Author: James Van Stramed (Unless otherwise explained, all time is Eastern Time)

The past 24 hours have been the busiest day in the encryption industry for many years. This price has been reflected in the price of Bitcoin (BTC) on Thursday. The price fluctuates by 2% to 3% in a few minutes. Nevertheless, it still manifests at the psychological level of $ 100,000, currently about $ 105,000.

President Trump’s remarks continue to lead to weakening the US dollar, which usually boosts risk assets such as cryptocurrencies. The US dollar index that measuring the US dollar against a basket of major trading partners has fallen to the lowest point since December 17, so this should bring good booster to risk assets. US debt yields and WTI crude oil are also declining, and oil prices have fallen below $ 75 per barrel, a new low of two weeks.

On the other side of the world, the Bank of Japan (BOJ) fulfills its promise: Raise interest rates againThe policy interest rate was raised to 0.50%, the highest level in 16 years. Then released very popular inflation data, the overall inflation rate increased by 3.6%compared with the previous year, the fastest since January 2023. The question is whether we will have the second liquidation of the yen arbitrage transaction that occurred last August last year. Time will prove everything. Keep vigilant!

What to see

Cryptocurrency:

January 25: SEC’s first deadline for the decision to make a decision on the four spot Solana ETF proposals: Press solana etf,, Golden Slit Solana ETF,, 21 cores Solana ETF and Van Exxoran Trust FundAll, sponsored by the CBOE BZX exchange.

January 29: ICE Open Network (ION) Main Network StartEssence

February 4: MicroslateGy Inc. (MSSTR) Increase report in the fourth quarter of fiscal year 2024Essence

February 4: PEPECOIN (PEPE) halvedEssence At 400,000 blocks, the reward will be reduced to 31,250 PEPECOIN.

February 5th at 3:00 pm: Boba Network’s new world hard split It is based on the network upgrade of the L2 main network of Ethereum.

Magnificent

4: 00 am on January 24: S & P Global release In January 2025, the HCOB Purchasing Manager Index (Flash) report.

The comprehensive PMI estimation value is 49.7 compared with the previous 49.6.

Manufacturing PMI valuation is 45.3 compared with the previous 45.1.

PMI service east. 51.5 Comparison of the previous page 51.6.

At 4:30 am on January 24: Standard Purcell Global Release of the British Purchasing Manager Index (Flash) report in January 2025.

Compared with 50.4 compared with the previous one.

Manufacturing PMI valuation 47 VS. Previous 47.

PMI service east. 50.9 Compared with the previous page 51.1.

9:45 am on January 24: Standard Purcell Global Release of January 2025 US Purchasing Manager Index (Flash) report.

In the last period, PMI 55.4.

The manufacturing PMI estimation value is 49.6 compared with the previous 49.4.

PMI service east. 56.5 Comparison of the previous page 56.8.

10:00 am on January 24: The University of Michigan released January American consumer confidence dataEssence

Consumer confidence index (final) is expected to be 73.2 compared to the previous 74.

Token event

Governance voting and appeal

FRAX DAO is discuss Investment in World Liberty Financial (WLFI) is $ 5 million, which is an encrypted project supported by Donald Trump’s family.

simple. 24: Bold’s decision Activate voting Last period. BOLD allows anyone to participate in verification and defense a malicious statement for the arbitrum chain state.

simple. 24: HBAR is Custody Community phone at 11 am

Unlock

January 31st: Optimism (OP) released 2.32% of circulation supply for $ 52.9 million.

January 31st: Jupiter (Jup) unlocked 41.5% of circulation supply at $ 626 million.

Meeting:

Day 12 of 12 days: 2025 Swiss WEB3FEST Winter Version (Zurich, San Moritz, Davos)

Day 5 (5 days in total): World Economic Forum Annual Conference (Davos Klossis, Switzerland)

Day 1 (2 days in total): Use Bitcoin (South Africa Cape Town)

January 25th to 26th: Castanbul 2025 (Istanbul). Jupiter’s first community meeting was based on the decentralized exchange (DEX) polymer built by Solana.

January 30, 12:30 noon to 5:00 pm: 2025 International DEFI Day (Online)

From January 30th to 31st: B Plan Forum (Salvador Saint Salvado)

January 30 to February 4: Nakamoto Cong Table Conference (Dubai)

February 3: Digital Asset Forum (London)

February 5th to 6th: 14th Global Blockchain Conference (Dubai)

February 6: The Weng Duo Summit in 2025 (New York).

