seven companies as first -class safe assets. In the world of inflationary spikes, political instability and Gridck and fiscal uncertainty, why not invest in companies with balance sheets, recurring revenue, stable cash flows, commanding positions on the market and respected managerial teams? The new generation of investors seems to implicitly perceive these companies almost as a government. In fact, as Tesla’s extraordinary award illustrates, it is clear that its founder Elon Musk inspired the loyalty that resembles the ruler. In the world of algorithmic trading and passive investment of these faiths take a speed This results in extremely high prices of large technological shares that we see today.

How did managers of these companies react to this massive influx of cheap money? Perhaps, just as they should, by pouring more and more capital into investment without worrying that they were expecting quickly. From a practical point of view, it seems that what they have done is to release a remarkable stream of spending on themselves. In other words, they eat alive.

NVIDIA, a highly induced creator of the next generation of AI chips whose shares were crushed on Monday, will receive almost half of its income from its siblings in a magnificent 7. In 2022 Google was paid by Apple Apple paid $ 20 billion According to the default Safari search engine according to the default search engine according to uninhabited court documents, and therefore most likely represents approximately 20 percent of Apple’s profits. Meta employs Amazon Web Services Pro cloud and increasingly in your pressure AIand all the technical giants released a disproportionate amount of expenditure about infrastructure.

And when technical giants do not raise each other, they often practice a different form of selfannibalism: they buy their own stocks. In the last three fiscal years, Apple, Alphabet, Meta, Microsoft and Nvidia bought back a total of more than $ 600 billion own shares – notorious Low Return Activity.

There is nothing particularly disturbing about the beautiful 7 shopping products and services. There is nothing necessarily bad with the spending of large particles for capital expenses or repurchase of shares. However, if all these decisions on the allocation and allocation of capital are governed by extremely low expectations of investors, they can eventually bring appropriate low returns. And that gives us a possible view of what lies in front of us for the beautiful 7 and AI, rather than the boom, which continues to expand to a speculative bubble or assembly for the remaining unmistakable 493 a technological future that will not be almost as revolutionary or immediate as promised.

More dangerously, these companies – Like all companies – one day disappoints those who consider them safe asset. And self -ntalization is revealed that it is not only an average investment, but also a shocking bet on the illusion promoted by the mythical and Messianic belief in technology and these companies.

Similar dynamics formed another period in American history. The remarkable distribution of railways in the 19th century caused similarly magical thinking; At the beginning of the 20th of the 20th century, after several decades of mad investment, the railway industry has created More than 60 percent of capitalization on the stock marketand his bonds were considered Safe bet. Their low yields driven steel expenses and eventually led to create A huge congglomerate of US Steel In 1901.

What followed in the first two decades of the 20th century? Remarkably low profits from these companies and average returns from Overall stock market. Natural limits on railways and players rooted steels soon became obvious as well as organizational problems that go along with such a scale.

Of course, natural physical boundaries that limit the growth of American railways may not exist for today’s beautiful 7. If artificial intelligence is truly real A general purpose technologyThen it can have much more potential. This means that information technology promises such productivity growth over the last two decades without delivery.

One does not have to look at ancient folklore to find Ouroboros. Economist Joseph Schumpeter once described Capitalism as a process of almost mystical recovery. Admiration he wrote The Industrial Mutation cycle “that constantly revolutionizes the economic structure from the inside, constantly destroys the old one and constantly creates a new one.” .