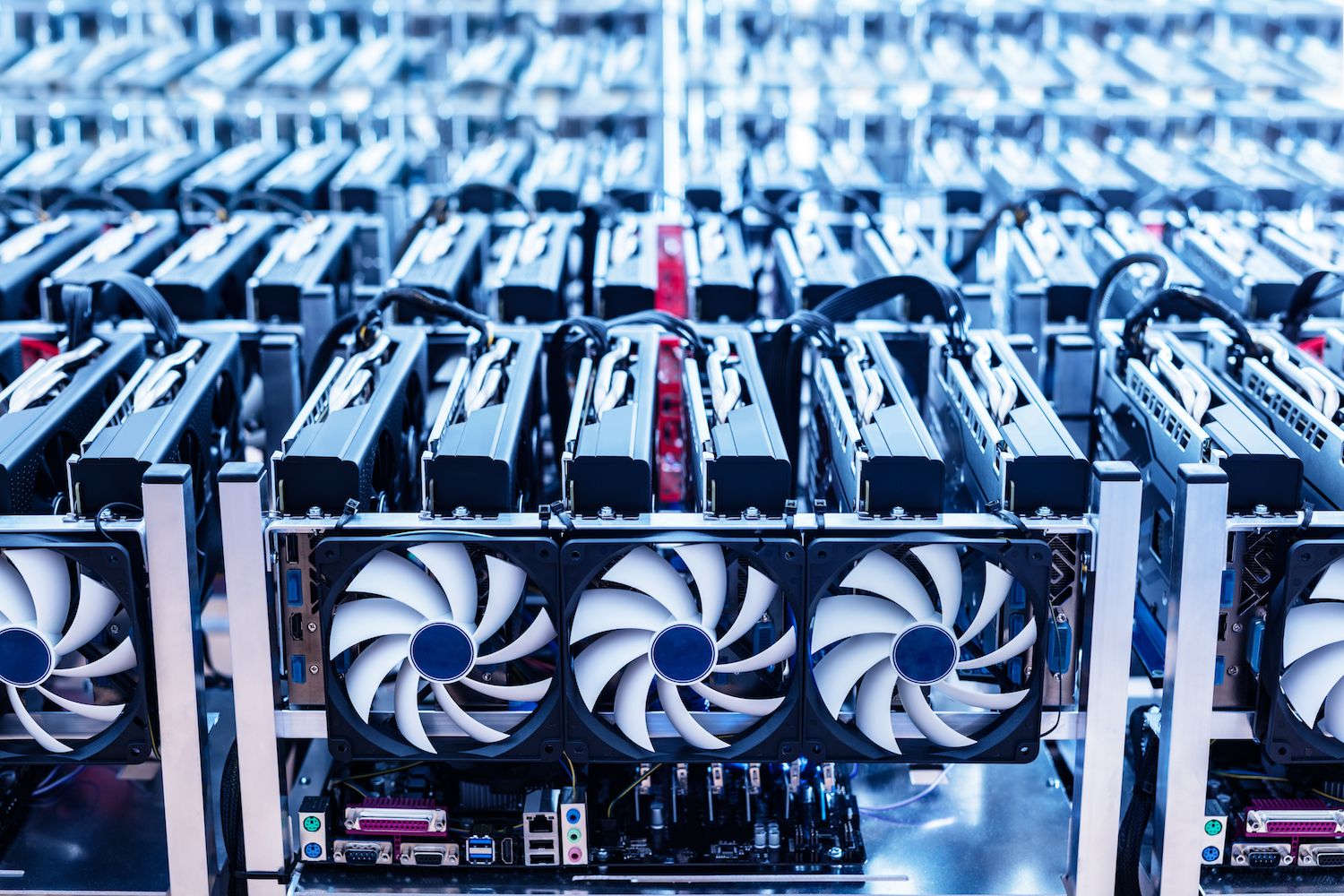

Computing LaboratoryThese startups turn industrial-grade GPUs powered by AI data into fractional production tokens, while enterprise AI cloud company Nexgen Cloud has teamed up to start allocating $1 million in “public library” ownership. ”

The power and profitability of AI infrastructure are To a large extent And it is usually limited to the large-scale level of AWS or large venture capital firms. However, Compute Labs is trying to directly access the money-making potential of its token holders in enterprise hardware, such as the NVIDIA H200 GPU, which will retail for around $30,000.

“For investors, the pilot (project) represents the first opportunity to earn Stablecoin yields directly from Live AI Compute without managing hardware or relying on overvalued public stocks.”

European nexgen, This has enabled its customers to gain AI computing power and improve $45 million in April, The initial financing will be processed through its investment arm Infrrahub calculations.

How it works

According to the press release, the funds raised will be used by Infrahub to purchase the GPU and then use it for the scores of investors and customers.

The first “treasury” has raised $1 million from investors. The initial vault will have the highest NVIDIA GPU, currently used for “AI training and reasoning,” the company said. These companies expect their yield in USDC to exceed 30% per year under active enterprise GPU leasing agreements.

