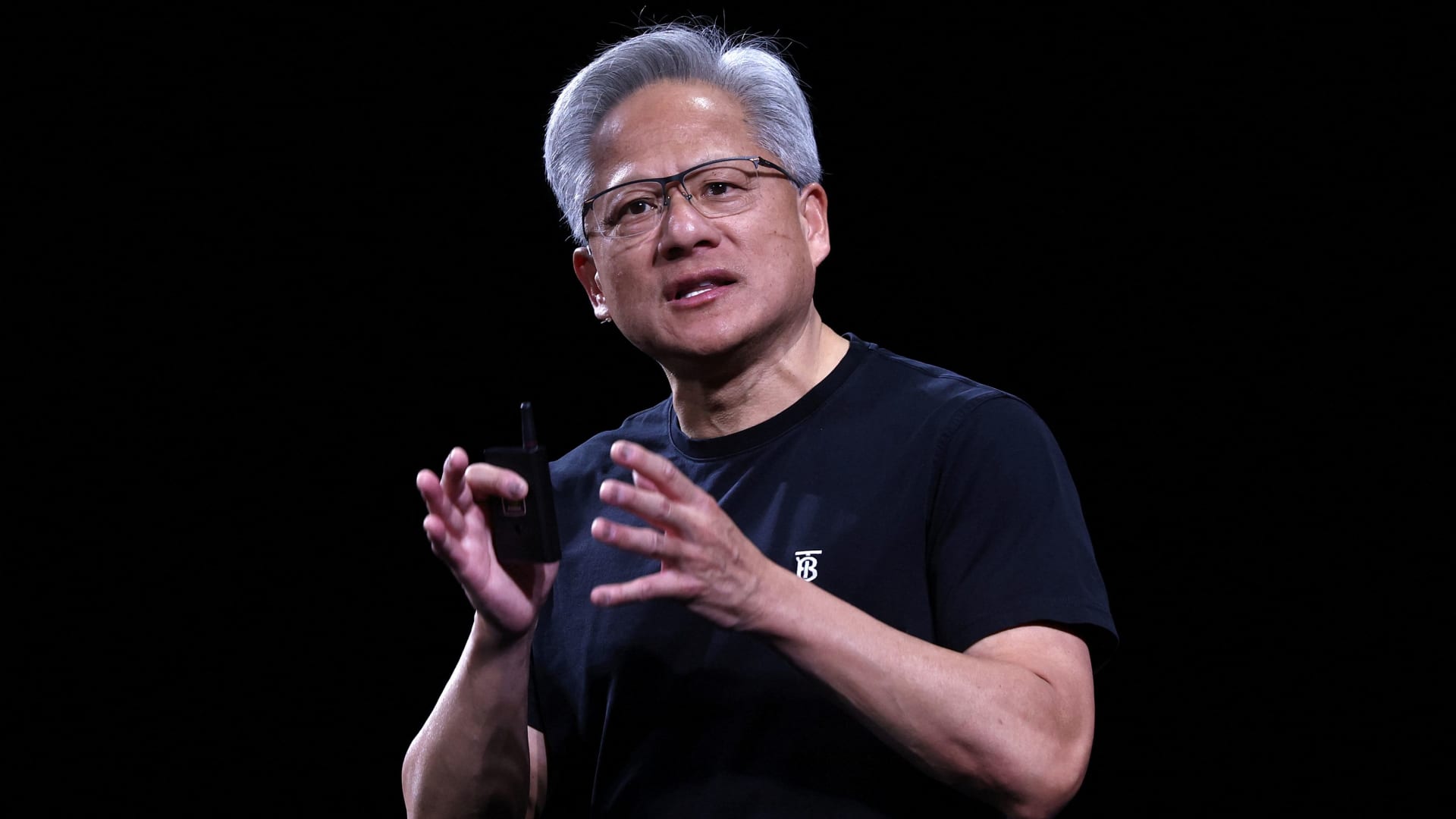

NVIDIA CEO Jensen Huang spoke at the Viva technical conference held at the Versailles Exhibition Centre in Paris, France on June 11, 2025.

Gonzalo Fuentes | Reuters

Nvidia Stocks rose for the fifth straight day on Friday as chipmakers hovered near fresh highs and investors shocked China’s attention.

The rise in shares helps AI Chip manufacturing giant regains seat The most valuable company.

The stock has grown 66% since hitting a 52-week low in early April. Its market cap ended up being around $3.8 trillion, putting it ahead of schedule Microsoft and apple.

Wedbush Securities Analyst Dan Ives NVIDIA and MICROSOFT are estimated to reach $4 trillion in market cap clubs this summer, reaching $5 trillion in the next 18 months.

The beginning of NVIDIA is difficult to start with 2025 as fears that tariffs on semiconductors and Chinese export controls have curbed sentiment. Earlier this year, the Trump administration told NVIDIA that it would require Export License Ship its H20 processor to China. According to the rules shared by Biden Administration, chips were introduced.

CEO Jansen Huang People are worried about being locked in a large $50 billion Chinese market and say the changes effectively cut sales without a “grace period.” NVIDIA’s recent quarterly results will be better if the company can sell chips in the world’s second largest chip, he said economy.

NVIDIA held its annual shareholder meeting on Wednesday, where Huang called The biggest opportunity for robots A chip manufacturer after AI. The company’s business units, including automotive and robotics divisions, reached $567 million, or about 1% of revenue.

“We are working toward billions of robots, hundreds of millions of self-driving cars, and hundreds of thousands of robot factories that can be powered by Nvidia Technology,” he said.