polka dot

According to Coindesk Research’s technical analysis model, there was a huge sales pressure, falling as much as 5% before rebounding, and it is possible to form a double bottom pattern to keep moving upward.

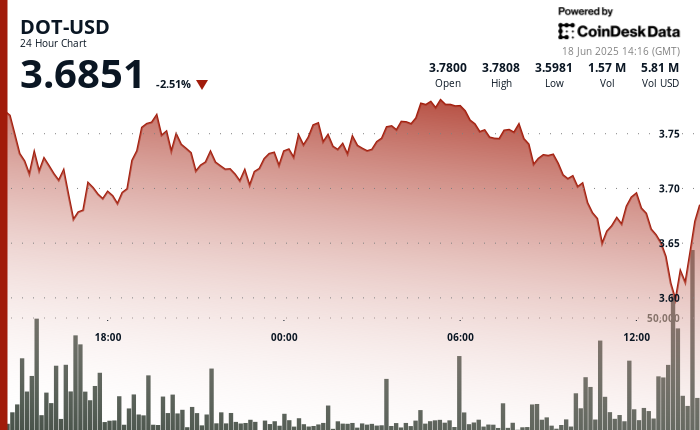

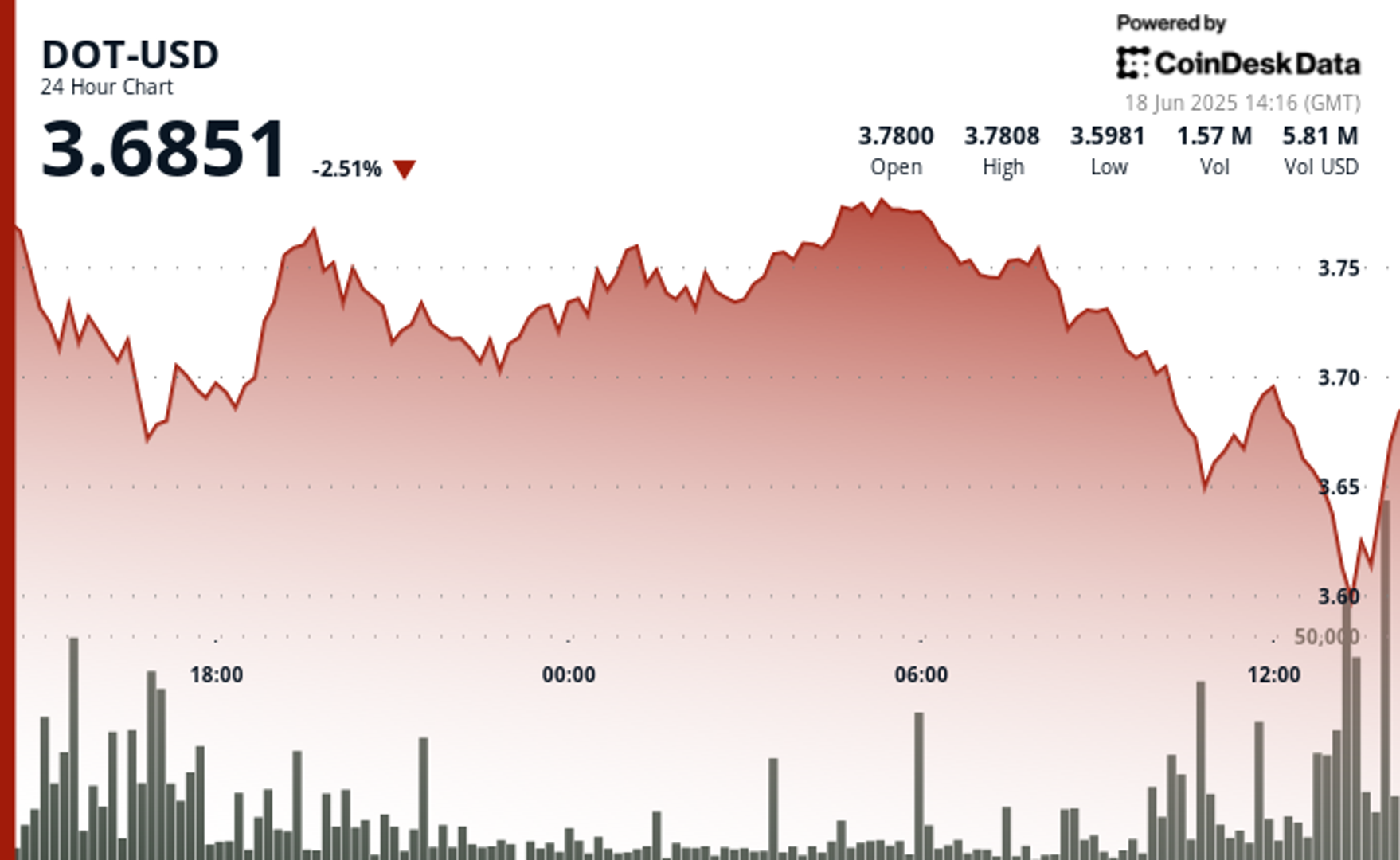

According to the model, after initially trying to establish an uptrend on a peak of $3.787, DOT encountered strong resistance and formed a bearish reversal pattern.

In recent deals, DOT fell 2.6% in 24 hours, trading around $3.63 with support of $3.59. The broader market scale, Coindesk 20, dropped 0.5% in publication time.

The model shows that the price action shows a potential double bottom pattern and raises momentum, indicating whether it will support staying above the price level above the $3.62 price level.

Technical analysis:

- DOT experienced a 24-hour volatility of 24 hours, with a range of 0.193 (5.1%), initially attempting to establish an uptrend of peaks before encountering strong resistance, with a peak of $3.787.

- Price action formed a bearish reversal pattern as DOT failed to exceed the $3.75 level and then accelerated sales in 10:00 and 13:00 hours, when the volume was as high as nearly 4 million units, well above the 24-hour average.

- Support appears at $3.594, although the current price structure suggests that downside risk is a further downside risk as DOT closes near weak momentum indicators near conference lows.

- In the last hour, DOT experienced significant volatility, falling sharply from $3.643 to a low of $3.594 before making a recovery attempt.

- The price gained strong support at the $3.594 level, which triggered a V-shaped recovery, boosting the point by 1.3% to $3.642.

- Recent price action constitutes a potential double bottom mode and improves momentum, suggesting that if DOT can keep support above $3.62, it may continue to move upward.

Disclaimer: Part of this article was generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and compliance Our standards. For more information, see Coindesk’s complete AI policy.