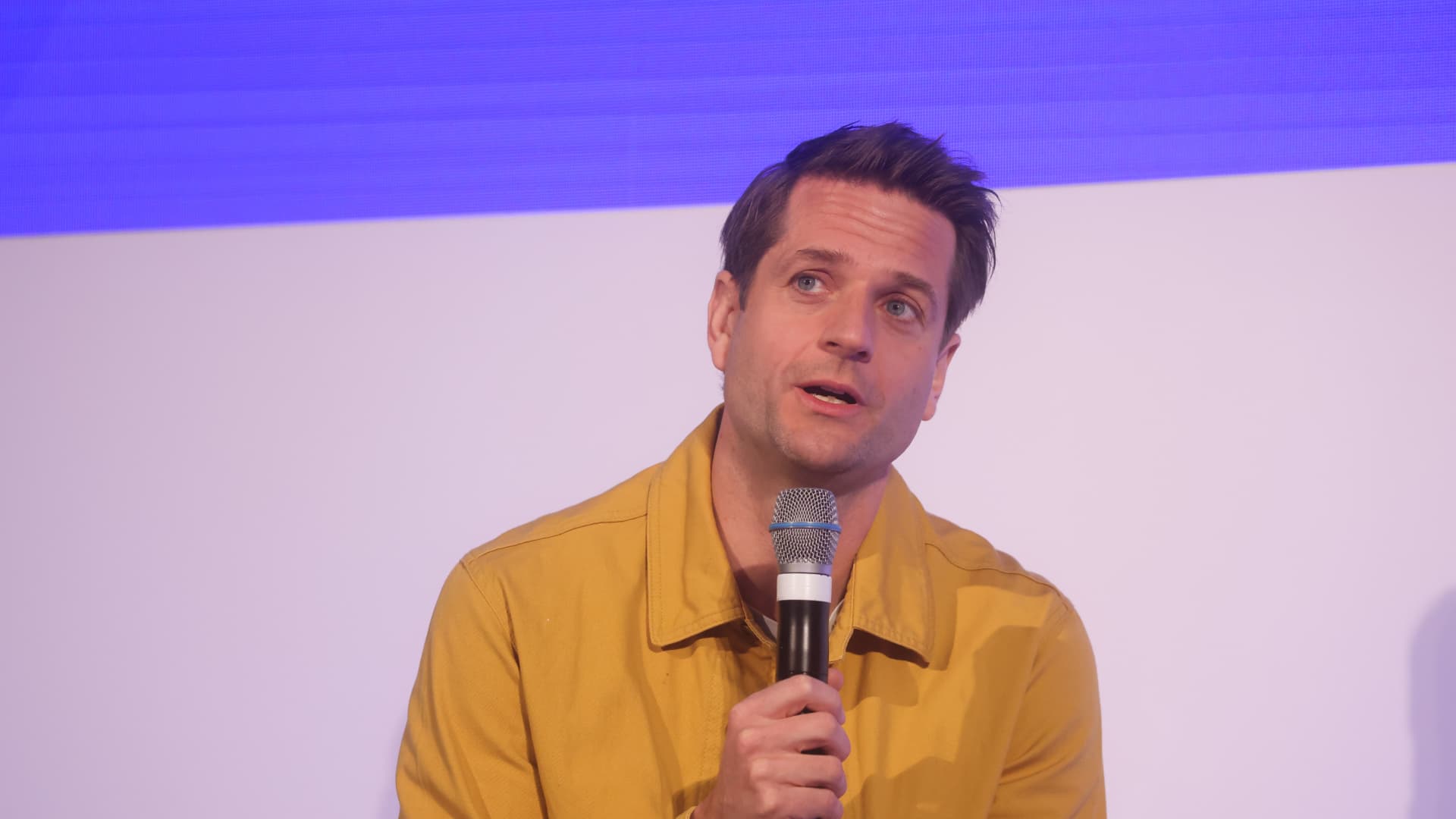

Klarna CEO Sebastian Siemiatkowski spoke at a fintech event in London on Monday, April 4, 2022.

