Another Hong Kong company is adding cryptocurrency to the Ministry of Finance, but it hopes to do more than just hold it passively.

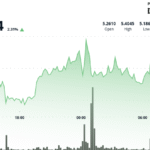

IVD Medical Holdings has purchased $19 million (HK$149 million) ether (ETH)positioning assets at the center of their actual asset token strategy.

The company is building IVD.XYZ, a platform for pharmaceutical intellectual property and other healthcare assets that will run entirely on Ethereum smart contracts.

Chief Strategy Officer Gary Deng said in a statement to Coindesk that Ethereum was selected as a core asset because it is the “most mature smart contract platform in the world” with “extremely liquidity” and institutional recognition, which demonstrates the US SEC’s recognition of on-site ETH ETFs.

IVD plans to use ETH for on-chain ownership recognition, automated revenue distribution, and compliance governance of token assets.

It will also serve as the settlement layer for the company’s planned IVDD Stablecoin, enabling cross-border transactions within the Hong Kong and U.S. compliance framework. The revenue from RWA transactions will be automatically converted into ETH and deposited into the treasury.

IVD also intends to deploy ETH to points, redevelopment and on-chain derivatives to improve returns and liquidity while increasing downside protection. The move has led IVD to use cryptocurrencies with a small group of Hkex listed companies, most of whom prefer Bitcoin

.

boyaa interaction (0434.hk) After converting almost all of Ethereum into Bitcoin, it has over 3,100 BTC worth more than $300 million. daughter (1357.hk) Buyed approximately 31,000 ETH and 940 BTC in 2021 forward Exit these positions.

Other smaller Bitcoin holders include Yuxing Infotech (8005.hk) There are 78 BTC,,,,, Moon Company (1723.hk) With 18.88 BTC, and Walnut Capital (0905.hk) 10 BTC donated by shareholders.

The IVD’s move is Announcement on broader partnerships with Hashkey Groupoperates a Hong Kong licensed hash stock exchange.

Read more: Sharplink raises $200 million in direct product to increase ETH stake to $2B