“The performance gap between Huawei and H20 is less than a generation compared to NVIDIA’s export-limited chips,” said Dylan Patel, founder, CEO and chief analyst of semi-analytics.

Official Learning | Moment | Getty Images

As the United States restricts China from purchasing advanced semiconductors for artificial intelligence development, Beijing will hope for domestic alternatives such as Huawei.

The fact that the U.S. containment not only curbs China’s chances of gaining the world’s most advanced chips, but also limits the use of technologies that are crucial to creating an AI chip ecosystem makes the task even more challenging.

These constraints cover the entire semiconductor value chain, from design and manufacturing equipment used to produce AI chips to support elements such as memory chips.

Beijing mobilizes Billions According to experts, while the money can be filled, it still has a long way to go, although it has been able to “explode” it into some breakthroughs.

“U.S. export control of Advance Nvidia AI chips has inspired Chinese industry development alternatives, and it also makes it harder for domestic companies to do so,” said Paul Triolo, a Chinese partner and senior vice president at consulting firm DGA-Albright Stonebridge Group.

This is how China piles up with the rest of the world in the four key segments needed to build AI chips.

AI chip design

NVIDIA is considered the world’s leading AI chip company, but it is important to understand that it does not actually produce physical chips for AI training and computing.

Instead, the company designed AI chips, or rather graphics processing units. The company’s orders for patented GPU designs will then be sent to Chip Foundries, a manufacturer specializing in mass production of semiconductor products from other companies.

Although U.S. competitors such as AMD and Broadcom offer different alternatives, GPU design from NVIDIA is widely regarded as the industry standard. The demand for NVIDIA chips is so strong that Chinese customers continue to buy any bargaining chips from any company they can master.

Nvidia, however, is coping with tightening restrictions in Washington. The company revealed in April Other paths It was prevented from selling its H20 processor to Chinese customers.

NVIDIA’s H20 is a less complex version of its H100 processor, dedicated to the previous export controls of the skirt. Nonetheless, it is more advanced than anything available in the country, experts say. But China wants to change that.

In order to cope with the restrictions, more Chinese semiconductor participants have entered the field of AI processors. They include a wide variety of emerging products such as Enflame Technology and Biren Technology, which they seek to absorb Billions of dollars in GPU demand left by NVIDIA.

But there is no closer to offering a true alternative to NVIDIA than Huawei’s chip design division Hisilicon.

Huawei’s most advanced GPU in mass production is its up 910b. The next generation is up 910c It is said that Although no updates appear, mass shipping is expected to begin in May.

Dylan Patel, founder of semi-analytics, told CNBC that while rising chips still lag behind Nvidia, they show Huawei has been making significant progress.

“The performance gap between Huawei and H20 is less than a generation compared to NVIDIA’s export restricted chips. Huawei is not far away and allows NVIDIA to be sold to China,” Patel said.

He added that as of last year, the 910b lagged behind NVIDIA two years, while the rise in 910c was just one year behind.

But while this shows that China’s GPU design capabilities have made great progress, design is only an aspect that hinders the creation of a competitive AI chip ecosystem.

AI chip manufacturing

To make its GPUs, NVIDIA relies on TSMC, the world’s largest contract foundry, which produces most of the world’s premium chips.

TSMC is in compliance with U.S. chip control and is also banned from taking any chip orders from U.S. trade blacklist companies. Huawei was listed in 2019.

This has led to Chinese chip designers like Huawei attracting local chip foundries, the largest of which is Smic.

SMIC is far behind TSMC – officially known to be able to produce 7-nanometer Chips, less improved technology than TSMC’s 3-nanometer production. Smaller nanosizes lead to greater chip processing capabilities and efficiency.

There are signs that SMIC has made progress. The company is considered to be Huawei’s 60 Pro’s 5nm 5G chip, which Full of confidence In 2023, the US chip control. However, the company still has a long way to go, and it can mass-produce advanced GPUs in a cost-effective way.

According to independent chip and technical analyst Ray Wang, SMIC’s known operational capabilities are dwarfed by TSMC.

“Huawei is a very good chip design company, but they still don’t have a good home chip manufacturer,” Wang said. It is said that Dedicated to your own manufacturing capabilities.

However, the lack of critical manufacturing equipment has hampered both companies.

Advanced chip equipment

The ability of SMIC to meet Huawei’s GPU requirements is limited by familiar export control issues, but in this case, the Netherlands.

