Stay informed with free updates

Simply register US inflation Myft Digest – delivered directly to your inbox.

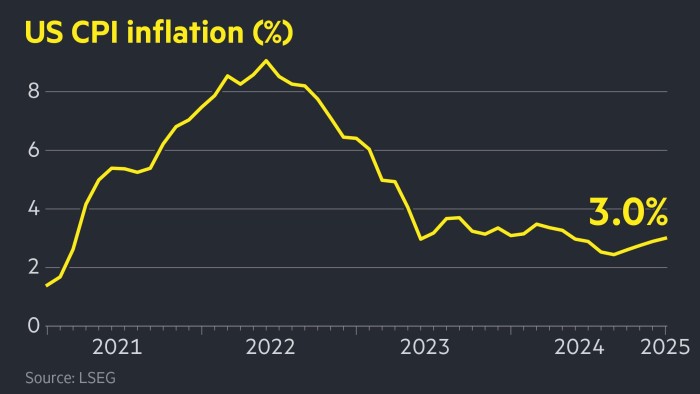

The US inflation rose unexpectedly to 3 percent in January and strengthened the case for the Federal Reserve procedure with interest rate cuts and hits of shares and state bonds.

The consumer price index on Wednesday exceeded the expectations of the economists surveyed by Reuters who were predicted inflation Would be stable at 2.9 percent in December.

The increase in the month around month in January was also 0.5 percent ahead of a 0.3 percent predicted.

The increasing price for eggs contributed strongly to the climb and rose by 15.2 percent and 53 percent in one year in the course of the month, sometimes due to the effects of bird flu.

The figures of the Bureau of Labor Statistics caused investors to bet the Fed that the interest rates would reduce this year. Before the data was published, the Futures market had expected the first reduction until September with a chance of 40 percent for a second reduction by the end of the year.

“I would say we are close, but not yet (still) in inflation,” Fed told Chairman Jay Powell to the legislators on Wednesday. “Today’s inflation pressure says the same.”

Powell told the hearing in the House of Representatives after the data had been published: “We have made great progress, but we are not quite there yet. For the time being, we want to keep politics restrictive. “

“The markets are not convinced that we will see later in the year in the year, and today’s data will certainly not provide any evidence of this,” said Eric Winograd, chief economist at Alliancebernstein. He emphasized the concerns that “if inflation does not drop, the Fed does not lower interest rates at all”.

After the data had been published, the two-year return for US finance ministries, which pursues the interest expectations and, conversely, moved to the price, by 0.07 percentage points to almost 4.36 percent.

Shortly after the Wall Street opening bell, the S&P 500 fell by up to 1.1 percent, but ultimately closed by 0.3 percent lower. The Technical Feavy Nasdaq Composite has closed, while a dollar of the dollar was slightly lower compared to six other currencies.

The inflation data on Wednesday also showed Kern -CPI that changes to the food and energy prices to 3.3 percent rose to 3.3 percent in December.

It came after the Fed defy calls From President Donald Trump to steep cuts to loan costs and instead held his main clause from 4.25 percent to 4.5 percent.

On Tuesday, Powell told the Congress that the central bank would continue.make our job And keep out of politics ”.

But on Wednesday Trump renewed his demands on his social platform of his truth. “Interest rates should be reduced, something that would go hand in hand with the upcoming tariffs !!!” The US President posted. “Leave us rock and roll, America !!!”

The CPI data will promote the concerns of the economists that the largest economy in the world is heating again when Trump progresses with plans for TariffsA procedure for immigration and broad tax cuts, many economists fear, could trigger a new increase in inflation.

Since returning to the White House on January 20, Trump has started to implement mass deportations from immigrants without papers and imposed 10 percent additional tariffs for Chinese imports.

He has also announced that high taxes for almost all imports from Canada and Mexico as well as for all steel and aluminum imports in March.

Powell said that it was too early to assess the effects of tariffs on the economy and monetary policy, as this would depend on the details of the taxes.

Whitney Watson from Goldman Sachs Asset Management said that the number of inflation on Wednesday together with the robust state of the US job should probably strengthen the “careful approach to relaxing” the Fed. She added: “We believe that the Fed will remain in” Warte-and-See mode “for the time being.

Although Powell recognized on Wednesday that the CPI reading was “over almost every forecast”, he offered the legislators a few precautionary notes on Wednesday.

“One is that we are not happy about one or two good readings and are not excited by bad readings. The second is that we address the PCE inflation because we believe that it is simply a better level of inflation, ”he said at the hearing and referred to the index for personal consumption.

Powell said the Fed would receive a better price pressure if the producer price index came out on Thursday.