About $ 7.8 billion Bitcoin (BTC) options expire at the end of this month, and the largest cryptocurrency transactions are much higher than the so -called Max Pain Paint Point. Low the future.

Deribit data on the largest decentralized option exchange shows that when the contract is settled at the 08:00 UTC on January 31, it will set it to $ 6 billion with currency or no value. 50 % of them are PUT options, which allows the holder to sell BTC at a predetermined price during a specific timer period, but there is no obligation.

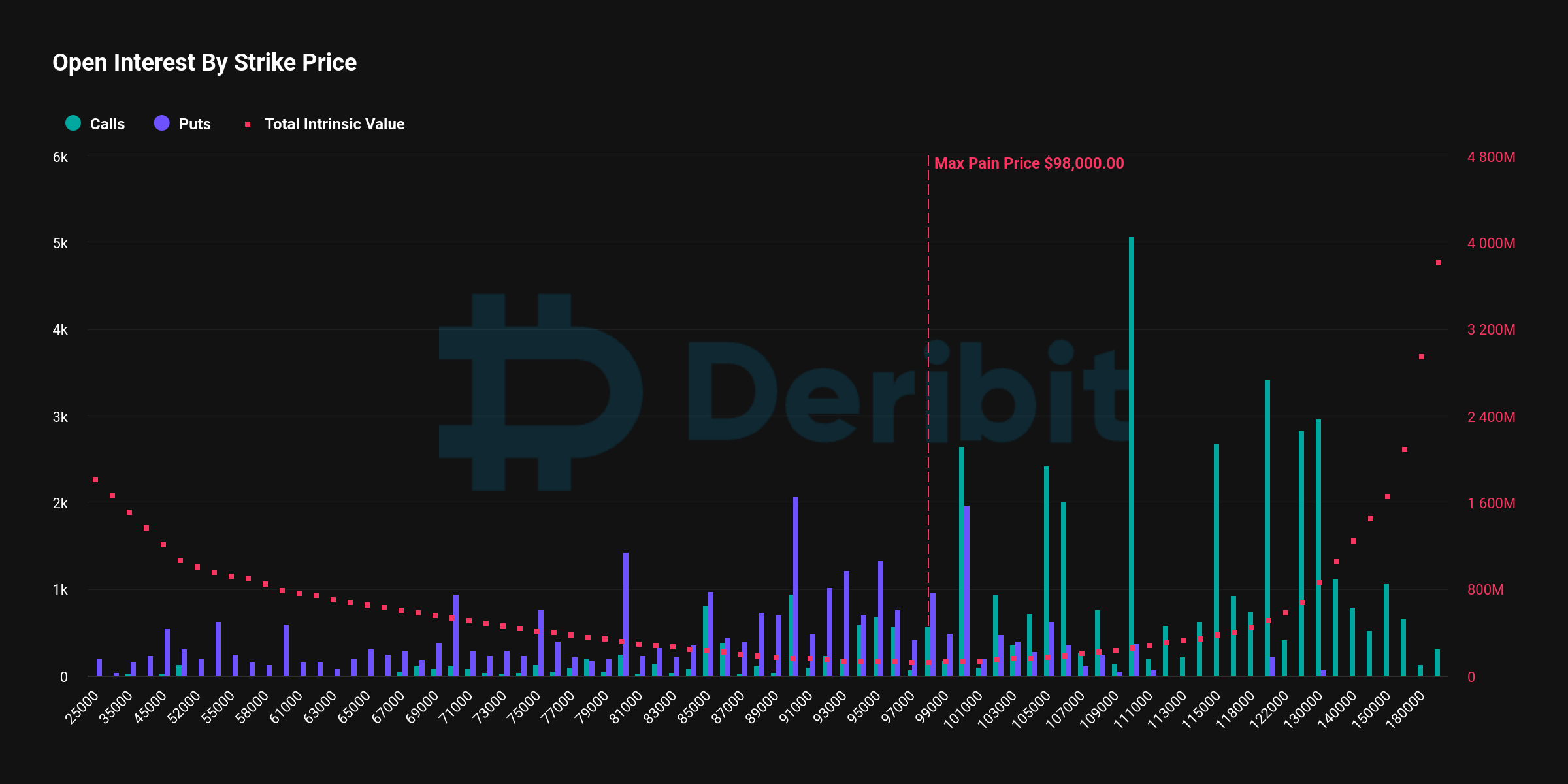

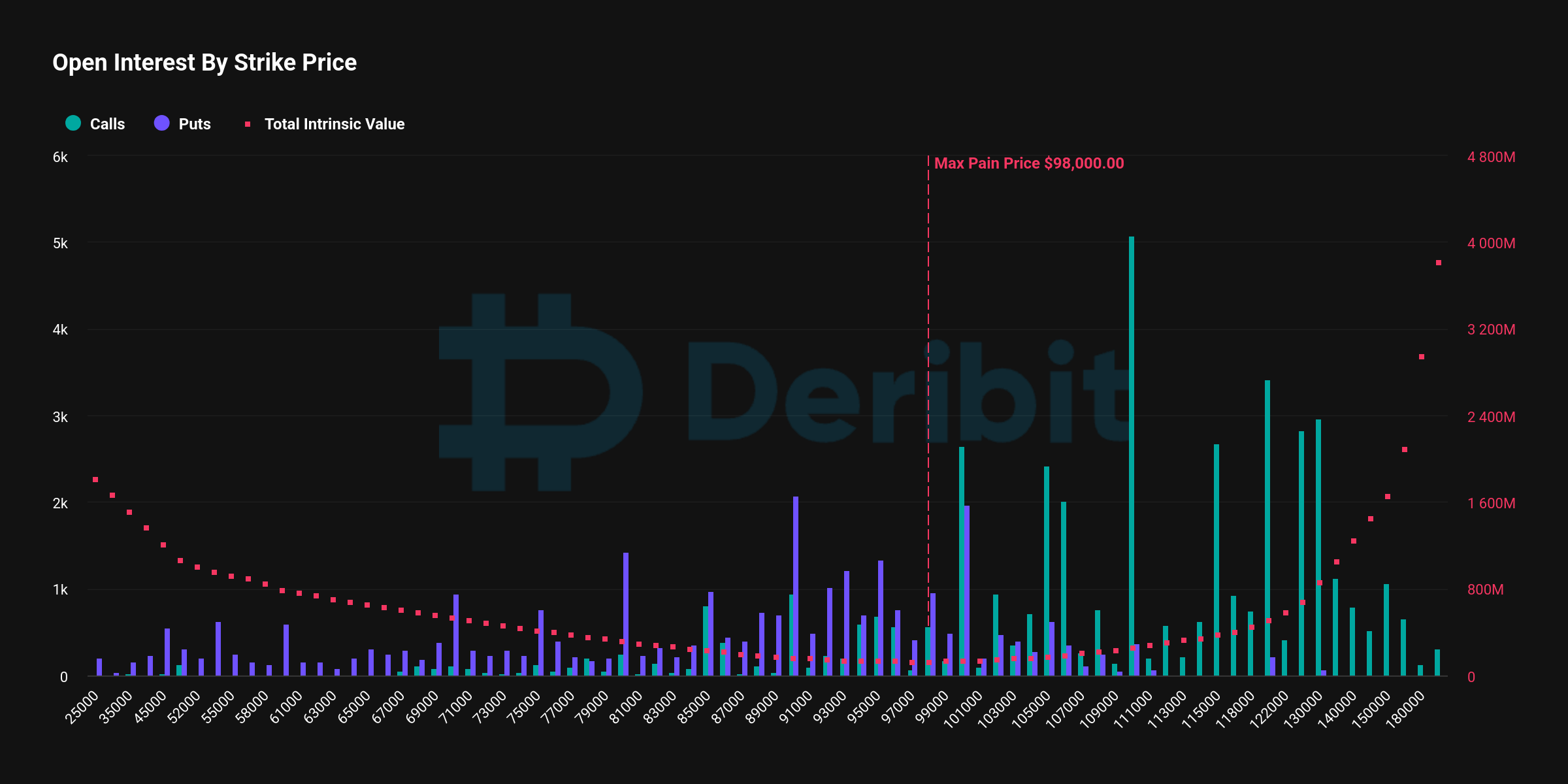

Deribit CEO Luuk Strijers told CoinDesk: “This maximum pain level of expires is $ 98,000, and it is expected to affect important market developments in price changes in the short term.” “Recently Rejected SAB 121 Making banks can host Bitcoin may release new institutions, and at the same time add more market expectations for the guessing of the Bitcoin Strategic Reserve announcement. ”

The voter is likely to hedge the risk of downrinking, either at the uncertainty of President Donald Trump’s inaugural ceremony.

The maximum pain price is where the buyer suffers the greatest loss, and the other side of the transaction is the largest. As the expiration is approaching, the price usually tends to the maximum pain, which means that it will monitor $ 98,000 within the next week.

“The BTC options of next week represent a significant event, because about 74,000 contracts have expired. The opening interest of BTC options is now US $ 28 billion, of which 7.8 billion US dollars will expire, about 22.6, about 22.6 % Of the box office (ITM) (ITM) is about 22.6 % (ITM) Strijers said: “It may trigger the Delta shedding in the market.

DVOL is a bias index that tracks Bitcoin’s hypothyroidism (IV). CoindeSk Research It has been pointed out that because Bitcoin broke into a new historical high, IV reached the highest level on January 20.