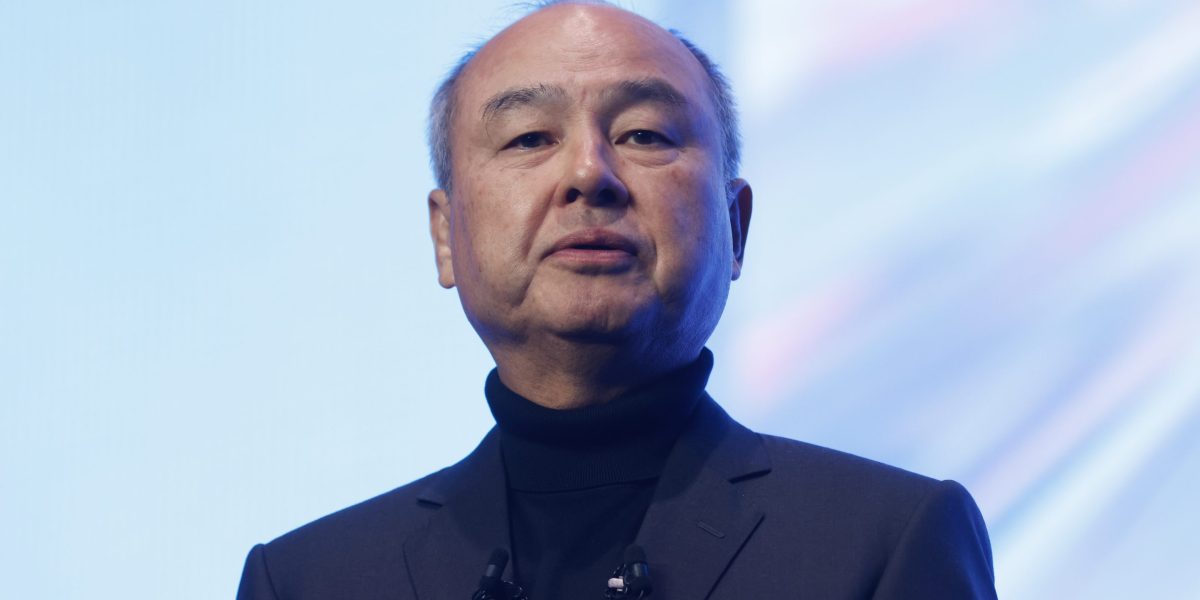

The Softbank Group Corp. Builds Nvidia Corp. and Taiwan Semiconductor Manufacturing Co., the latest reflection by Masayoshi Sohn, which focuses on the tools and the hardware artificial artificial intelligence.

The Japanese technology investor increased its share of NVIDIA to around 3 billion US dollars by the end of March, compared to $ 1 billion in the previous quarter. It bought TSMC shares worth around 330 million US dollars and $ 170 million in Oracle Corp.

While the Softbank Signature Fund has monetized almost 2 billion US dollars in public and private assets in the first half of 2025, according to a person familiar with the activities of the fund. The Vision Fund prioritizes its investment returns and there is no special pressure from Softbank to monetize their assets, said the person who asked not to be mentioned in order to discuss private information. A representative of Softbank rejected a statement.

In the heart of Softbank’s AI ambitions is Chip Designer Arm Holdings PLC. Son gradually builds a portfolio around the company in Cambridge, in Great Britain, with important actors in the industry and tries to catch up with after a historical rally that was missing Nvidia for a $ 4 billion giant in the amount of US dollar, and has increased his contract chip maker TSMC near $ 1 trillion.

“Nvidia are the picks and shovels for the gold rush from AI,” said Ben Narasin, founder and general partner of Havacity Venture Capital, and referred to a concerted exertion of the world’s largest technology companies to spend hundreds of billion dollars in advance. The purchase of the US company’s share through Softbank could buy more influence and access to Nvidia’s most sought-after chips, he said. “Maybe he can skip the line.”

Softbank, which reports quarterly profits on Thursday, should have benefited from this bet on Nvidia – at least on paper. Nvidia has increased a market value of around 90% for a year in early April, while TSMC has increased over 40%.

This helps to compensate for a large part of Nvidia’s post-chatt rally-one of the greatest ever. Softbank, which started early before the bet on AI, long before Opena’s pioneering chatbot, was shared in early 2019 of a 5.9% participation in Nvidia, which would be worth more than 200 billion US dollars today.

Paralyzing losses in the Vision Fund also hindered the ability of Softbank to be an former investor in a generative AI. The attempts by the company to buy some Nvidia shares back in addition to those from Proxy TSMC would help son to regain access to some of the most lucrative Parts of the semiconductor supply chain.

The 67-year-old soft bank founder is now trying to play a more central role in spreading AI through extensive partnerships. This includes the 500 billion dollar stargate counter-forum from Softbank with Openai, Oracle and Abu Dhabi-supported investment fund MGX. Son is too recruit TSMC and others about participating in an AI manufacturing center of 1 Billion US dollar in Arizona.

Since the intellectual property of ARM is used to supply the majority of mobile chips with electricity and are increasingly being used in server chips, soft bank could get a unique position without being a manufacturer himself, says Richard Kaye, co-manager of the Japan shares in Comst Asset Management and long-standing soft bank investor.

“I think he sees himself as a natural provider of the AI hauler technology,” he said. “What son really wants to do is to conquer the electricity and the more electricity.”

Investors cheered on the son’s bold plans, while analysts say that Softbank reports a decline in a net income in the June quarter. The soft bank shares marked a record high last month. Softbank is planned 6.5 billion US dollars Deal to take over the US chip company Ampere Computing LLC and another 30 billion dollar investigations in Openai encourage investors who see the stock as a way to achieve the dynamics of the US startup.

However, according to people near the billionaire, the son is dissatisfied. Son sees the big projects in the United States as the potential to help Softbank to overtake the current managers in the AI in order to become a trillion dollar or larger company, they said.

The share continues to act with a discount of around 40% on soft bank total assets, which includes around 90% of the value of $ 148 billion. The market capitalization of Softbank is around 118 billion US dollars, a fraction of the evaluation of 4.4 trillion dollars by NVIDIA and the other technology companies that are closely connected to AI progress.

Son, who in the past derailed or derailed Washington’s fusion plans like the Union of Arm and Nvidia, tries to use his relationship with Donald Trump and organizes frequent meetings with officials from the White House. These efforts are critical today because AI and semiconductors become geopolitical flash points. The Softbank plan to buy ampers probe From the Federal Trade Commission.

The attention in the yields of the June Quartal will be to the other assets that Softbank could sell to secure the liquidity it needs to double hardware investments. The Japanese company has moved around so far 4.8 billion US dollars By selling some of his T-Mobile share in June. The Chief Financial Officer Yoshimitsu Goto quoted the company’s net assets in the amount of 25.7 trillion yen ($ 175 billion) and said that the company had plenty of capital to cover the financing needs.

The outputs of the Vision Fund included in March of the Doordash Inc. and View Inc. as well as Cloud Security Company Wiz Inc. and Enterprise Software Startup Peak, also bought the operations in Nvidia, TSMC and Oracle as a soft bank.

“We are behind the AI after a number of startups and group companies,” Son told the shareholders in June. “We have a goal,” he said. “We will be number 1 in the artificial super intelligence.”