February 7: Sorana APEX (Mexico City)

February 13th to 14th: The fourth edition NFT ParisEssence

From February 18th to 20th: Consensus Hong Kong

February 19: Sui Connect: Hong Kong

From February 23rd to March 2nd: ETH Denver 2025 (Denver)

February 25: Ivy League 2025 (Denver)

Tokens

Author: Shaolia Malva

A humorous new decentralized autonomous organization FARTSTRATEGY (FSTR) DAO is investing in user funds to FARTCOIN.

DAO is using the borrowed SOL to obtain tokens to provide investors with the opportunity to understand their price changes through FSTR.

If FSTR’s transaction price is lower than its FARTCOIN support, token holders can vote to dissolve DAO, and redeem their FARTCOIN shares in proportion after solving any unsuccessful debt.

With less than 48 hours after the release of Vine Memecoin, the market value jumped to $ 200 million.

It was launched by Rus Yusupov, one of the co -founders of the original VINE application, and paid tribute to the nostalgia of the same name for its six -second cycle video. Before closing in 2017, VINE was an important cultural phenomenon.

Recently, for discussions on the application of the application, Yuspov and technical bureaucrat Elon Musk expressed their interest in their return.

Derivative

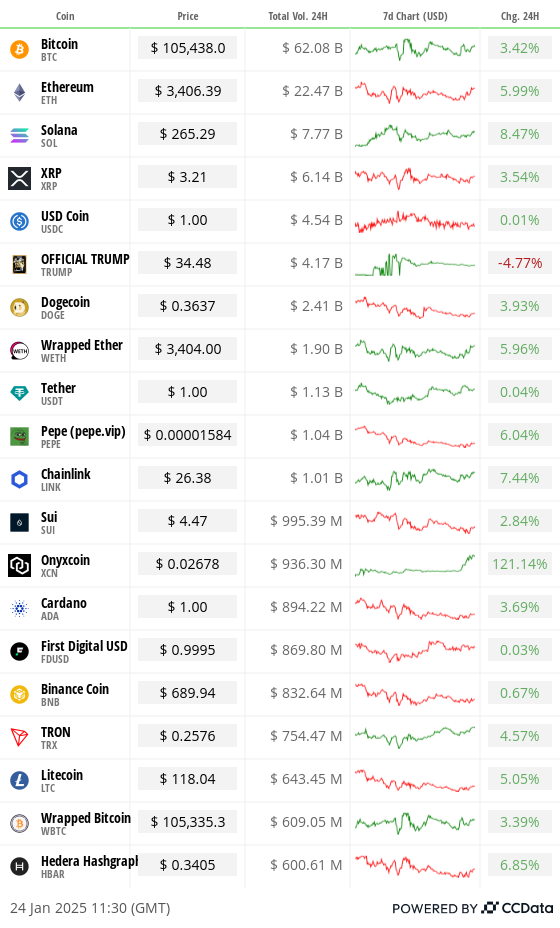

TRX leads the growth of unclean contracts for main currency perpetual futures.

The main funds interest rates are still less than 10%of the annualization, which indicates that the market has not excessive speculation, although the price of Bitcoin transactions is close to historical highs due to optimistic emotions for Trump crypto currency policy.

BTC and ETH’s bullish option deviation has been strengthened. The characteristics of the block flow are that the BTC bullish options with a higher price of the price are directly done. In ETH, the bullish dating prices are poor. Among them, the exercise price is $ 5,000 and $ 6,000 Look at the options.

Market trend:

