Solana

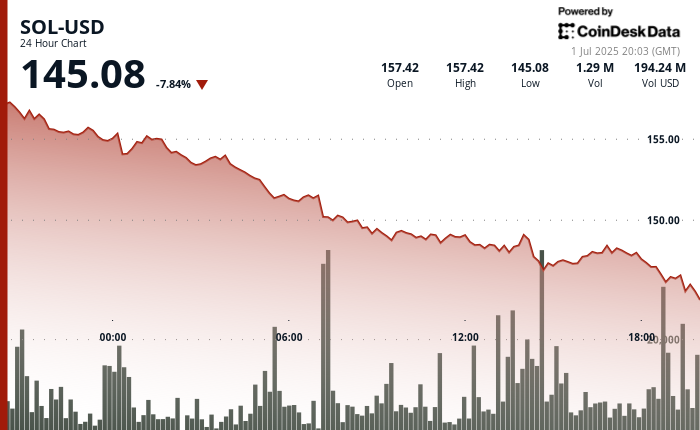

According to Coindesk Research’s technical analysis model, it fell 7.84% in the past 24 hours, with UTC trading at $145.08 as of July 1, 2025. During the same period, Coindesk index 20 {{cd20}}down only 0.24%.

Sol’s sharp decline is only a day ahead of the major milestones in the ecosystem: the launch of the Rex-osprey Sol + Staking ETF.

Schedule for debut on July 2, 2025 (Stock: SSK) It is the first exchange-traded fund listed in the United States that can directly access Solana’s original tokens while also providing opportunities to receive deposit rewards. Unlike traditional crypto ETFs that track prices only, the fund allows holders to passively benefit from Solana’s commodity proof reward system.

About 80% of ETF assets will be allocated to SOL, with about 50% of the tokens actively placed. The fund is structured under the Investment Companies Act of 1940, which is usually more favorable than the 1933 regulations. The 1940 ACT structure could improve investor protection and accelerate approval, which could affect wider institutional participation.

Analysts say the launch is an important step in Solana’s credibility among U.S. financial institutions. By integrating production production directly into ETFs, it has a more comprehensive exposure to assets than spot tracking funds. Some market participants believe it can serve as a catalyst for long-term adoption, especially when other companies, including Grayscale, Vanek and others, pursue similar SOL ETF applications.

However, despite the ETF’s pending launch, SOL saw widespread sales pressure on Monday, highlighting the city’s cautious stance before the event.

Technical analysis highlight

- Sol has dropped $12.34 over the past 24 hours, down from $157.42 to $145.08, losing 7.84% with a price range of $12.34.

- In the first hour of the analysis window, strong resistance was encountered, selling for $157.42, and then continued sales pressure throughout the session.

- The largest peak peak occurred within 06:00 UTC hours, with more than 1.57 million vehicles, and the price refused to approach $151.50.

- Upport’s appearance at $146.55 in the 14:00 UTC hour also coincides with the increase in volume, indicating cumulative interest at this level.

- In the last hour of the analysis window, the SOL dropped from $146.31 to $145.08, reaching the lowest price of the day.

- Price action forms a well-defined descending channel characterized by lower lows and lower lows throughout the trading period.

Disclaimer: Part of this article was generated with the assistance of AI tools and reviewed by our editorial team to ensure accuracy and compliance Our standards. For more information, see Coindesk’s complete AI policy.