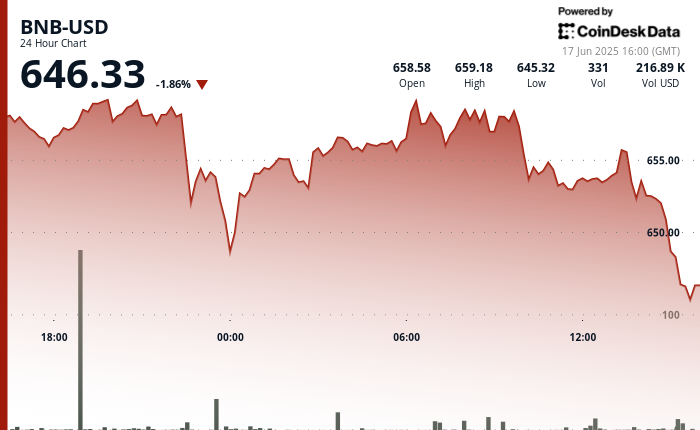

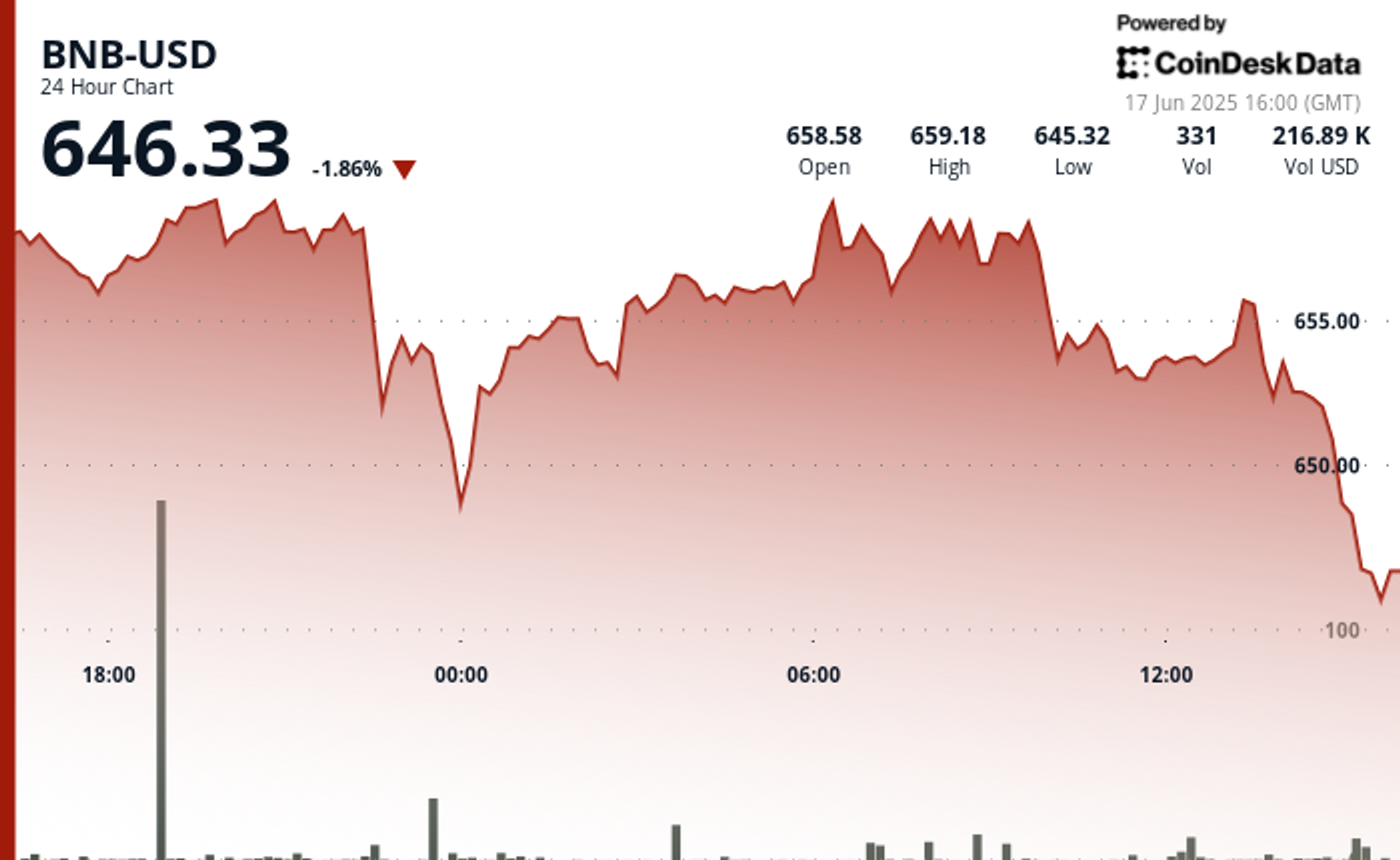

BNB, the Aboriginal token of the BNB chain, has dropped 1.7% over the past 24 hours, and markets are becoming increasingly uneasy after U.S. President Donald Trump calls for the escalation. National Security Council preparation In the situation room.

BNB is between $659 and $646 during the day, marking a close but significant trading range. According to technical analysis data from Coindesk Research, this $647 level has become the support line for the tokens and now hoveres below it.

Despite the turmoil, the fundamentals of the BNB chain are still strong.

Over the past month, it has processed over $100 billion in diversified exchanges (DEXs) and over $10 billion in the past 24 hours According to Defilama.

Now, investors are watching Wednesday’s FOMC meeting. Signals of any interest rate can affect liquidity, especially in risky assets such as cryptocurrencies.

The tangle in the background is also Vaneck’s BNB ETF Appit was filed in May. If approved, it may open the door to larger institutions to participate.

Technical Analysis Overview

- According to Coindesk Research’s technical analysis data, strong support forms at a price of $647, with its number increasing to 82,311 tokens, almost triple the 24-hour average.

- The resistance is between $658 and $659, and the price is rejected twice as the quantity rises.

- The hourly chart shows $655 and then a slight callback to $652. This determines the local resistance of $655.70-$655.80.

- Sales pressures intensified during the decline. BNB is currently consolidating the following resistance with a bearish tilt, which further disadvantages if sentiment remains weak.

Disclaimer: Part of this article was generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and compliance Our standards. For more information, see Coindesk’s complete AI policy.