NewYou can listen to Fox News articles now!

Apps like Venmo, Zelle, Cash App and PayPal have changed the way we currency. They are fast and convenient, but can be easily exposed. If you send funds to the wrong person, they may disappear forever. There is usually no real way to recover, especially when the recipient disappears behind a fake username and unresponsive support system.

In times of crisis, this vulnerability becomes even more dangerous. In natural disasters, high-profile social movements or health emergencies, people are given mobile. The liar knows this and takes advantage of the impulse. One such scam involves a fake venmo account that pretends to collect donations for Minnesota nonprofits after George Floyd’s death. The account looks legitimate, but the funds never reach the organization.

Similar scams target Miles Perret Cancer Services, a Louisiana-based nonprofit. Scammers created a fraudulent Venmo account that closely mimics the legal Venmo handles of cancer nonprofits. They are using this fake account to trick good-willed donors into sending money and think they are supporting real charities.

Sign up for my free online report

Get my best technical tips, emergency security alerts, and exclusive deals delivered directly to your inbox. Plus, when you join, you will immediately have free access to my ultimate scam survival guide.

Zelle and Venmo apps (Kurt “Cyberguy” Knutsson)

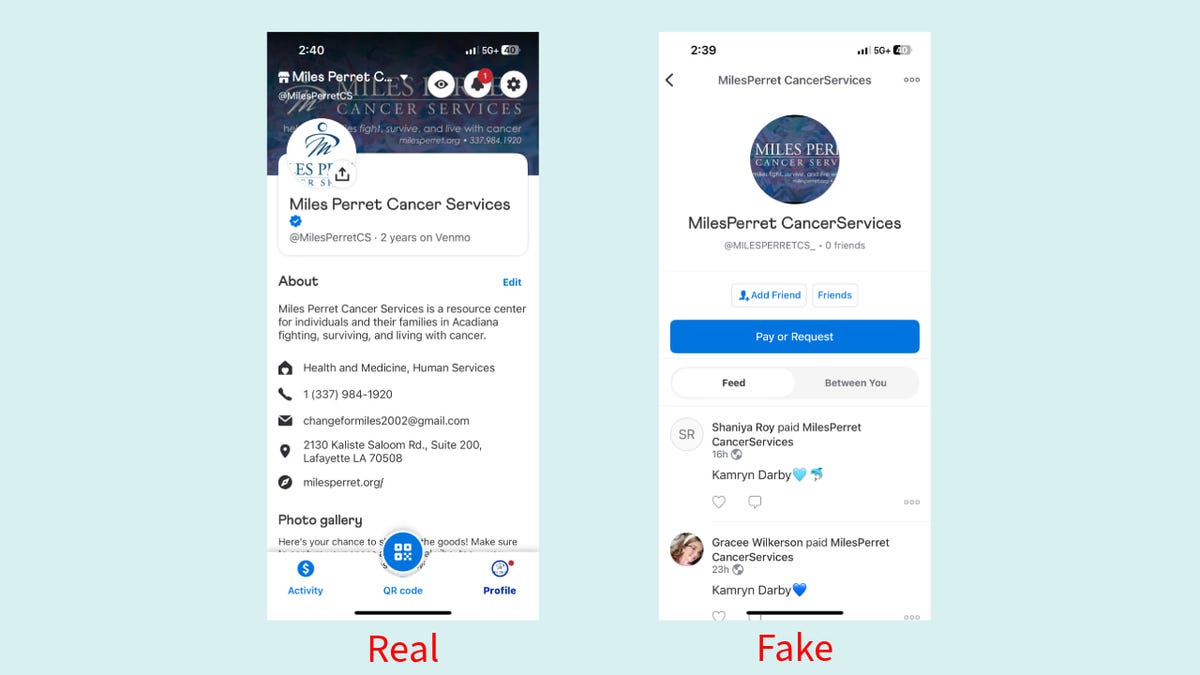

Fake venmo account imitates real charity: How 1 character cheats you

Miles Perret Cancer Service (MPC) supports families facing cancer diagnosis. They recently discovered that a fraudulent Venmo account was impersonating their official account. Their real handle is @milesperretcs. Scammer’s account use @milesperretcs_almost indistinguishable copy.

For ordinary people, differences are invisible. That’s what makes it dangerous.

“We reported the account through the app 24 hours ago,” MPCS executive director Timothy Rinaldi told Cyberguy. “There is no follow-up at Venmo. We tried the live chat option, but it suddenly turned off and there was no solution.”

Instead of helping, Venmo hit Rinaldi with a universal FAQ and a legal disclaimer. Even if he is associated with the on-site support agent, the response is a standard script. He was told that the problem had escalated, but no one could provide a timeline that exceeded three to five working days for blur windows.

Real and fake Venmo accounts (Kurt “Cyberguy” Knutsson)

FBI warns scams targeting victims with fake hospitals and police

Charity Scam on Venmo: How Scammers cheat donors to use fake accounts

In recent years, fake Venmo accounts have been used to exploit donation drives for hurricane relief, animal shelters, medical funds and other reasons. The formula is very simple. Take a known nonprofit, adjust your username slightly, and ride the momentum of goodwill. When anyone catches it, the money disappears and the damage is caused.

