Legal observers in Crypto Space say the conviction of the co-founder of the Tornado Cash and developer Rome Storm could set a “dangerous” precedent for developers and privacy.

Storm convicted Operating unlicensed currency transfer business On Wednesday, August 6, the crime was sentenced to up to five years. The jury was unable to reach a consensus on conspiracy to engage in money laundering and conspiracy to violate the consensus on U.S. sanctions. Federal prosecutors can still try him again on both charges.

Although the storm has not yet faced sentencing, other crypto-related cases, including former FTX CEO Sam Bankman Fried and Onecoin co-founder Karl Greenwood, were tried and sentenced to guilty in the same area and eventually served their sentences.

Legal professionals and industry observers condemned the verdict, saying it sets dangerous precedents for open source developers and has had an impact on user privacy.

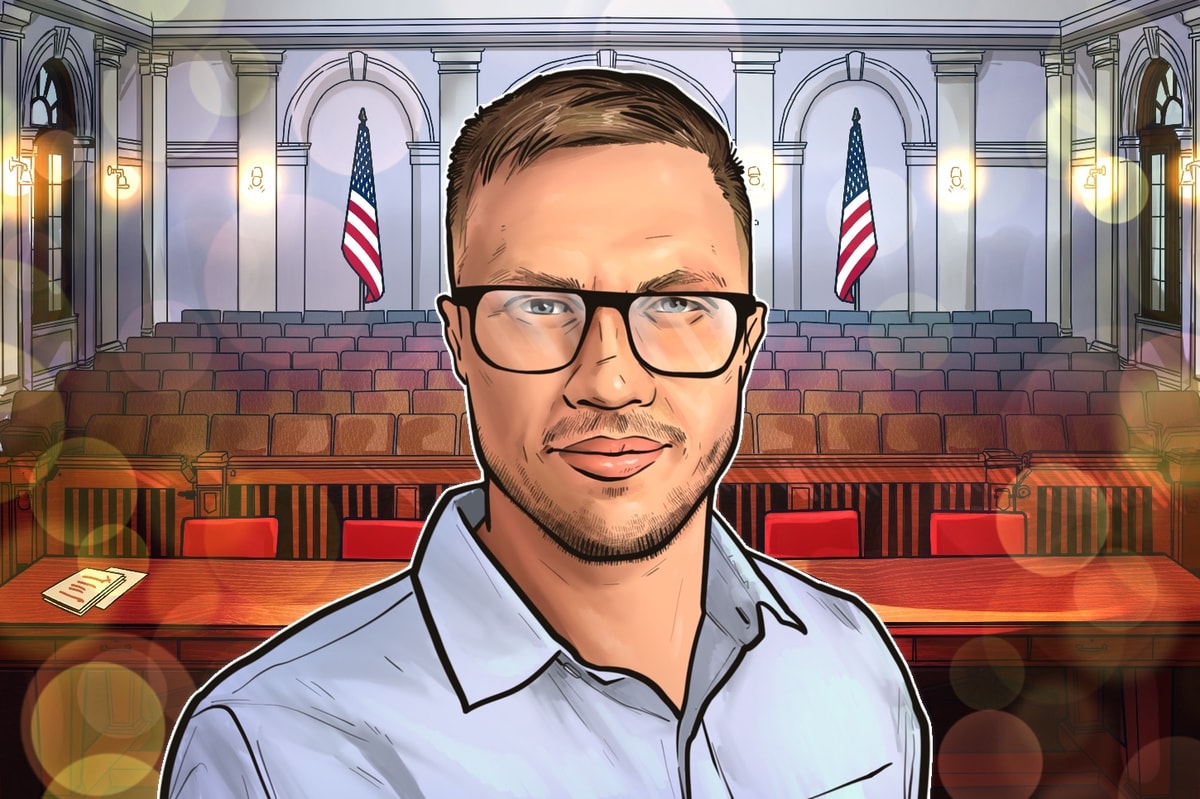

Roman storm convicted in tornado cash laundering problem

Founded in 2019, Tornado Cash is a cryptocurrency mixer and privacy tool to mask the source of funds. Founded by Storm, Alexey Pertsev and Roman Semenov, the tool quickly caught the attention of regulators Delusion In March.