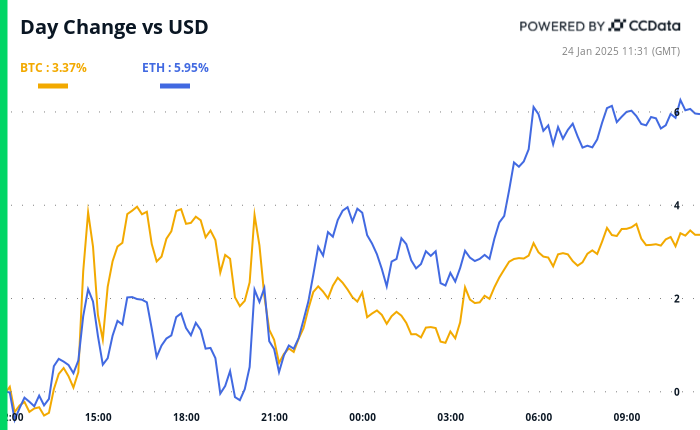

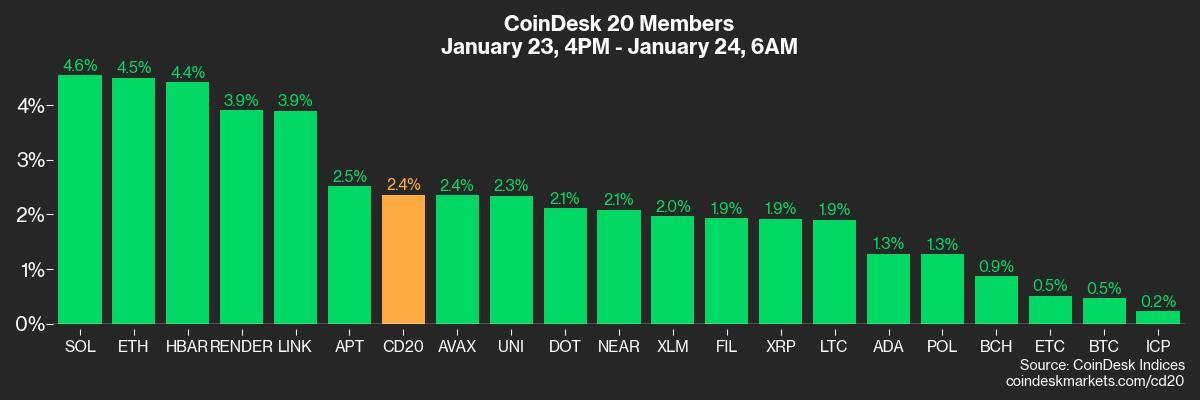

BTC rose 2% from 4 pm Eastern time on Thursday time to 105,450.57 US dollars (24 hours:+3.43%)

ETH rose 4.96% to $ 3,409.62 (24 hours:+6.18%)

Coindesk 20 rose 2.4% to 3,988.16 (24 hours:+4.79%)

CESR comprehensive pledge rate rose 1 basis point to 3.16%

The BTC financing interest rate on Binance is 0.0069%(7.58%annualized)

DXY fell 0.48% to 107.53

Gold rose 0.68% to $ 2,775.28/ounce

Silver rose 1.21% to $ 30.86/ounce

Nikkei 225 index closed unchanged, at 39,931.98 points

The Hang Seng Index closed up 1.86%to 20,066.19

FTSE index fell 0.33% to 8,537.12

The European Stock 50 Index rose 0.73% to 5,255.47

Dow closed up 0.92%on Thursday to 44,565.07

Standard 500 Index closed +0.53 Report 6,118.71

The Nasdaq Index closed up 0.22%to 20,053.68 points

S & P/TSX Comprehensive Index closed up 0.48%to 25,434.08

Standard 40 Latin American index closed up 0.57%to 2,310.35

American 10 -year Treasury bonds fell 13 basis points to 4.64%

E-Mini Standard Purcera 500 Index Futures fell 0.13%to 6,143.75

E-Mini Nasdaq 100 futures fell 0.56%to 22005.50

E-Mini Dow Jones Industrial Average Futures remains unchanged at 44,709.00

Bitcoin statistics:

Bitcoin leading position: 58.51 (-0.11%)

Ethereum and Bitcoin ratio: 0.032 (0.68%)

Computing power (seven -day moving average): 784 EH/S

Hash price (spot): $ 61.0

Total expenses: 6.8 BTC/ 104,070 US dollars

Zhishang Institute Futures Unlisted Contract: 191,645

BTC priced at gold: 38.1 ounces

Bitcoin and gold market value: 10.83%

Technical analysis

Ethereum seems to depict a declined wedge -shaped mode, which is characterized by two convergence of trend lines, representing a series of lower highs and lower lows.

The aggregation nature of the trend line indicates that the seller is slowly losing control.

It is said that the breakthrough represents the reversal of the bullish trend.

