Litecoin

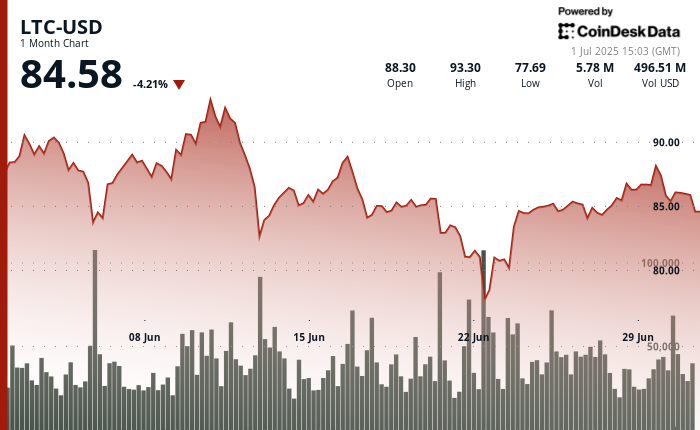

Side trades have been made in the past 24 hours after two weeks from the high of $88. In today’s fair, the token has been bounced between $85 and $87, highlighting the tug-of-war between Dip-Buyers and the seller, who sees $87 as the ceiling.

According to Coindesk Research’s technical analysis data model, the chart hints at an imminent “golden cross”, an imminent “golden cross”.

The mode is usually before a multi-week rally, but the momentum is still weak until the Bulls rushed past $87. The broader crypto market measured by Coindesk 20 (CD20) Index, which fell only 0.25% in the past 24 hours.

The prospect of the future tells a bright story. Bloomberg analysts on Monday raised the chances that the SEC would trade for the green light attractions exchange for XRP, Solana and Litecoin, 95% by year-end. polymerodds are 86%.

Approval will expand demand for mainstream investors to have an easy way to own LTC through brokerage accounts.

Technical Analysis Overview

Over the past 24 hours, the price of Litecoin has moved to the $2.09 range, equaling 2.46% relocation as traders tested the support and resistance levels. Sellers strongly topped $86.65 to $87.10, an area confirmed by a surge in high volume sales.

However, buyers repeatedly defended the region in midday trading on July 1 $85.02 to $85.23.

While the broader 24-hour chart plots bearish tones, marking lower highs, it tracks down trendlines, but has a shorter time range that suggests brewing optimism.

Litecoin started recovering earlier, falling from $85.22 to $85.59, an increase of 0.43%. In a brief window, the gathering gained traction when more than 5,500 tokens purchased on 5,500 tokens per minute, which helped LTC break through secondary resistance at $85.50.

In the same hour, another support bag is between $85.03 and $85.18.

Combined with a short-term ascension channel showing higher lows, the pattern suggests that despite greater caution, LTC may still be trying with upward momentum.