avalanche

According to the Coindesk Research technical analysis model, despite attempts to stabilize key support levels, efforts are still being made to maintain short-term momentum, and despite attempts to stabilize channels, the trading model shows a decline in channel formation.

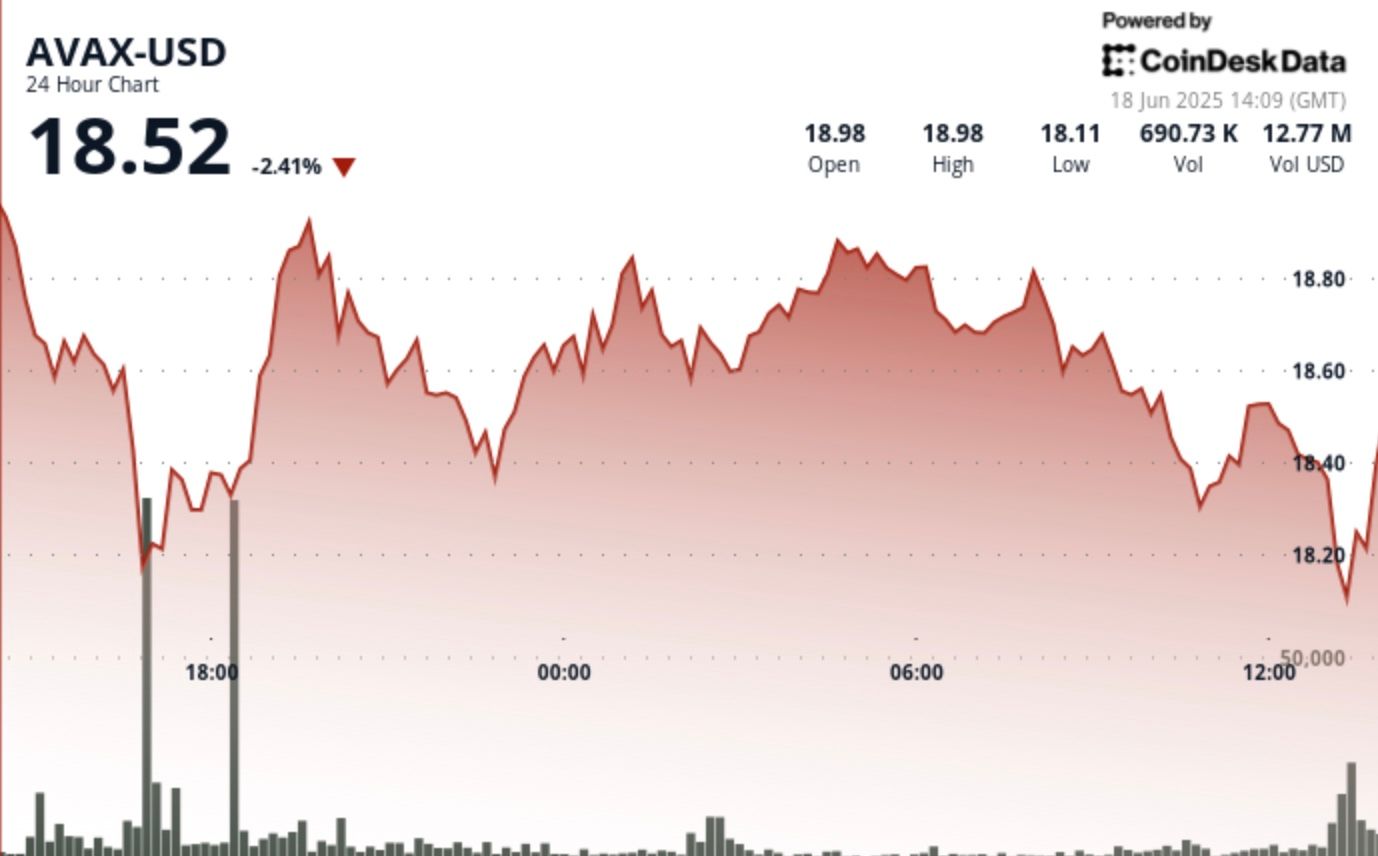

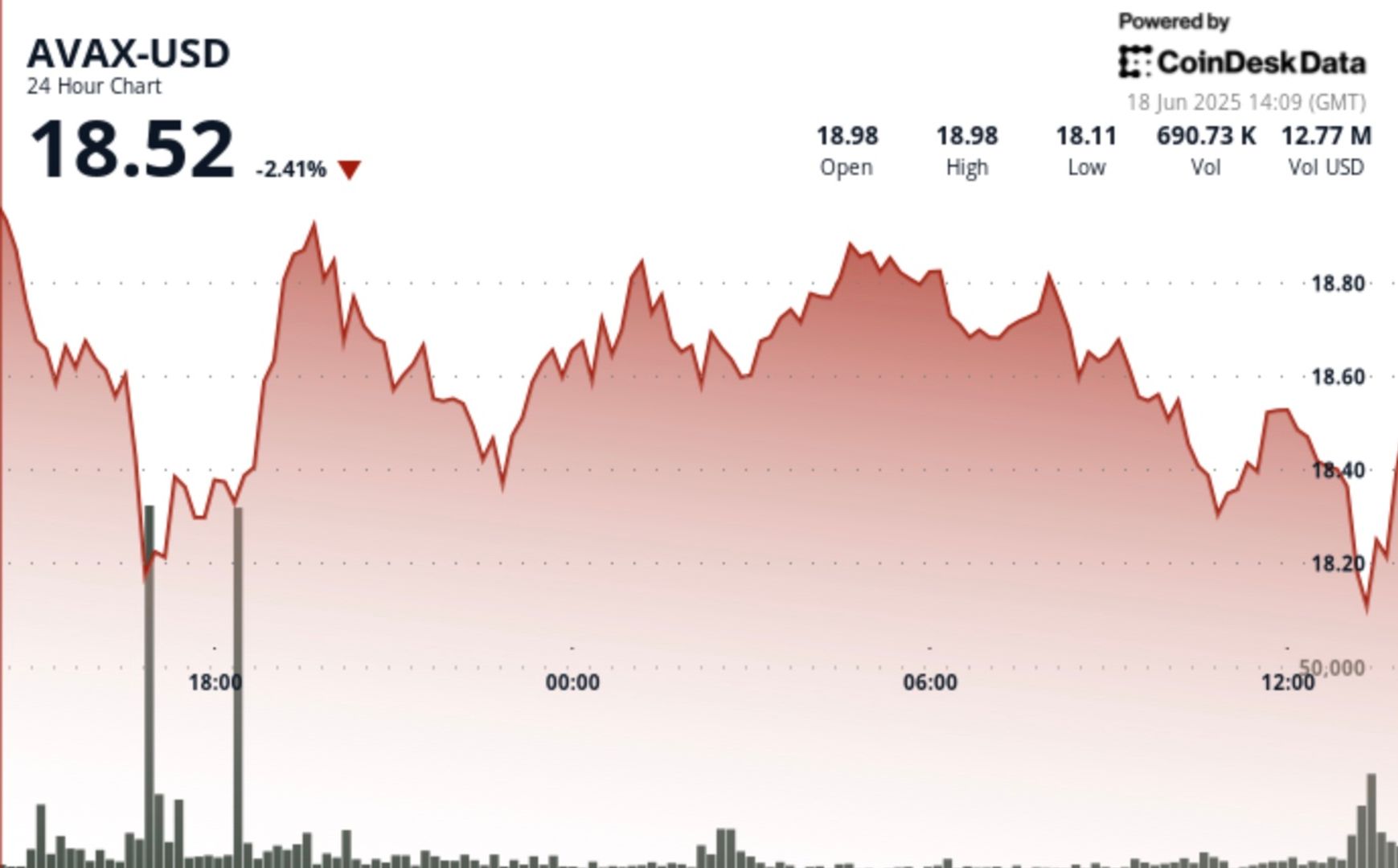

The token has dropped 1.4% to $18.43 in the past 24 hours, while Coindesk 20 (by market cap by market cap, this is the index of the top 20 cryptocurrencies, excluding Stablecoins, Memecoins and Exchange Coins, with only 0.5%.

The recent massive sales pressure shows that in the short term, there is continued bearish sentiment, despite a recent decline in strong buying.

Technical Analysis

•Avax has experienced significant price volatility over the past 24 hours, in the range of 0.84 (4.5%) between up to $18.93 and $18.09.

• Assets gain strong support in the $18.15-$18.25 area, while resistance encountered is close to $18.85-$18.90.

• Price action forms a channel of decline, and despite attempts to stabilize at around the $18.40 level, the recent massive sales pressure suggests continued bearish sentiment.

•Avax experienced a V-shaped recovery, sliding from $18.35 to a low of $18.09, with a high elasticity (52,056 units), and then rebounded to $18.40.

•When the price of the $18.27 exceeds 67,000 units, the momentum of recovery is huge, creating a new support zone of about $18.33 to $18.35.

•The uptrend climaxes with three consecutive zero volume minutes, indicating that a merger is possible before the next price rises.

Disclaimer: Part of this article was generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and compliance Our standards. For more information, see Coindesk’s complete AI policy.