The Stablecoin protocol level improves a round of venture capital to expand its $80 million yield stability as the demand for generating digital asset products is increasing. Cooling Encryption Price.

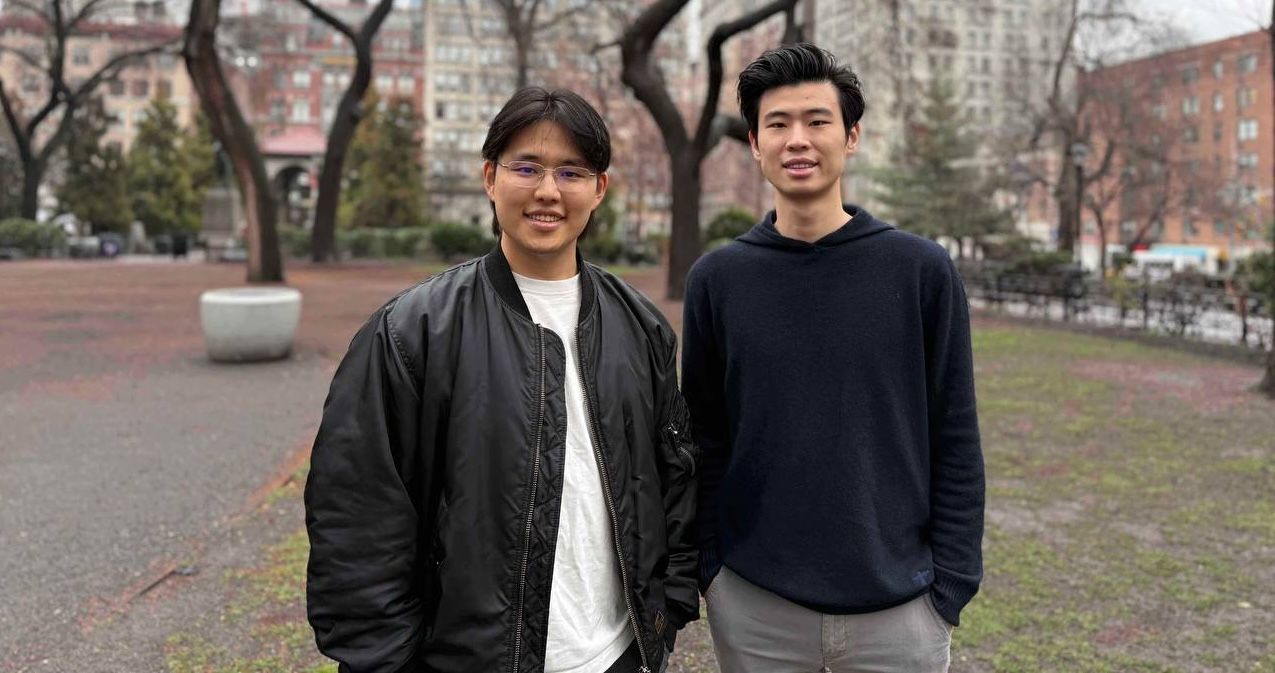

Founders David Lee and Kedian Sun told Coindesk in an interview that second-level development company Peregrine Exploration is the development company of Level Suff, which was also led by Backer Dragonfly Capital and PolyChain. New investors include Flowdesk, Echo Syndicates’ local cryptocurrency and Feisty Collective, as well as Frax’s Angel Investors Sam Kazemian and Injective’s Albert Chon.

The latest round of venture capital has reached $6 million in total capital so far after the $3.4 million raise in August.

Level has participated in the fast-growing Stablecoin Asset class with its LVLUSD tokens, one of the hottest sectors in cryptocurrencies and a darling in venture capital. Stablecoins (with fixed prices as fixed prices, which are mainly closely related to the US dollar) are the key infrastructure for blockchain transactions and transactions. However, the largest issuers generally do not provide yields to users earned in assets in backup reserves. Tether, for example, reported $13 billion in profits last year, partly because the U.S. Treasury Department generated its $143 billion tokens.

That’s why the new generation of money-making stables are becoming more and more popular among crypto investors. Ethena’s USDE has generated adverse transportation trade strategies in more than a year in the market. Harvest futures financing rates yields more than $5 billion. Meanwhile, the token version of money market funds and Treasury bills (another stable alternative) hits the Market value of US$4.6 billion.

Level’s Stablecoin provides investors with investor returns, allowing assets to undergo diversified financing (DEFI) loan agreements (such as AAVE) while automating their reserve management. Users can create LVLUSD by storing Circle’s USDC or USDT Stablecoins and locking (stake) tokens to generate on-chain production. As of last week, LVLUSD’s Staked version had an annual yield of 8.3%, higher than the marking money market fund yield. Meanwhile, LVLUSD has been integrated with FEFI schemes such as Pendle, Spectra and LayerZero and can be used as collateral for Morpho.

“Their completely transparent links, transparent approaches distinguish them from competitors who rely on opaque centralized approaches,” said Sven Wellmann, of Polychain, one of the investors in the deal.

according to Calculation of the levelThe deal has surpassed the yield on rival Stablecoins in the past month, which has exceeded $80 million in supply in five months since its beta launch.

Kedian Sun explained that with the latest funding, the Level program expanded its team and marketing efforts while continuing to expand its utilities at LVLUSD. The agreement also plans to leverage Morpho in the next few weeks to generate revenue.

Through these efforts, LVLUSD could move towards a $250 million market capitalization, a key milestone the team wants to achieve, Sun said.