Switch off the editor’s digest free of charge

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

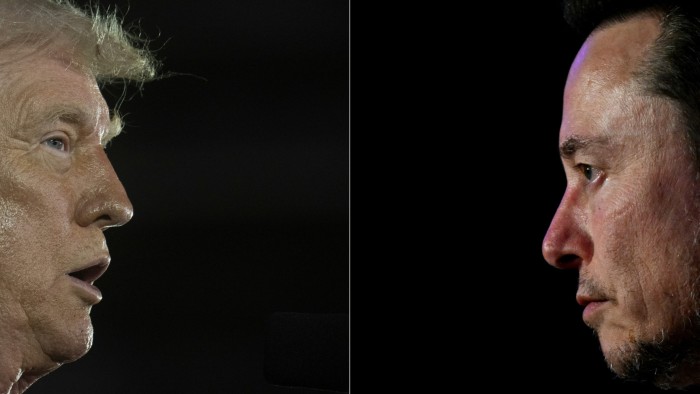

Elon Musk’s artificial intelligence company Xai joined a $ 5 billion for the debt financing package in order to finance new data centers and chips to provide its business with electricity. On Thursday, the richest man in the world torded his relationship with US President Donald Trump.

Musk’s bankers at Morgan Stanley must now fight with this new complication Dramatic development from Musk’s connections to the president, according to people who were informed in this matter. The debts could also be more expensive, they added.

Before the two men started a war war – the Trump’s threat to the abolition of Musk government contracts – the investors had given more than $ 4 billion orders for the deal.

Borrow money to a AI company that belongs to the “first buddy” of the President musk It also looked like a solid bet.

The enthusiasm drew Morgan Stanley Near the finish line of debt procurement with large names investors such as TPG in tow.

The interest was so high that Morgan Stanley had taken the view Xai Could block cheaper financing than they originally set up.

But this pricing is now in the air, whereby some investors may have to pay Xai to determine the financing.

The multibillion dollar creditator package is expected to be divided between fixed and floating interest rates and a corporate bond, and a person who was informed in this matter said that the capital procurement of USD 5 billion is still on the right track.

At the beginning of this week, the bankers discussed the reduction of the voucher for bonds and loans with a fixed rate from 12 percent to 11.5 percent, while the floating rate loan was expected with a interest rate of 7 percentage points above the benzmark swimming rate.

“It makes it even more difficult,” said a person who carried out in the Deal Due Diligence via Musk Fallout with Trump. “You need the government’s support for the entire ecosystem, not only for this.

Xai Management hit investors on Thursday when the two men blocked the leaders on social media and shared projections for the company’s business and its growth prospects.

Morgan Stanley had submitted the debts to large loan transactions, giving up the orders of at least $ 100 million and attacking many of the same investors who had agreed to buy loans from Xai’s sister company, social media site X at the beginning of this year.

In a sign of the impact that the Kerfuffle had on Musks shops, the prices for XS debts set about $ 96 from more than $ 99 cents a day before.

Morgan Stanley had confronted with an investor pushback before spitting. The lenders had expressed concerns about the documents that underpin the deal and demanded that XAI demand a number of traditional protective measures offered to investors. This includes the amount of the incremental debt, which Xai can also take over, how much cash can pay its investors.

Others had raised questions about intellectual property that secured the loan package and the value of the collateral. The debts are also secured by the data centers. Xai builds.

Some investors had signaled that they would move away from the deal if their concerns were not discontinued, which could reduce how much money Xai is able to increase or increase its interest burden. Morgan Stanley works for a period of June 17 to hammer these terms.

Xai did not immediately answer a request for comments. Morgan Stanley and TPG rejected a statement.

Investors who carried out the debts for the debts said that Xai was a loss formation and the income is low. However, their investment thesis is partially underpinned by the company’s equity assessment and its conviction that Xai will sell lucrative corporate contracts for the use of its technology.

“It is a product that will probably be one of the winners of the commercial AI,” said a lender. “Openai has a big lead on the consumer side, but on the commercial side you can be a material player, and that will be worth much more than $ 15 billion to USD 20 billion.”

The financial times Registered on Monday That Xai a 300 million. -Tollar -shares launched the market that would evaluate the group for $ 113 billion.

Nevertheless, some creditors have complained about the limited data that have been shared so far.

Those familiar with the deal said that Morgan Stanley had kept a tight yoke about access to the data room and when calling with the management. One person added that a slide deck Xai, who was presented on Thursday before a presentation of the investors to investors, had about 10 or less foils.

“It was really Fugazi and I say that as a lover of the Xai data room,” said the person with a slang term for Phoney.

“It’s all imagination, it’s an idea,” said a second person about the presentation. “They spend money and do not make any money yet.”

Additional reporting by Robert Smith in London