Pertsev was arrested in the Netherlands in August 2022, where he faced his own legal battle. A year later, the storm was arrested in the United States, while Semenov was still broad and on the FBI’s list of most wanted.

Some insist that Tornado Cash developers are not or should not be held responsible for the actions of users of the platform, especially if the platform (like Tornado Cash) does not monitor or control funds. Critics and the U.S. government, especially insist that they have a responsibility.

Judge Katherine Failla deny A motion dismissed the case in September 2024, noting that tornado cash is eligible for currency transmitters regardless of whether the developer has controlled the funds or not. Therefore, they should develop the same anti-money laundering as any other such platform and understand your client measures.

The privacy-centric cryptocurrency community follows the case closely, and now, with the storm convicted, people are about what this means for decentralized finance (DEFI) and software development.

Blockchain Association is Washington’s crypto industry hall group explain On Wednesday, the ruling “sets dangerous precedents for open source software developers.”

The association also referred to the Alumni Summary (in this case, for one party in the lawsuit, in this case, tornado cash), which stated that the storm had no control over the cryptocurrency passing the agreement.

Related: Roman Storm’s early enthusiasm for code leads to Silicon Valley, Tornado Cash – and guilty verdict

Rome Storm builds operational privacy technology No His custody/control of Tornado Cash User Funds. (…) Tornado Cash acts as non-monitoring software, which means that users always maintain full control of their assets. ” said the association.

The Blockchain Association further pointed out that the judgment not only threatens open source software, but also threatens “fundamental abuse of currency transmitter laws.” It concluded that this lawsuit would “criminalize developers of browsers, messaging applications, or any software abused by bad actors, seriously threatening U.S. leadership in the technology field.”

Solana Institute of Policy Studies statement The belief means that developers can also face criminal liability even if they establish a non-custodial open source protocol that can give up control through unchanged smart contracts and have no ability to control abuse.

According to the group, this represents a “basic misunderstanding” of decentralized technology and how or should be regulated.

What is the future of Storm and open source software development?

Although far from the results of the cryptocurrency industry, it is not all lost.

“It’s not just men or sound mixers. It’s a referendum for individual institutions in the open source era,” Andrew Rossow Law’s policy and public affairs attorney and principal.

Rosso noted that while the verdict on developer responsibility was “blacked”, the jury was unable to rule on the other two charges, “adhering to the standard of code itself not being a “crime”, especially in a license-free environment that resists censorship.”

The question of whether the creators of neutral software should bear criminal liability for their abuse of liability”. According to Rossow, the case also exposed the judicial system’s current ability to understand and rule on decentralized technologies.

Still, “the jury’s silence on the hardest questions is the openness of the industry’s speech.”

Industry groups plan to do so. Solana Institute of Policy Studies is urgent To get Congress to pass the Clarity Act, the bill will provide, among other things, legal definitions and decompositions for certain aspects of Defi activities.

Blockchain Association statement The administration of U.S. President Donald Trump needs to stop “passing prosecution regulation,” an introduction to the more commonly used phrase “law enforcement regulations,” a methodology by regulators under former President Joe Biden for cryptocurrencies.

There is also the possibility of appeal. “The battle is not over yet” explain Ji Kim, CEO of the Crypto Innovation Council (CCI). “The appeal to the Second Circuit Court. It also needs to be clear to clarify the definition of a currency transmitter,” he said.

CCI is another crypto industry hall group, Called The appeal is “necessary” and the Blockchain Association urges the same appeal.

After his conviction, Storm made no public statements. Whether he will seek appeals, and his judgment date is pending.

The crypto industry and its supporters obviously won’t take a verdict. One day after the ruling, the Ethereum Foundation ensure Match $500,000 to Storm’s ongoing legal expenditure. “Privacy is normal, writing code is not a crime,” said Hsiao-Wei Wang, co-executive director of the foundation.

Magazine: How Ethereum Finance Company sparked “Defi Summer 2.0”