Chris Ratcliffe | Bloomberg by Getty Images

Klarna’s CEO is so optimistic about AI that he sees it changing the way fintech’s 100 million users bank.

On Wednesday, Klarna, a pioneer in the popular Buy Now, Pay Later (BNPL) payment method, announced the launch of a mobile phone program in the U.S. through a partnership with Telecom Services Services Startup Gigs. The move comes after competitors Fintechs Revolut and N26 released similar products. Krana’s plan comes with unlimited data, phone calls and text, and costs $40 per month.

The new telecom company offers a vision consistent with CEO Sebastian Siemiatkowski, even if Klarna becomes more of a comprehensive personalized financial “Super App” that can serve in the traditional financial sector.

This is not the company’s first attempt. Previously, Klarna tried to make herself more similar to “super apps”, similar Tencent WeChat Pay – Provide other services through multiple different buttons. Siemiatkowski told CNBC in an interview that this ended up being “confused with customers.”

But the boss of Klarna stressed that AI can show diversified services and is known for its BNPL release.

“I think there is a better opportunity to provide customers with different services in this new AI world, and then adopt the level of expression and visualization of those services in history,” Siemiatkowski said.

“With AI, you can abstract and take more experience to the specific users you want to deal with,” he added.

Super apps are popular in China and other parts of Asia. They are designed to serve as a one-stop shop for all your mobile needs, for example, for taxi and food ordering in the same location as payment and messaging services.

But despite the booming Asian super apps, adoption in the Western market remains Slower due to various reasons.

“Great Opportunity”

Siemiatkowski said he spent a lot of time focusing on AI.

“It’s a huge opportunity – but it’s just making it work,” he said. “Everyone who uses it knows it can spit out something exciting, but you need to make sure it works every time.”

Looking ahead, the head of Klarna believes that the platform is increasingly becoming a “digital finance assistant” for users’ daily banking needs.

“If we have some information that you are paying for your carrier subscription, data or any other information,” Siemiatkowski said.

Siemiatkowski admitted Klarna’s previous attempt to be a problem with super apps, saying the technology wasn’t “mature” enough at the time.

Clear Reported a loss of $99 million In the quarter ending in March, one-time fees related to depreciation, stock-based payments and restructuring were cited.

Perception problems

Despite this, Krana still has to overcome the perceptual problem. In the United States, the company has become synonymous with the Buy Now, Pay Later (BNPL) payment method, which allows consumers to pay off their orders on monthly installments – usually without interest.

By contrast, European consumers realize that they can use Krana to store deposits and make a payment through a credit plan and pay for it.

He was also frustrated with “the kind of meme we got in the United States, like, ‘Oh, the kind of meme that Krarner initiated together doordash …This is a sign of the macroeconomic environment,” To announce partnership with Doordash for food delivery applications Earlier this year, online experienced a rebound.

Simiakovsky said this reaction would not happen in the German or Nordic markets, and Krana operates more like PayPal on the online payment system.

He sees the future of Klarna, a more omnibusy financial ecosystem with additional services such as investment capabilities for stocks and cryptocurrencies – not “too far”, he added.

“Providing people with the ability to invest in stocks and cryptocurrencies is a more standard part of what new chickens offer,” he said. Robin.

When will Klarna IPO be released?

Clear Suspension plans are released in AprilAfter U.S. President Donald Trump announced large quantities of tariffs on dozens of countries.

Siemiatkowski says Klarna has achieved its goal to prepare for this milestone – i.e., build a brand in the United States

“The United States is our biggest market right now. It’s a profitable market for us,” he said. “These things have been done.”

Krana’s business strategy remains the same regardless of whether the company is public or not.

“It’s just a healthy way to bring liquidity to our shareholders and provide more ways to fund the company, if you want, … indicates that it’s an established company.”