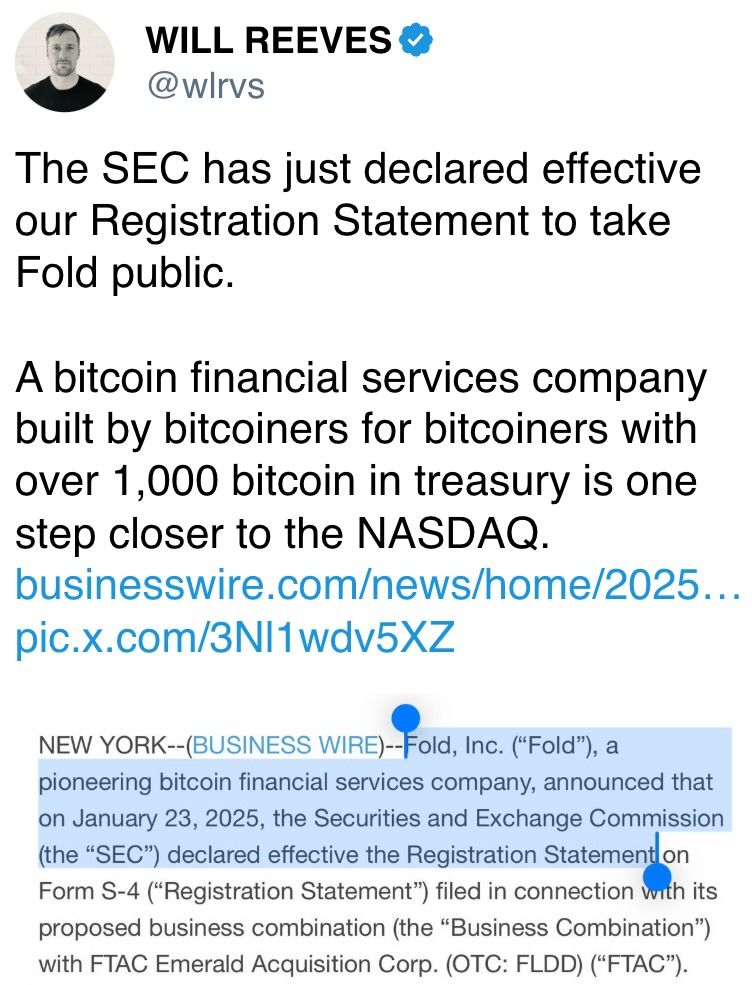

Encrypted stock

MicroStrategy (MSTR): It closed at $ 373.12 (-1.11%) on Thursday, and rose 2.55% to $ 382.62 before the market.

Coinbase Global (Coin): It closed at $ 296.01 (+0.05%), and rose 2.16% to $ 302.39 before the market.

Galaxy Digital Holdings (GLXY): Close at 33.94 Canadian dollars (+3.44%)

Mara Holdings (Mara): It closed at $ 19.95 (+1.32%), rising 1.8% to $ 20.31 before the market.

Riot Platforms (RioT): It closed at $ 12.99 (-1.14%), rising by 2.62% to $ 13.33 before the market.

Core Scientific (CORZ): It closed at $ 16.34 (+2.32%), rising 1.04% to $ 16.51 before the market.

Cleanspark (CLSK): Closed at $ 11.41 (+2.42%), rising by 2.19% to $ 11.67 before the market.

CoinShares Valkyrie Bitcoin ETF (WGMI): It closed at $ 25.65 (+0.47%), rising 1.75% to $ 26.10 before the market.

Semler Scientific (SMLR): It closed at $ 61.15 (-1.55%) and fell 10.89% to $ 54.49 before the market.

EXODUS MOVEMENT (EXOD): It was closed at $ 44 (+7.32%), and rose 0.75% to $ 44.33 before the market.

ETF traffic

Spot BTC ETF:

Daily net traffic: $ 188.7 billion

Cumulative net flow: $ 39.42 billion

The total holdings of BTC are about 1.169 million.

Spot ETH ETF

Daily net traffic: -14.9 million US dollars

Cumulative net flow: $ 2.79 billion

ETH holds about 3.663 million.

