Switch off the editor’s digest free of charge

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

Nvidia Insider have sold more than 1 billion of the company’s shares over the past 12 months, including a recent trade offer as managers who use the enthusiasm of investors for artificial intelligence.

This month, more than $ 500 million in stock sales took place this month when the share price of the chips based in California rose to a record high.

Investors have stacked themselves back into the stock, which makes it the most valuable company in the world because they bet on the enormous demand for chips for power applications. The price increase comes after a turbulent year in which Nvidia was beaten by US China trade voltages and Chinese AI breakthroughs that threatened the demand for their products.

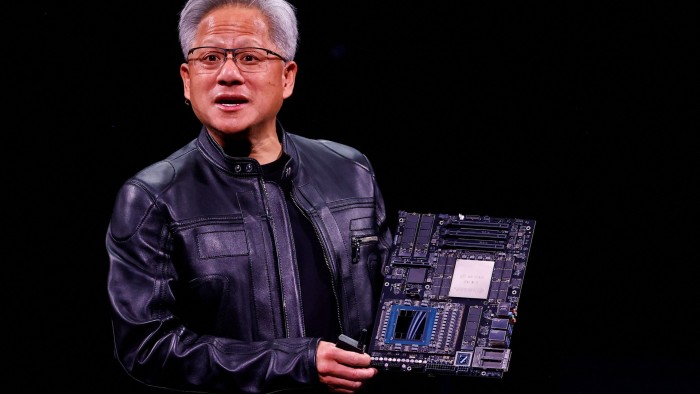

Jensen Huang, Chief Executive from Nvidia, started selling this week for the first time since September.

NVIDIA said that all Huang sales were part of a pre -ordered trading plan that was agreed in March, which determined the prices and data to which sales would be triggered. Huang Stills keeps the vast majority of his shares in Nvidia.

“When the stock (broken off) was in the first quarter, he didn’t really sell,” said Ben Silverman, Vice President of Research at Veritydata.

“(Huang) waited for the stock to return to levels that he felt more comfortable,” added Silverman.

Veritydata, which is pursuing insider sales based on regulatory submissions, said in a report that the Nvidia share price triggered Huang’s turnover over 150 US dollars.

Huang started to sell, shortly after a prescribed 90-day cooling period for his sales plan had expired. Directors and leaders often agree on these plans to avoid insider trading allegations.

As part of the plan, Huang can sell up to 6 million stocks before the end of this year. To the current share price, Huang leaves the right way to earn more than $ 900 million.

According to Forbes, Huang’s net assets are estimated at $ 138 billion.

The market capitalization of NVIDIA has quadrupled to USD $ 3.8 billion within a few years, since companies and nation states flow into billions from dollars into the infrastructure behind AI.

A number of other top executives from Nvidia also harvest the company’s growth.

This includes long -time board member Mark Stevens, a former managing director of Sequoia Capital, who was one of the earliest investors in Nvidia. On June 2, he announced that he would sell up to 4 million stocks, currently worth $ 550 million, and since then sold $ 288 million.

Jay Puri, Vice President of Nvidia, Vice President of the worldwide field operations, a two -decades long veteran of the company, who put Huang on the trip to China, sold shares worth around $ 25 million on Wednesday.

Two other board members, Tench Coxe and Brooke Sewell, sold, with Coxe unloading around $ 48 million on June 9 and Seawell this month.

Coxe, former managing director of Sutter Hill Ventures, is another long -standing board member who has been in the company since his early days. Huang was a co-founder of the company in 1993 as a video game graphics card company in a Denny’s restaurant in San Jose.

Seawell, who came to the board in 1997, is a partner of the venture company New Enterprise Associates and former executive at Chip Design Software Company Synopsys.

Nvidia’s shares have recovered in the past few weeks, whereby market capitalization has been reproducing around 1.5 minutes since its lowest point in April. The stock scored a goal after China’s Deepseek breakthroughs and the new US export controls for AI chips intended for China.