Switch off the editor’s digest free of charge

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

The US dollar has been in the first half of the year since 1973 when Donald Trump’s commercial and economic policy causes global investors to rethink their commitment in the dominant currency of the world.

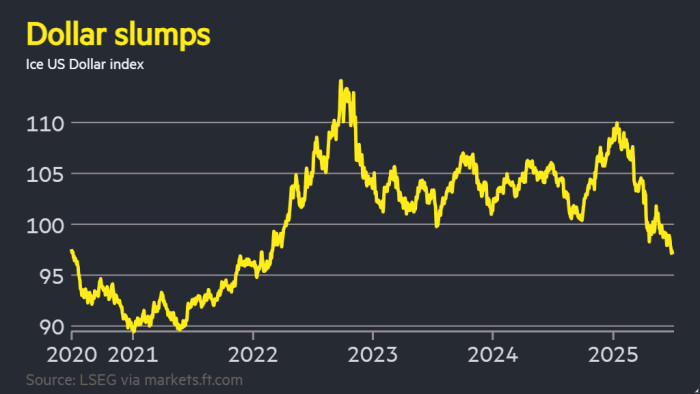

The dollar index, which measures the strength of the currency against a basket of six others, including the pound, euro and yen, has so far dropped over 10 percent in 2025, the worst start of the year since the end of the Bretton Woods system.

“The dollar has become the whipping boy of the unpredictable policy of Trump 2.0,” said Francesco Pesole, FX strategy at ING.

The start of the president Tatruff wasHe added the enormous loans from the United States about the independence of the Federal Reserve as a safe port for investors.

The currency fell by 0.5 percent on Monday when the US Senate was ready Voices about changes To Trump’s “big, beautiful” tax bill.

Landmark legislation is expected to record $ 3.2 in the coming decade and trigger concerns about the sustainability of the loans in Washington and triggered an exodus from the US financial market.

The dollarThe sharp decline for the worst first year of the year has set off the weakest performance over a period of six months since 2009 for a loss of 15 percent in 1973.

At the beginning of the year, the slide of the currency confused widespread predictions that Trump’s trade war would damage the economies outside the United States more closely while stimulating American inflation and strengthening the currency against its competitors.

Instead, the euro, which several Wall Street banks predict, would increase this year with the dollar to parity from $ 13 to over 1.17 US dollars, since investors have focused on growth risks in the largest economy in the world -while the demand for safe assets has increased elsewhere such as German bonds.

“They had a shock with regard to the day of liberation with regard to the US political framework,” said Andrew Balle, Chief Investment Officer for Global Fixed Income with the Pimco bond group and referred to the announcement of Trump’s “Reciprocal tariffs” in April.

There was no major threat to the status of the dollar as the DE -Facto reserve currency in the world, argued balls. The “does not mean that you cannot have any significant weakening in the US dollar,” he added, raising a shift in global investors to secure more from their dollar exposure, which even drives the Greenback.

The depth of the depth of the dollar this year was also Increasing expectations The fact that the Fed will lower the interest rates more aggressive in order to support the US economy to support-from Trump-with at least five quarter-point cuts that are expected by the end of next year, in accordance with the levels implied by futures contracts.

The bets on lower interest rates have helped us to shake off the things of trade war concerns and conflicts in the Middle East to achieve record highs. However, the weaker dollar means that the S&P 500 in Europe continues to remain far behind competitors if the returns are measured in the same currency.

Large investors from pension funds to Central Bank Reserve managers have declared their wish to reduce their commitment to the dollar and US assets, and asked whether the currency still delivers a refuge from market fluctuations.

“Foreign investors need greater protection for dollar-picked assets, and this was another factor that prevents the dollar from preventing the US’s background capital,” said Ing Pesole.

Gold This year has also achieved record highs during further purchase by central banks and other investors who were concerned about the devaluation of their dollar wealth.

The $ dollar has brought him to his weak level towards the competing currencies for more than three years. In view of the speed of the decline and the popularity of Bärische Dollar bets, some analysts expect the currency to stabilize.

“A weaker dollar has become a crowded trade, and I suspect that the pace of decline will slow down,” said Guy Miller, chief strategist at the Zurich insurance group.