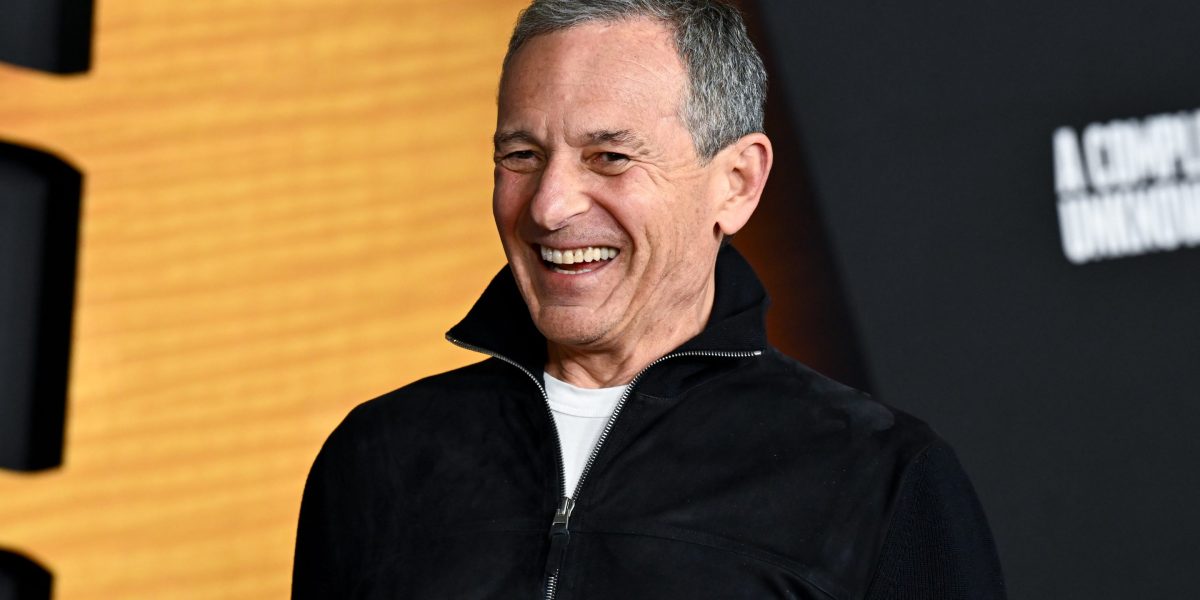

The streaming wars occurred another new iteration on Wednesday Disney If a significant change in the department, which she describes directly to consumers: Disney+ will integrate Hulus processes into something and turn into something that looks very similar to the old linear television bundle. As CEO Bob Iger told the company’s investors Income in the third quarter“Combine Hulu in Disney Plus (Will) to create a uniform app experience with brand and general entertainment, news and sports, which leads to a unique entertainment goal for subscribers.”

Disney published his income in the third quarter on the night before DisneyThe company confirmed that it had concluded a contract with its long-term partner in Sport, the National Football League, an asset and an equity exchange, in which the NFL receives 10% of the ESPN Division from Disney and ESPN/Disney acquired several streaming assets from the NFL. The 10% of the NFL participation to ESPN has a value between 2 and 3 billion US dollars per per Octagon estimates.

ESPN will receive the rights to three additional NFL games per season that were previously broadcast by the NFL’s own networks and will be more of the top-rated TV show live football in America, as the company strengthens its streaming war treasury. Disney has reconstructed ESPN to survive the decline of the linear television with the start of an independent streaming service, and it will now be connected by football fanatic: The NFL Network, the NFL Redzone Distribution Rights and the NFL Fantasy Football. In streaming, Netflix And Amazon You have acquired more NFL rights in recent years, so Disney’s move shows his game defense and some crimes on this front.

Disney also announced an extended agreement with the WWE, another recently in Netflix partner, who was then created as A 1.6 billion US dollars deal This will make Disney the home of the Wrestlemania marquee. Iger said that ESPN “will be the exclusive home for WWE Premium Live events and that the ESPN right -wing portfolio is expanding”. In the plans of Disney in this area, Iger added that Disney “Espn builds into the outstanding digital sports platform with our highly expected direct direct offer for the consumer sports offer”.

Disney announced in her profit that the sports department anchored by ESPN declined by 5% to $ 4.3 billion, mainly due to the higher fees for the rights of the NBA and college sports. However, the segment gain rose by 29% to 1 billion US dollars than A Fusion in its Indian unity took some losses from his balance sheet.

Streaming profitable in the middle of linear television, film studio decline

In total, Income in the third quarter showed resilience in important business segments for Disney such as streaming and themed parks, also showed fatigue as its traditional television and film studio departments. The total turnover for the quarter up to June 28th rose by 2% to $ 23.7 billion compared to the previous year, just below the forecasts of Wall Street, while the adjusted result increased by 16% to $ 1.61, which exceeded the analyst expectations of $ 1.47. Net income before tax rose by 4% to 3.2 billion US dollars.

A headlining performance for Disney was the solid performance of his streaming business, which achieved a sales profit by 6% to $ 6.2 billion and achieved an operating profit of $ 346 million -a significant handling of a loss of $ 19 million in the same quarter of the previous year.

The subscription indicators reflected constant profits, with Disney+ 1% quarter-over quarter increasing to 55.5 million subscribers with the same margin for a total of 128 million. The combined subscriber base from Disney+ and Hulu rose to 183 million and 2.6 million compared to the previous quarter. Disney also completed the remaining participation in Hulu from Comcast/Nbcuniversal in June and made the stage in June for closer integration of its streaming brands in the course of this year.

In the entertainment segment of Disney, sales growth was initiated from 1% to 10.7 billion US dollars, which decreased by 15% of the operating result to $ 1 billion. Theater publications, including original animated and live action remakes, remained below average compared to the strong health insurers last year with “Inside Out 2”. In addition, the linear TV networks from Disney, including ABC and Disney Channel, recorded a decline in sales of 15% compared to the previous year to $ 2.3 billion and underlined continuous challenges by the cutting edge and lower international results according to the Star India deal.

With a view to the front, Disney expects that Disney+ and Hulu will increase as a total subscriptions in the next quarter by over 10 million, which is partly driven by an extended agreement with an extended agreement Charter communication.

Topics and experiences shine

Disney’s “experience” segment that covers themed parks, cruise lines and consumer goods were delivered robust numbers and earlier forecasts were exceeded. The turnover in the third quarter rose $ 9.1 billion compared to the previous year, which was heated by an increase in the operating result of 22% in domestic parks and experiences to $ 1.7 billion. Disney pointed out strong guest expenses and higher occupancy rates in the parks and cruise lines, especially in Walt Disney World, despite the excited opening of the Epic Universal Universal in Orlando. The managers emphasized the “continuing resilience” of Disney’s parking business in the face of new competitions.

Relatives guidance, optimism for 2025

In particular, Disney increased its guidelines for the 2025 financial year and predicted adjusted profit of $ 5.85 per share – an increase in the previous year by 18%. The company also expects a double -digit segment that the operational income growth in entertainment and sport with an experience of 8% for the whole year. CEO Bob Iger confirmed Disney’s commitment to global expansion, stated more active parking by parking than at some point in the history of Disney and emphasized ongoing strategic investments in streaming, topic parks and sports as a driver for future growth.

“Disney is not finished and we are happy about the future,” said Iger after the earnings published.

For this story, Assets Used generative AI to help with a first draft. An editor checked the accuracy of the information before publication.