one Kansas banker robbed millions of dollars from its small-town bank in 2023This triggered a collapse that lost most of its funds, targeting a record Department of Justice bust, according to a complaint filed Wednesday.

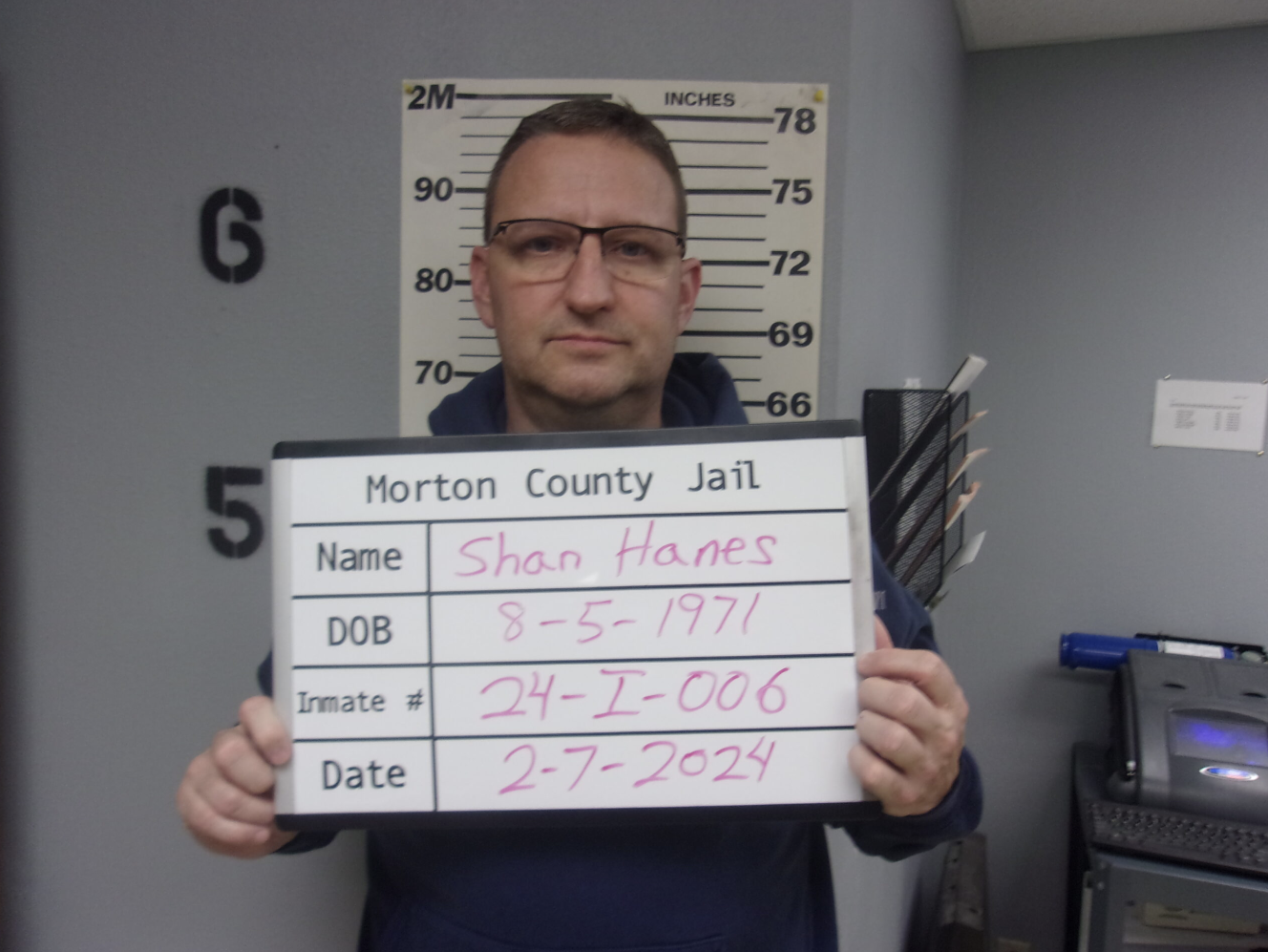

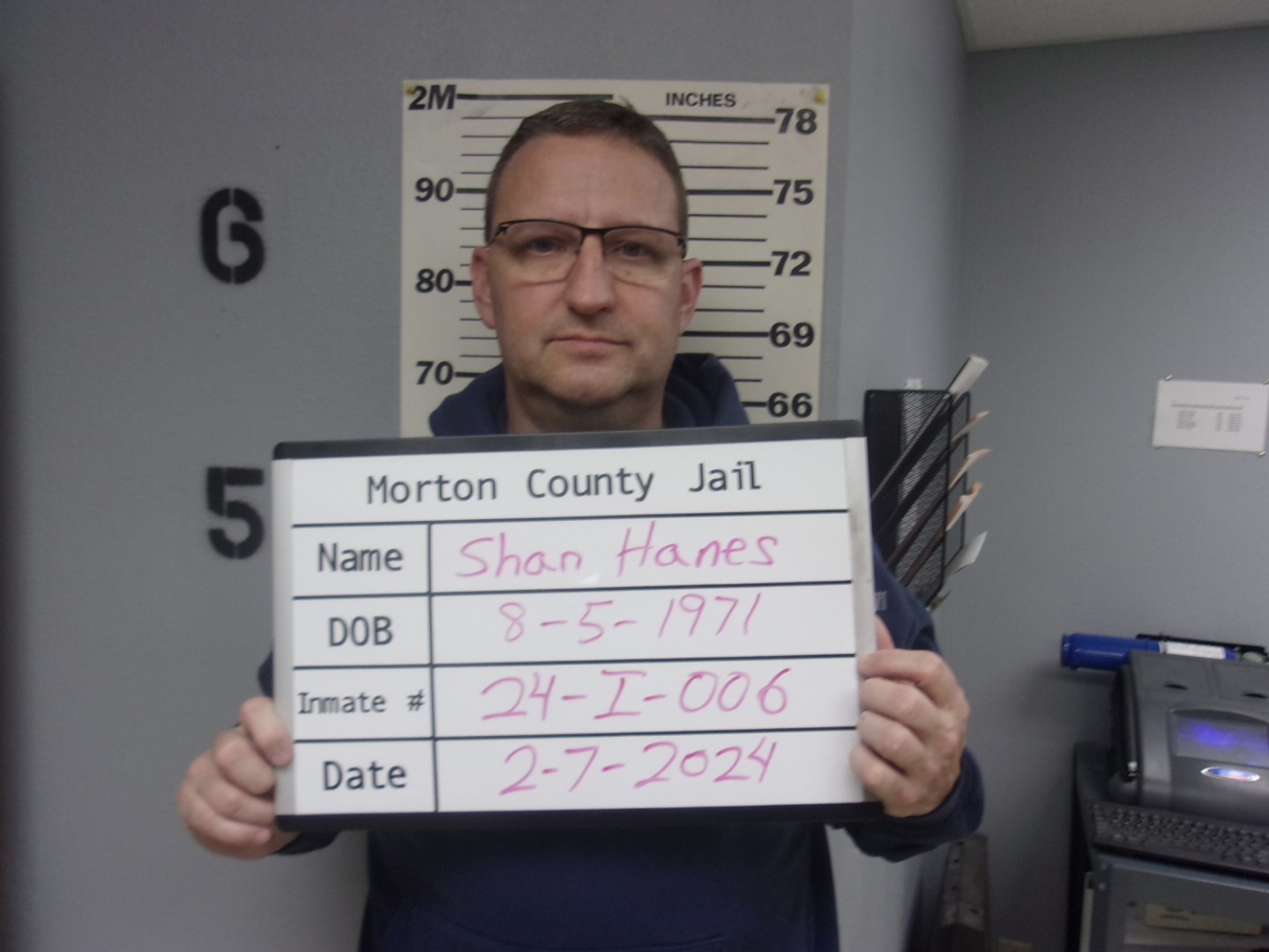

Prosecutors have filed a civil forfeiture lawsuit against more than $225 million in money laundering as part of a massacre scam with the Philippine call center, which is trapped in dangerous Shan Hanes, a shameful former CEO He embezzled $47 million from Heartland Tri-State Bankdirectly theft Attributable to the demise of agricultural lenders in 2023.

according to Judicial DepartmentOKX, a crypto exchange that provides critical information to help determine the complex account network of exchanges used for money laundering.

The scammer first instructed the victim to send USDT to the deposit addresses of 93 scams. From there, the funds were routed in one process by up to 100 intermediate wallets, designed to mask the sources of funds from multiple victims and sources of mixed sediments, the complaint said.

These money laundering funds were then remitted to 22 major OKX accounts and further reorganized in 122 other OKX accounts, all of which were linked by a shared IP address, reused KYC file, and coordinated behavior, which allegedly traced back to Manila-based scam compounds, which were called the complaint name of Itechno Peraceist Inc.

The Justice Department said in total that the money laundering network generated about $3 billion in transaction volume.

The biggest victim

The Justice Department said in total that there were 434 victims and determined that 60 of them had lost $19.4 million.

The largest of these victims is Hanes, who the Justice Department has identified $3.3 million of the $47 million he misappropriated in the seizure.

