The cryptocurrency market showed signs of new strength as near-protocol differences broke through key resistance levels in the final trading on July 7. Decisive moves A great move is 61% higher than the daily average, which confirms the breakthrough effectiveness of the rising triangle pattern formed throughout the day.

Trading data shows that near users built strong support in the range of $2.16-$2.17 and bounced multiple times before eventually overcoming the $2.19-$2.20 resistance. The breakthrough was particularly noteworthy during the 60-minute period ending at 14:04, when it soared from $2.17 to $2.19, forming what analysts call the textbook cup and handle pattern.

This technological development comes as Bitcoin crosses 109k with an all-time high of $111,970 as the wider crypto market experiences a huge momentum.

The total capitalization of cryptocurrency market capitalization has expanded to $3.3.6 trillion in trading volume growth of 40%, providing favorable conditions for AltCoins, such as improved market sentiment close to capitalization. Despite close-range price action, the asset is significantly lower than its all-time high of $20.42 in January 2022. The current technical indicators show a mixed situation, with 14 days out of the last 30 green dates, but the RSI is 31.09, indicating that the oversell conditions can support further recovery.

Technical Analysis

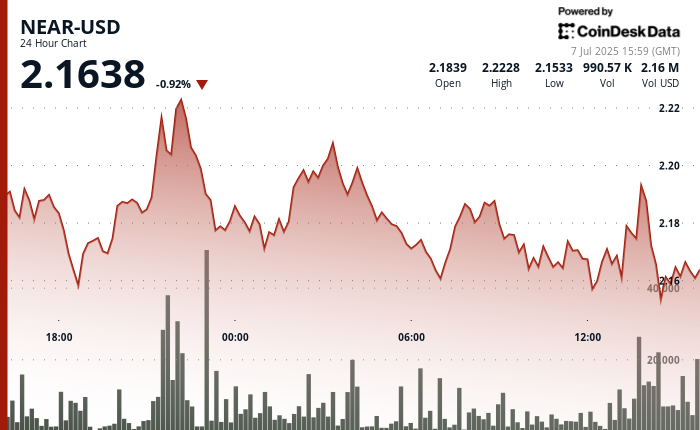

- During the 24-hour period from July 6 to July 14:00, close-up usd showed significant fluctuations, with a price range of $2.16 to $2.22, accounting for 3.15% of the swing.

- The asset built key support for multiple bounces at $2.16-$2.17, and eventually overcame resistance at the last hour, $2.19-$2.20. (197 million is versus 1.22 million in 24 hours).

- The decisive breakout over the $2.19 level throughout the period, coupled with the bullish triangle pattern, suggests a possible upward momentum with the next resistance target of $2.22.

- During the 60-minute period from July 7 to 14:04, the near-USD trend showed a strong bullish trend, soaring from $2.17 to $2.19 with a yield of 1.13%.

- Assets break key resistance at $2.18, with excellent peaks at 13:57-13:58 (143,856 units)forming a cup and handle pattern, ultimately leading to a decisive breakthrough to $2.19.

- Support during the mid-term callback period is $2.16 (13:17-13:20) Holding firmly, the buyer actively intervened to cheer on the subsequent rally, which reached $2.19 before a small profit occurred in the last few minutes.

CD20 whip 1.17% before looking for support

The CD20 index has experienced significant volatility in the past 24 hours from July 6 to July 14:00, with a price range of 1.17% ($21.06) Between the high of $1,793.57 and the lowest point of $1,772.50.

After peaking in the early hours of July 7, the market entered a merger phase, down 1.17% at 13:00, down $1,772.50 before recovering to $1,780.94 at the end of this period, indicating potential stability following early volatility.

Disclaimer: Part of this article was generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and compliance Our standards. For more information, see Coindesk’s complete AI policy.