Events involving MPC are not isolated cases. In December 2024, Final Victory Animal Rescue, a South Carolina-based nonprofit organization. Discover Venmo account, impersonating an organization and collecting donations designed to be true charities. Michael Sniezek, the group’s general manager, confirmed that the account had received funds from unsuspecting donors before the issue was posted.

In another case, one is no longer Phoenix’s nonprofit dog rescue, Posted on Facebook The fraudulent Venmo account has been targeting past donors, sending them payment requests and soliciting additional funds under false pretexts.

The MPC has submitted a report to the Federal Trade Commission, but it cannot guarantee a quick resolution. As of press time, fraudulent accounts remained active. It is not clear how much has been lost or whether Venmo will restore and return any of them.

Hackers at work (Kurt “Cyberguy” Knutsson)

This is the error of the scammer making a call

How to Avoid Venmo Scam: 11 Expert Tips to Protect Your Money

Scammers are not only targeting charities. They follow anyone and everyone. Here are a few ways to protect yourself and keep your hard-earned money safe.

1) Always access the payment app from the official app or website, And not from any third-party platform or service.

2) Check the security settings Payment apps provide and ensure they are all set to the highest and most protected settings.

3) Consider using personal data deletion services to protect your privacy and reduce the risk of scams. Scammers targeting payment apps like Venmo, Zelle, Cash App and PayPal often rely on data brokers and people to search for information on the website to create compelling fake or phishing attempts. These sites can list your name, address, phone number, and even connections to organizations you support, making it easier for fraudsters to trick you or others into sending money to fake accounts.

Personal Data Deletion Services can automatically delete your information from hundreds of data brokerage sites, making it harder for scammers to find and abuse your detailed information. By scrubbing data from these sources, you can reduce the risk of being targeted in payment app scams and reduce the likelihood that someone will pretend to be you or the nonprofit you care about. View my preferred data deletion service here.

Get one Free scan Find out if your personal information is already on the Internet

4) Create a powerful, unique and complex password For each of your mobile payment apps, and change frequently. Consider using a password manager to generate and store complex passwords. Get more details about me Best Expert Review Password Manager in 2025.

5) Enable Two-factor authenticationwhich means you need to enter a code or unlock your account with your fingerprint or face to prevent unauthorized access. This way, even if someone knows your password, they can’t log in without your device or confirmation.

6) Lock the device and log out of your application. You should always lock your phone with a password, pin, pattern, fingerprint or face. Never share passwords, PINs or security codes with anyone. After each use, you should also log out of the mobile payment app and turn off the automatic use feature. This way, even if someone takes or borrows your device, they will not be able to access your mobile payment app without your approval.

7) Verify the identity and legality of the sender or receiver. You should always check the name, photo, username and contact information of the person or organization you want to or receive the money before accepting or sending any payment request. You should also confirm the reason and amount of the transaction before agreeing. If you are unsure or have any questions, you should contact the person or organization directly through other means, such as phone calls, text messages or emails, provided that you are sure that these forms of communication are legal. You absolutely do not send money or provide your account details to anyone you don’t know or trust, or anyone you ask you to do from the blue.

8) Link your Venmo to your credit card Contrary to debit cards, you can more easily dispute the fraudster’s allegations. However, remember that linking a credit card to your payment app can provide additional protection in the event of fraud, but this may bring additional fees in terms of transaction fees.

9) Try not to maintain balance in your currency transfer application. When it comes to fraud, your bank or credit card company has a better opportunity than you offer from the currency transfer app.

10) Use powerful antivirus software and never click links from unknown sources. Especially when email or text appears to be coming from a payment app. Protect yourself from accidentally clicking malicious links by running antivirus software on your device.

The best way to protect yourself from installing malware (malicious links that may access private information) is to install antivirus software on all devices. This protection can also remind you about phishing email and ransomware scams, ensuring your personal information and digital assets are secure. The choice of the best 2025 antivirus protection winners for your Windows, Mac, Android and iOS devices.

11) Monitor your account activity and report any suspicious or unauthorized transactions. You should set up notifications from the payment app and bank via text or email and check your account activity regularly. Look for any signs of fraud, such as payments you haven’t paid or received, or changes to your account settings or information.

Kurt’s key points

Unlike traditional banks that are bound by federal consumer protection laws and timetables for fraud resolutions, peer-to-peer payment applications run in a more relaxed regulatory environment. Services like Venmo often state in their user agreements that they are not responsible for errors or unauthorized payments unless there is clear evidence of an account compromise or technical failure. Venmo’s only advice here is to respond to the support vote and wait. There is no emergency fraud hotline, no dedicated links for nonprofits, and no indications of urgent action. Payment apps that allow donations to flow quickly like text messages also have to assume the responsibility to ensure the security of these transactions. Something is destroyed when nonprofits have to beg for support to protect their identity.

Responsible for payment platform for the losses caused by imitation scams? By writing to us, let us know cyberguy.com/contact.

For more technical tips and security alerts for me, please subscribe to my free online coverage newsletter cyberguy.com/newsletter.

Ask Kurt a question or let us know what stories you want us to cover.

Follow Kurt on his social channels:

Answers to the most popular web guess questions:

New things from Kurt:

Copyright 2025 CyberGuy.com. all rights reserved.