Business Reporter

Learning Resources

Learning ResourcesDonald Trump’s comprehensive tariff plan will expire for 90 days on Wednesday, which could disrupt our trading relationship with the rest of the world. But uncertainty in recent months has forced several companies to rethink their supply lines in a radical way.

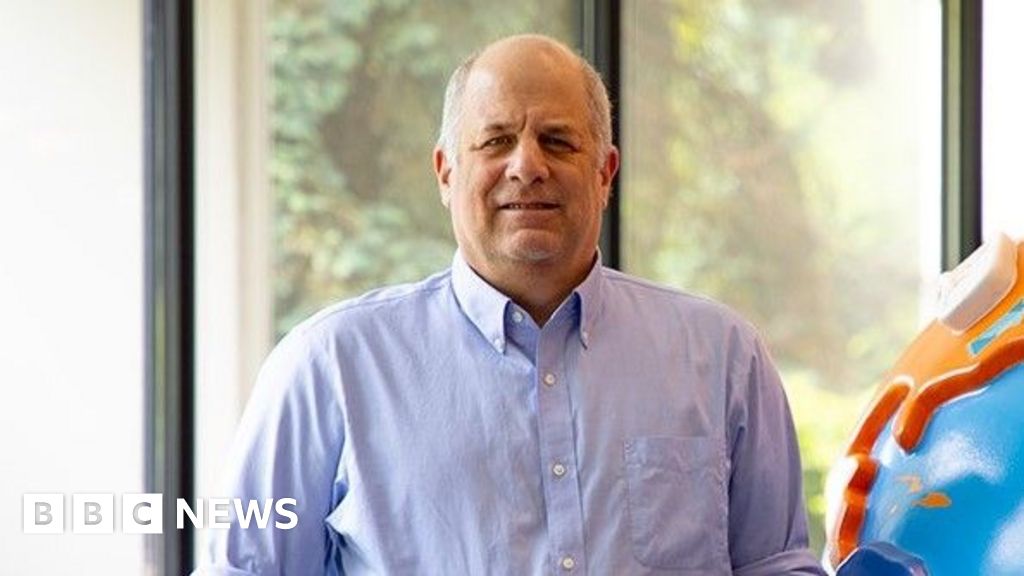

When an Illinois toy maker heard that Trump imposed tariffs on Chinese imports, he decided to sue the U.S. government.

“When my company is really dangerous, I tend to stand up,” said Rick Woldenberg, CEO of educational toy company Learning Resources.

Most of his company’s products are made in China, so the tariffs that our importers have to pay, not Chinese exporters, have now made him pay a huge sum of money.

He said his import tax bill went from about $2.5 million (£1.5 million) a year to more than $100 million in April, when Trump temporarily raised tariffs on Chinese imports to 145%. This will “destroy” the company, he said.

“This impact on my business is hard to get my mind entangled,” he said.

Since the U.S. tariffs on Chinese imports are now 30%, this is still unbearable for many U.S. companies, such as learning resources.

So, besides the ongoing legal battle, it is changing its global supply chain, shifting output from China to Vietnam and India.

Like most other countries in the world, these two countries have seen the United States attack them with 10% tariffs, two-thirds lower than China. Although this 10% tariff will be exhausted on Wednesday, July 9, uncertain tariffs remain uncertain.

Meanwhile, many Canadian companies often trade in their home country and the United States, now posed a double blow to their supply chains.

These hits are Trump’s 25% tariff on many Canadian imports and mutual levels on the same level as Canada’s numerous exports to the United States.

Other businesses around the world are considering exporting less to the U.S. as their U.S. import partners have to raise prices to pay the tariffs they have to pay now, making their products more expensive on U.S. shelves.

In terms of learning resources, Mr. Waldenberg has now transferred 16% of manufacturing to Vietnam and India. “We went through the process of reviewing new factories, training them to make sure things can flow easily and relationships grow.”

However, he admitted that there was uncertainty: “We don’t know if they can handle our business capabilities. Not to mention the whole world moving there at the same time.”

He also noted that switching production to another country is expensive.

Meanwhile, his legal case against U.S. tariffs, known as “Learning Resource et al. Donald Trump, et al.,” is continuing to move forward through the U.S. court system.

In May, a judge in the U.S. District Court of Washington, DC ruled for tariff violations It is illegal. But the U.S. government appealed immediately, and learning resources still had to temporarily pay tariffs.

Therefore, the company is continuing to move production away from China.

Learning Resources

Learning ResourcesGlobal supply chain expert Les Brand said it is expensive and difficult for companies to convert manufacturing to different countries.

“Trying to find new sources of key components of anything you do – that’s a lot of research,” said Mr. Brand, CEO of Supply Chain Logistics, consulting firm.

“There are many quality tests for the right test.

He added: “Knowledge transfer to train a whole new group of people how to make your product takes a lot of time and money. This impact is already Razor-the meager profit margin business now owns.”

For Canadian fried chicken chain Clucks, its supply chain is affected by Canadian revenge tariffs on U.S. imports. This is because while its chicken is Canadian, it can be imported from both a catering refrigerator and a pressure fryer from the United States.

While it can’t survive without a refrigerator, it decided to stop buying more fryers. However, since there is no alternative company for Canadian companies, it has to limit its menus in its new store.

This is because it requires these high-pressure fryers to cook chicken pieces. Instead, the new store can only sell boneless chicken because it’s different.

“This is a big decision for us, but we think it’s the right strategic move,” said Raza Hashim, CEO of Cluck Clucks.

“It is important to note that we do plan to retain the necessary kitchen space for the new location to reintroduce these fryers if future tariff uncertainties are completely resolved.”

He also warned that now, in U.S. refrigerators, the company is buying more, and the price of its food charges may have to rise. “We can’t absorb certain costs as brands, we may have to pass them on to consumers. It’s not what we want to do.”

Mr Hashem added that the business is continuing the U.S. expansion plan and establishing a local supply chain for sourcing U.S. chicken. Currently, it has a U.S. export in Houston, Texas.

Crook cl

Crook clIn Spain, olive oil producer Oro del Desierto currently exports 8% of its production to the United States. It said the U.S. tariffs on European imports (currently 10%) must be passed on to U.S. shoppers. “These tariffs will directly affect the end consumers (in the United States),” said Rafael Alonso Barrau, the company’s export manager.

The company also said it is considering reducing the amount sent to the United States if the tariffs make the transaction less profitable and instead export more to other countries.

“We do have other markets to sell the product,” Mr. Barau said. “We sell in another 33 markets, and all of these markets, as well as our local markets, we can buffer our losses.”

Mr Brand said companies around the world would suffer less if Trump’s tariffs were slower. “The speed and speed of these decisions really make everything worse. President Trump should get slower and more meaningful for these tariffs.”

Back in Illinois, Mr. Waldenberg is also worried about Trump’s next destination in the trade struggle.

“We just have to make the best decision based on the information we have and see what happens,” he said.

“I don’t want to say ‘hope for the best’ because I don’t believe it’s a strategy.”