According to a complaint from the Department of Justice, Hans misappropriated the money between May 30, 2023 and July 7, 2023 Fed’s report Enter Heartland Tri-State Bank crashes, one of the banks collapsed after bankruptcy The US banking crisis in 2023.

During this six weeks, Hanes launched a $1 billion wire transfer from Heartland Tri-State Bank, a small community lender focusing on agricultural loans to crypto wallets he controlled.

These wire transfers occurred between the bank’s quarterly regulatory reporting period, thus leaving the activity undetected initially.

At the time, Heartland had $13.7 million in capital and $139 million in assets, but Hanes’ actions drained its liquidity, triggering $21 million in emergency lending and carrying $35 million in capital holes, forcing regulators to close it in July 2023.

According to CNBC’s prior reportHanes also stole $40,000 from the Elkhart Church of Christ, earned $10,000 from the Santa Fe Investment Club, stole $60,000 from his daughter’s college fund and liquidated nearly $1 million in stock from a company called Elkhart Financial to send a pork slaughter.

He was sentenced to 24 years in prison August 2024.

The Justice Department complaint claimed that he was the perpetrator and the victim.

Seized cryptocurrency may be fed to stock

The cryptocurrency seized by the U.S. government, for example, is likely to be designated as an inventory that has not yet been established Ordered by President Donald Trump.

Bitcoin

Stocks of reserves and other cryptocurrencies have not been formally established, but the Ministry of Finance has been leading an audit of government digital asset holdings to determine what needs to be collected.

Once established, long-term cryptocurrencies may incorporate seized bitcoins into one fund and other types of tokens.

According to the document, holdings in this case appear to have a large amount of USDT. It is not clear which funds can be returned to the victims in the end, as only a relatively small percentage of those who were directly hurt was determined.