source: Remote investor

Overnight

Daily chart

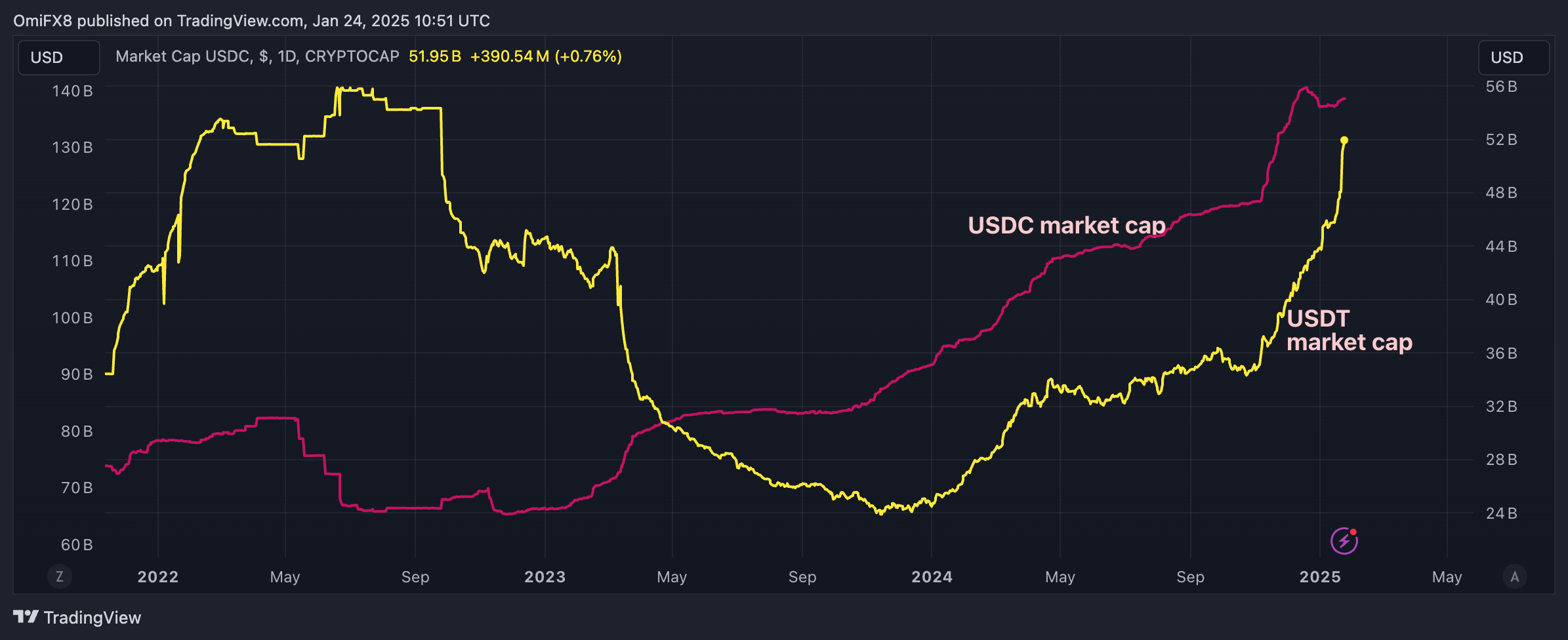

The USDT market value of the world’s largest stable currency Tether has tended to be nearly $ 138 billion.

USDC’s supply has continued to increase, and this week has risen to nearly 52 billion US dollars, the highest level since September 2022.

When you are asleep

After the Bank of Japan ’s eagle interest rate hikes, Bitcoin stabilizes nearly $ 104,000 (Coindesk): Although the Bank of Japan raised interest rates, Bitcoin was still stabilized above $ 104,000 during the Asian period on Friday, because the market was concerned about the administrative order of Cryptocurrency on Thursday and the potential policy changes in the United States.

