Switch off the editor’s digest free of charge

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

The writer is the author of ‘Chip War’ and Vulcan elements consultant

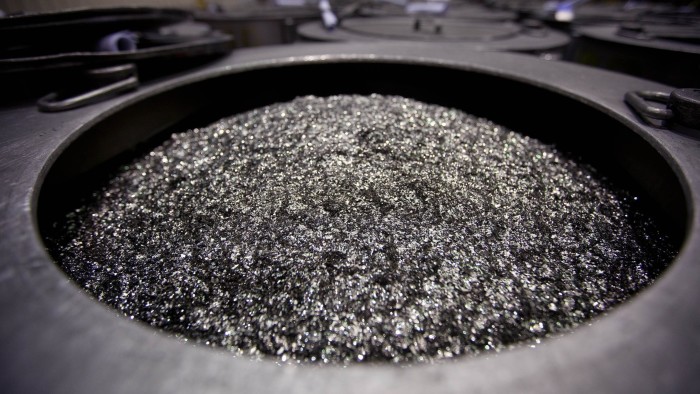

Shortly after Beijing had announced new restrictions on the export of rare dates and the specialized magnets, warned the world’s automotive industry Bottlenecks That could force factory closures. China’s skillful use of sanctions for rare earths this spring was probably the key factor to force Washington to reverse his tariff shots in the country. They represent a new era of Chinese economic occupation – evidence of a sanction policy that can not only put pressure on small neighbors, but also the largest economy in the world.

China has been a productive user of economic sanctions in recent years, but many of his efforts were blunt and only partially effective. Immissions were often hidden and even officially rejected. The Chinese tour groups lost interest in the Philippines, as we were told. Taiwanese pineapple could not meet the health standards and the Chinese consumers simply didn’t want to buy Korean products.

Boykotte supported by the government have imposed the economic costs for the Chinese trading partners, but their records about the achievement of political goals have been mixed. They seem to have prevented some countries from accommodating the Dalai Lama or challenging Beijing’s nine-through line of Beijing in the South China Sea. However, they have proven to be less effective when the national core interests are at stake.

Australia did not hunt when China, for example, reduced wine purchases for foreign policy disputes over wine. South Korea also has no rocket defense system that installed it in 2016, although China imposed sanctions and demanded its retreat. And China’s earlier sanctions against the USA – including the black defense companies and the imposition of license regimes for certain mineral exports – were political signal as an economic substance.

The new controls for exporting materials and magnets of rare earth are different. In just a few weeks, they threatened to close key factories in the auto industry – the largest processing industry in most advanced economies. They also brought the US president into his signature initiative: the trade war.

The White House believed that it had achieved an escalation dominance. His theory was that Sky High tariffs were so expensive that Beijing would have no hope than negotiating. In fact, China’s leader could swallow the political costs for tariffs. But Washington could not ignore the loss of materials for rare earth and its effects on automotive companies.

Why did these sanctions have proven to be so much more effective than earlier efforts? Some because Beijing has improved his toolkit and has built up a legal regime to reduce strategic exports and to improve the knowledge of the pain points of the trading partners. China even made this non -tax ratorial and demands that companies in other countries do not use Chinese minerals to produce products for the US defense industry. Beijing bothered that other large trading partners do not blame it for the rare earth restrictions, but that Washington urges to reset tariffs.

In fact, the Chinese exports of minerals and magnets of rare earth have not only fallen to the USA, but also other large trading partners such as Japan and South Korea since April. Indian car manufacturers have reduced production in the face of material shortage. The President of the European Commission, Ursula von der Leyen, brought A Rare for June G7 meeting to demand more non-China production. The EU prioritizes exports for rare earth in its diplomacy with China.

This broad global influence indicates that China’s ability to take rare earth restrictions can continue to be limited. It is more difficult to restrict raw materials such as rare earth oxides than, for example, Jet engines or chipmaking devices. If China only wanted to prevent rare earth materials from reaching the United States, it could fight to do so. Companies in other countries could continue to sell softly to American customers.

However, the most striking aspect of the Chinese weapon of rare earth is how unprepared Western governments and companies were. Even those who cannot name a single element for rare earth know that China dominates its production. Nevertheless, the West has found no new suppliers since China cut the exports of rare earth to Japan.

Some modest steps were taken. Korea extended its stocks. Japan invested In Australian mines. However, most western governments developed critical mineral strategies and then decided not to finance them. Manufacturers speak of resistance, but some only stick to rare earth magnets in their stocks for a week. This is a weapon that she has been staring at for decades. You shouldn’t have been surprised when Beijing finally pulled the withdrawal.