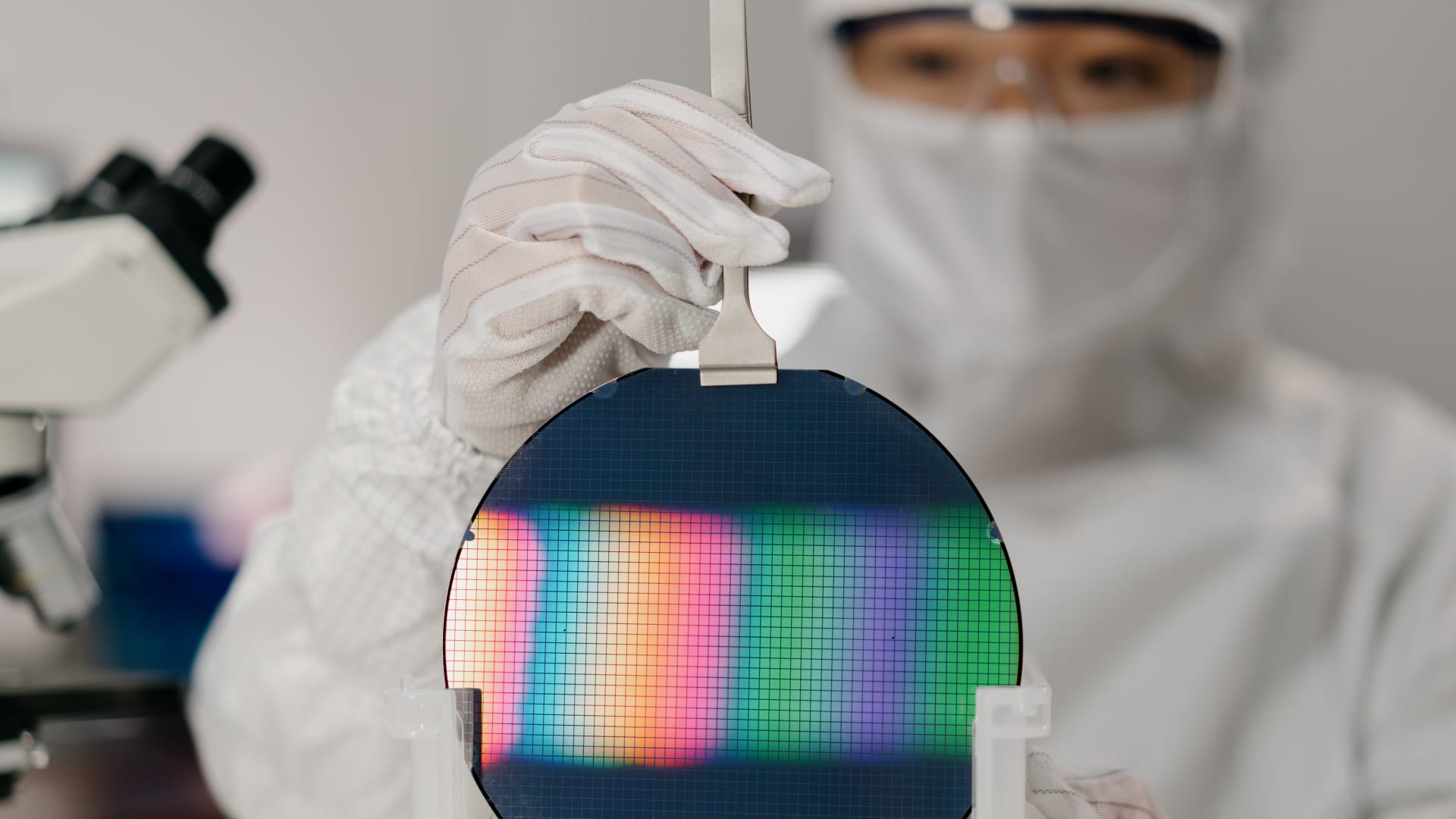

While the Netherlands may not have any outstanding semiconductor designers or manufacturers ASMLa global supplier of advanced chip manufacturing equipment – machines that use optical or electronic beams to transfer complex patterns to silicon wafers, forming the basis of microchips.

Under U.S. export controls, the country agreed to block the sale of ASML’s most advanced ultraviolet (EUV) lithography machines. These tools are essential for advanced GPUs at scale and cost-effectively.

Semi-analytical analyst Jeff Koch said EUV is the most important obstacle to China’s late-stage chip production. “They have most other tools, but lithography limits their ability to extend to process nodes of 3NM and below,” he told CNBC.

Smic discovered it Solution Lithography limitations were performed using ASML’s less advanced deep UV lithography systems, which had fewer limitations.

Koch said that with this “brute force,” it is feasible to produce chips at 7 nm, but the yield is poor, and the strategy may reach its limits, adding: “At the moment, it seems that SmiC cannot produce enough domestic accelerators to meet the demand.”

Sicarrier Technologies is a Chinese company engaged in lithography technology. It is said that Connected to Huawei.

However, it can take years (if not decades) to mimic existing lithography tools. Instead, China may pursue other technologies and different lithography techniques to drive innovation rather than imitation, he added.

AI memory components

Although GPUs are often identified as the most critical component in AI computing, they are far from the only ones. To operate AI training and computing, the GPU must work with memory chips, which are able to store data in a wider range of “chipsets”.

In AI applications, a specific memory called HBM has become the industry standard. South Korea SK hynix Has achieved an industry leader in HBM. Other companies in this field include Samsung and the United States Micrometer.

“In the AI progress phase, high bandwidth memory is already crucial to training and running AI models,” analyst Wang said.

Like the Netherlands, South Korea is working with US-led chip restrictions and begins to comply A fresh road About selling certain HBM memory chips to China in December.

In response, Chinese memory chip maker Changxin Memory Technologies or CXMT, a collaboration with chip packaging and testing company Tongfu Microectronics, is in the early stages of producing HBMs Reuters’ report.

According to Wang, CXMT is expected to lag behind the global leader in HBM development for three to four years, despite its major obstacles, including export controls for chip manufacturing equipment.

Semi-analysis Estimated in April The CXMT is one year away from accumulating any reasonable amount.

China Casting Wuhan XINXIN semiconductor manufacturing is It is said that Build a factory for the production of HBM wafers. one Report SCMP said Huawei Technologies has partnered with the company to produce HBM chips, although the companies did not confirm the partnership.

Semiaalsis says Reportplease note that although the chip is designed domestically, it still relies on foreign products obtained before or despite restrictions.

“Whether it is HBM from Samsung, crystals from TSMC, or equipment from the United States, the Netherlands and Japan, it is very dependent on foreign industries,” said semi-analyst.