Although President Donald Trump’s tariff war is designed to inspire a manufacturing boom, U.S. companies’ spending is firmly focused on “fragments” rather than “bricks and mortar.”

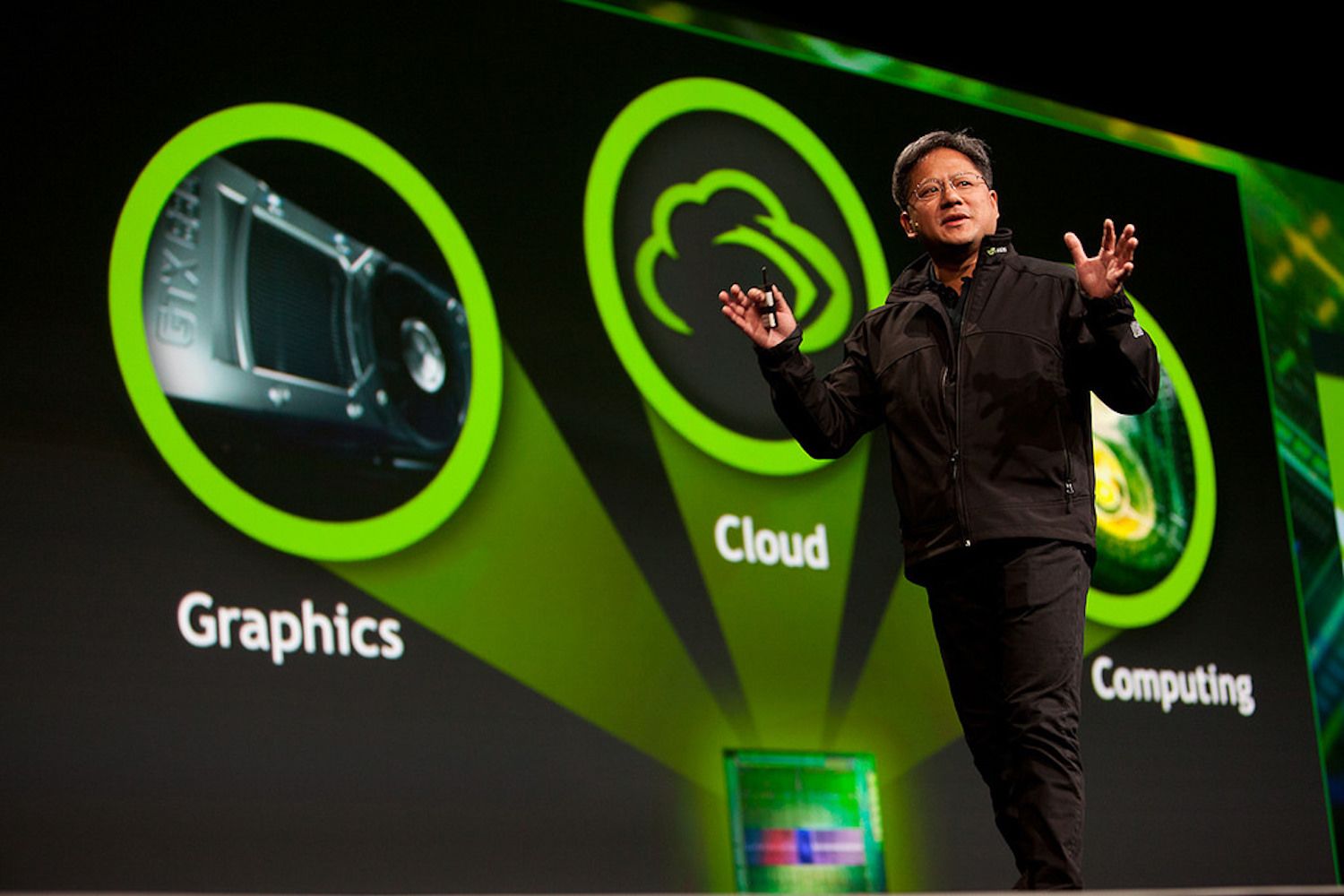

This contrast is obvious in the grand 7 spending model (MAG 7) Stocks – A group of large tech companies including letters (Google’s parent company)Amazon, Apple, Meta Platform (Party of Facebook and Instagram)Microsoft, Nvidia and Tesla.

These companies are expected to spend $60 billion this year on capital expenditures (Capital Expenditure) And research and development (R&D)According to data tracked by Lloyds Bank. The bank noted on Thursday that the amount was greater than the UK government spent on public investment in a year.

If this figure alone doesn’t impress you, consider the following: Total economic investment expenditures for IT equipment and software continue to grow this year, accounting for 6.1% of GDP, while private fixed and fixed non-residential investments (excluding private fixed and fixed non-residential investments) have both shrunk for consecutive quarters.

FOMO and AI

According to Nicholas Kennedy, FX strategist at Lloyds, the decline in investment in other economic sectors may be due to several reasons, including fears of missing outings. (FOMO) On artificial intelligence (AI) Prosperity.

“In addition to the crowding of spending and political/trade uncertainty through it, there may be some explanations; the building boom triggered by Biden’s Chips Act, which promoted the bill, which strengthened the structure, for example, FADS gradually faded into customers.

The chart shows that U.S. corporate spending on IT equipment and software has increased to $1.4.5 trillion, accounting for 13.6% year-on-year. Statistics account for more than 40% of the total private fixed investment in the United States.

U.S. second-quarter GDP estimates released earlier this week showed private fixed investment increased by 12.4% in the quarter.

Meanwhile, investment in non-IT sectors or the broader economy fell by 4.9%, thus expanding the three-quarters trend.

From “bricks” to “fragments”

This continued dominance of US corporate “bit” spending should calm the nerves of those who worry that government attention to manufacturing may absorb capital from emerging avenues such as cryptocurrencies.

Bitcoin and NVDA are the leaders of everything, both bottoming out in late November 2022, enjoying an incredible bull run since with the launch of Chatgpt, which demonstrates the strong correlation between the rise of technology and the cryptocurrency market.

“Whether (the AI spending boom) produces returns is another matter, but it does reshape the brick’s plans,” Kennedy said.

In addition, the cryptocurrency market has found forms of favorable regulatory policies under Trump. The government proved its pro-Cretter bias by signing several key legislation aimed at clarifying regulatory oversight of digital assets and stable shares, including measures that gain bipartisan support. In addition, the government has made strategic appointments to financial regulators.