The war in Ukraine served as a awake call for Europe, and Defense Tech went from a sector, which most European VCs did not affect one of the highest investment areas in Deep Tech.

This change is trapped in Dealroom’s latest Report of Defense, Resilience, and Security (DSR) in EuropeReleased in conjunction with the NATO Innovation Fund (NIF), a multi-country country € 1 -miliard initiative Making direct investments and support funds in this space.

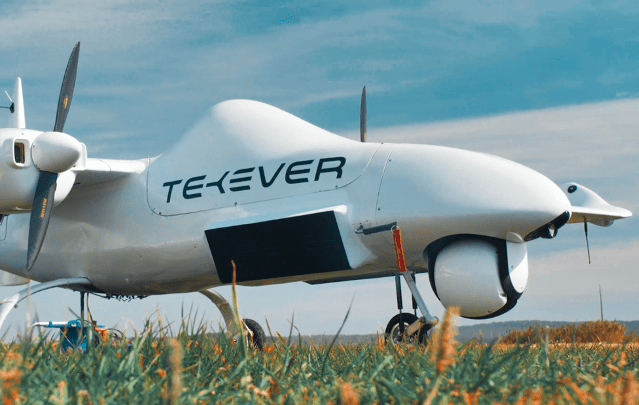

The NIF portfolio includes startups as a Portuguese-based double use-Dronary company Tekever, which raised $ 74 million series B In November. In overall, DSR stations reached a record $ 5.2 billion in risky capital last year, more than 24% compared to 2023, and almost five times more than in 2019.

Despite the growth, $ 5.2 billion is only twice as much capital than US defense ie Companynica company Anduril is reportedly looking for lift only for itself. However, this is also a monthly maximum of 10% of all VC funding in Europe-2,5-fold growth over the past two years, according to Dealroom.

“Appetite for defense, security and resistance starting investment is unknown in Europe for just a few years ago,” its founder and general manager, Yoram Wijngarde, said in Statement. “It follows an ongoing trend to put capital and innovation to work on Europe’s core strategic needs through deep technologies.”

With DSR now responsible for one third of each deep Technic corporate funding in Europe, it is obvious that the two overlap. This is because DSR is broader than defensive technique, with the acknowledgment that supply chain, quantum technologies and energy can be equally critical for the region’s sovereignty.

This means that a wider range of startups now fall into the DSR pipeline, especially now that growing defense budgets are making the idea of selling double technology in Europe less bold. NIF himself also hopes to help on that front; It recently appointed the veteran of British Army John Ridge as its chief adoptive officer.

Fragmentation and slow adoption aside, VC -apitis has long been an obstacle, but this changes. The rise of dual use companies contributed to this development: it facilitated generalist VCs to accommodate the sector within their mandate, which often prevents them from investing in pure defense technology, even less weapons.

Pure defense technique is only responsible for a smaller subset of overall funding, but that also increases; A previous agreement of an agreement envisioned $ 1 billion By 2024, five times growth since 2018. On the contrary, a wider range of European VCs now make investments adjacent to Defend Tech, with more than 850 investors active in at least one DSR agreement in Europe, according to the report.

This growth is particularly striking in Germany; With Munich and Berlin as its main Hubs, it affirmed Europe’s top spot in DSR funding in 2024, followed by the UK and France. AI Defense Tech Rising Star Helsing, which is based in Germany, earned about $ 487 million In a series C led by a general catalyst last year.

However, these adaptations take time. The Defense Equal Facility (DEF), € 175 million ($ 182 million) launched in January 2024 by the European Commission and the European Investment Fund (EIF), only announces its first investments, as the European Investment Bank (EIF parent organization) ) had to Update its rules About dual use technology.

However, of all challenges, a lack of founders is not one of them, as confirmed by recent defense Hackathons across Europe. “Despite recent growth, defense, security, and resistance Te Techniko remain a relatively born sector, but the data shows an active pipeline from early stage companies looking to change that,” Wijngaarde said.