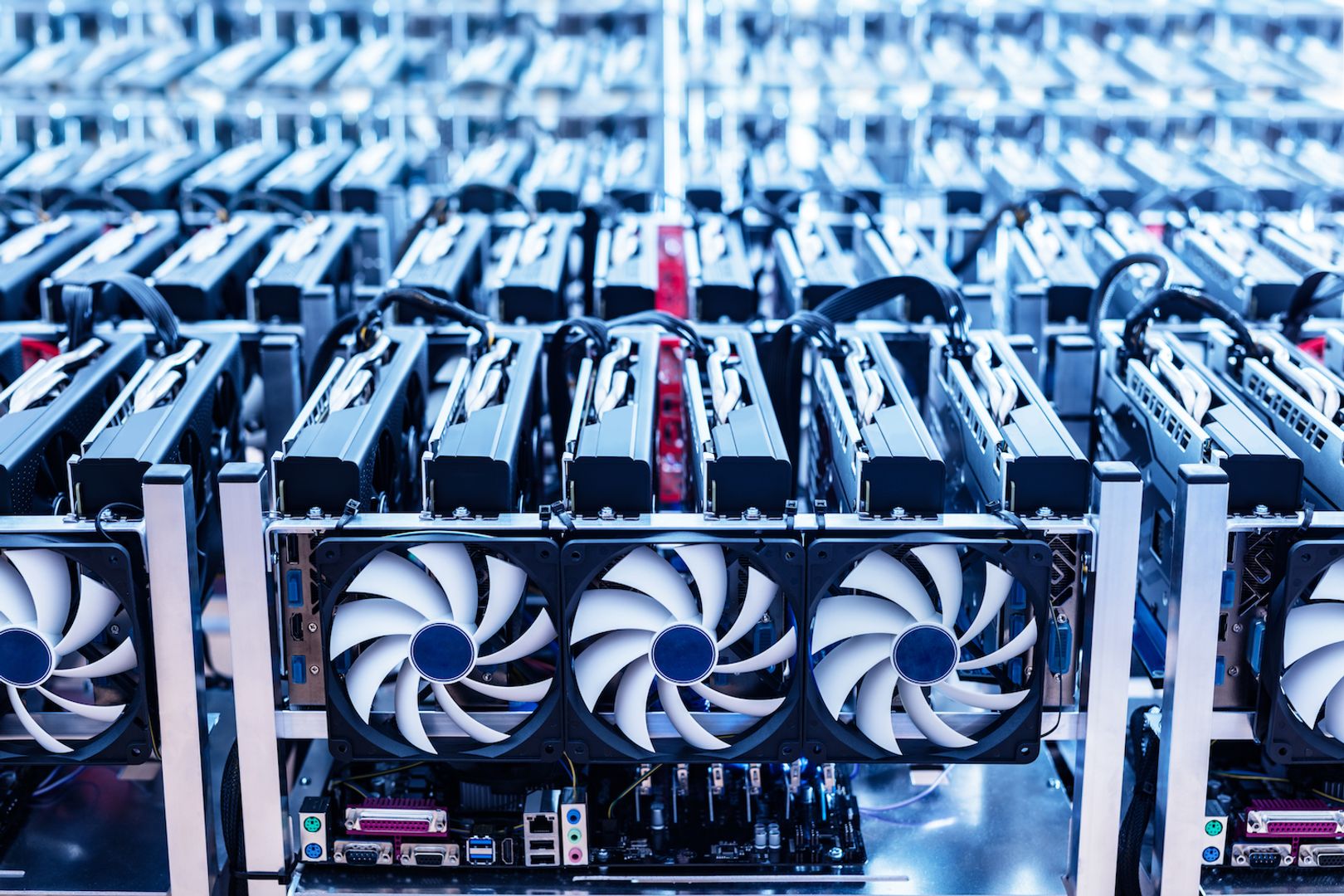

Nikolay Filichkin, chief business officer at Compute Labs, talked to the type of data center operators who may have extra floor space and want to add additional capacity; he said in an interview with Coindesk that the data center is equivalent to “mom and popular stores.”

“When a data center uses an investor-owned GPU, the computing lab manages it through its protocol and balance sheet and leases the GPU to the data center,” Filichkin said in an interview. “Things like net income, minus custody and energy costs, can be traced back to investors with GPU processing power.”

These companies frame these GPUs in a vault and group them and then offer them to individual investors in increments of several hundred dollars. NFT is also used to distinguish different types of token GPU hardware investments.

Compute Labs is supported by Protocol Labs, OKX Ventures, CMS Holdings, and Amber Group. The company operates a 10% fee structure within the scope of tokenization, asset management and performance yields.

“The model allocates specific, tradable value to each GPU cycle, rationalizing the AI market by removing investor speculation and directly linking supply, demand and prices,” said Youlian Tzanev, co-founder and chief strategy officer of Nexgen Cloud.