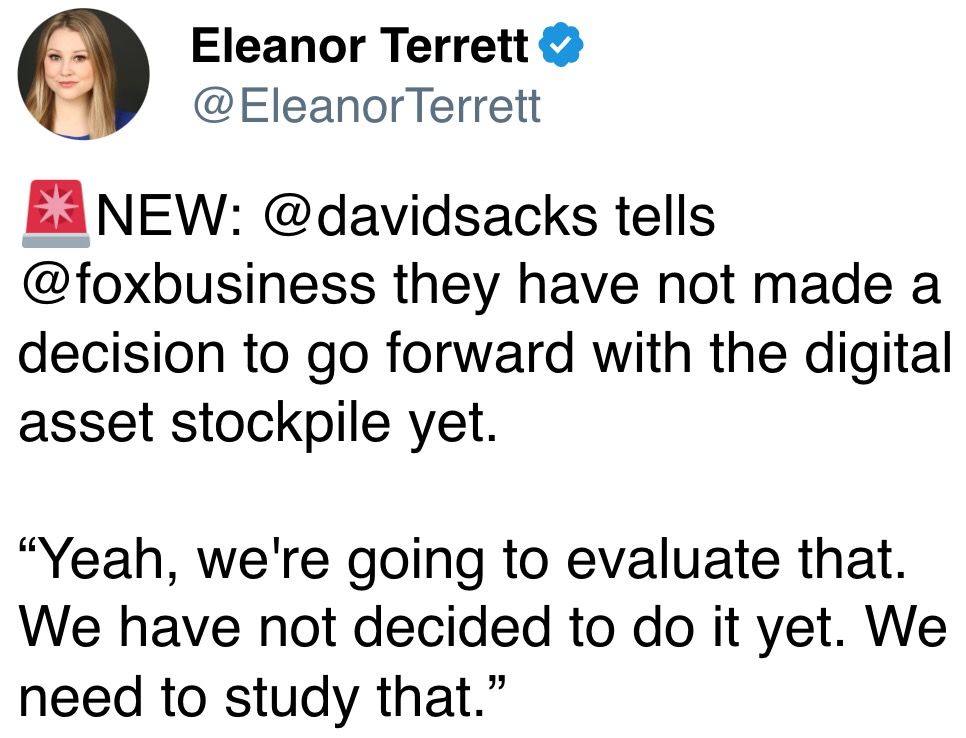

Trump issued a cryptocurrency administrative order to pave the way for digital assets in the United States (Coindesk): President Trump issued an administrative order that supports cryptocurrencies, guiding the creation of digital asset frameworks, prohibiting CBDC from developing and considering the establishment of national digital asset reserves.

Vitalik Buterin calls for increasing attention to Ethereum as part of the network expansion plan (Coindesk): In the post on Thursday, Vitalik Buterin, co -founder of Ethereum, outlined the strategy of improving the value of Ethereum, including using it as mortgage, implementation expenses incentives, and increasing temporary transaction data called Blob.

Japan’s interest rate hikes, consolidate the situation that gets rid of the minimum loan cost (Bloomberg News): The Bank of Japan raised the key interest rates by 25 basis points to 0.5%on Friday. The highest level in 17 years, the yen was strong, and the 10 -year Treasury yield rose to 1.23%.

Since the Internet era, U.S. stocks are the most expensive for bonds (Financial Times): The stock valuation of the S & P 500 Index has reached a record high. Driven by the surge in demand for leading technology companies, the stock risk premium has become negative for the first time since 2002.

So far, Trump 2.0 has progressed smoothly for China. Can the honeymoon last? (CNN): In a Thursday interview, President Trump claimed that tariffs had “huge power”, but implied that reaching an agreement to avoid stricter measures. Beijing is cautious about probation, focusing on negotiations, and preparing for future tensions.

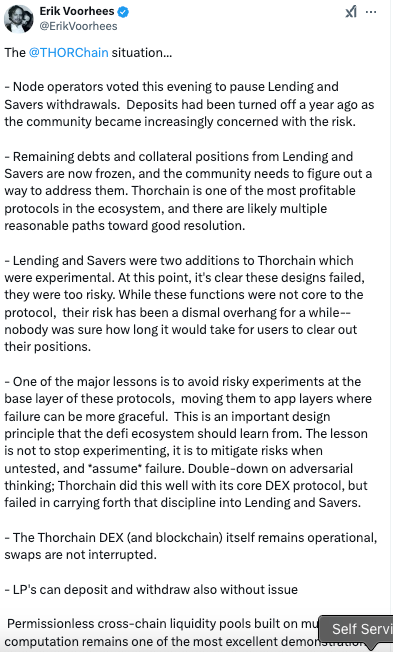

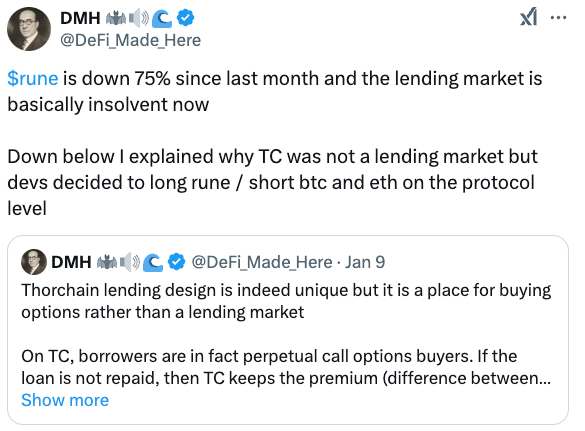

In Ethereum