BBC News

BBC Indonesian

Getty Images

Getty ImagesVietnamese entrepreneur Hao Le saw the opportunity when U.S. President Donald Trump reached tariffs on tariffs during his first term.

His company is one of hundreds of companies whose exports are increasingly subject to Western restrictions.

Located in Hai Duong’s emerging industrial hub, LE’s SHDC electronics sells $20 million (£1.5 million) of telephone and computer accessories to the United States every month.

But if Trump imposes a 46% tariff on Vietnamese goods, income may dry up. Currently suspended plans Until early July. That would be “disaster to our business”, Le said.

He added: “We cannot compete with Chinese products.

Trump’s 2016 tariffs sent cheap imports originally designed to the United States into Southeast Asia, harming many local manufacturers. However, they have also opened new doors for other businesses, often global supply chains, and they want to reduce their dependence on China.

But Trump 2.0 threatens to close those doors. This is a blow to fast-growing economies such as Vietnam and Indonesia that have become key players in the industry from bargaining chips to electric vehicles.

They also find themselves trapped between the world’s two largest economies – China, a strong neighbor and its largest trading partner, and the United States, a key export market, which may hope to reach a deal with Beijing’s fees.

Getty Images

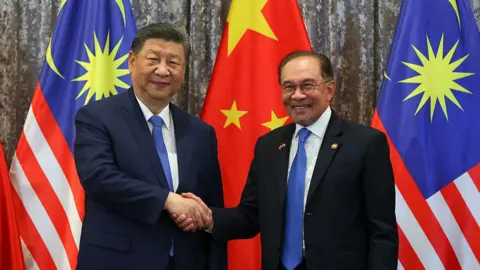

Getty ImagesChinese President Xi Jinping has been visiting Vietnam, Malaysia and Cambodia this week, urging tariffs to unite with Trump. The trip has long been planned, but considering the importance of East Asia to China’s economy.

China received a record $3.5TN in exports in 2024 – with 16% export volumes, which is to Southeast Asia, making it the largest market.

Malaysia’s Trade Minister Tengku Zafrul Aziz told the BBC ahead of XI’s visit on Tuesday: “We can’t choose, we will never (choose between China and the United States).

“If the question is about something we believe is against our interests, then we will protect (our ourselves).

A wake-up call

exist Trump announces his full tariffs a few days laterSoutheast Asian governments compete for trading models.

Trump calls it a “very productive call” from Vietnam’s leaders to Lin, who proposed to completely abolish tariffs on U.S. goods.

The U.S. market is crucial to Vietnam as a new electronics and electricity company. Taiwanese companies’ manufacturing giants, like Samsung, Intel and Foxconn, have signed stores to make iPhones.

Meanwhile, Thai officials traveled to Washington, with plans including higher U.S. imports and investments. The United States is their largest export market, so they want to avoid Trump’s possible return to Thailand’s 36% tax.

“We will tell the U.S. government that Thailand is not only an exporter, but an ally and economic partner that the U.S. can rely on for a long time,” Prime Minister Paetongtarn Shinawatra said.

The Association of Southeast Asian Nations (ASEAN) ruled out retaliation against Trump’s tariffs, but chose to emphasize its economic and political significance to the United States.

Getty Images

Getty Images“We understand the concerns of the United States,” Mr Zafrul told the BBC. “That’s why we need to prove that we are actually the bridge to our ASEAN, especially Malaysia.”

This is where Southeast Asia’s export-driven economies play a great role – they benefit from trade and investment in China and the United States. But the taxes that Trump suspended could undermine that.

Indonesia, which could face 32% tariffs, is home to huge nickel reserves, has its eyes on the global electric vehicle supply chain. Malaysia is preparing to become a semiconductor hub, which could be subject to a 24% tariff.

Cambodia is a Chinese ally facing the steepest tax: 49%. It is one of the poorest countries in the region, and it is a thriving multinational hub targeting Chinese businesses trying to comply with U.S. tariffs. Chinese companies currently own or operate 90% of clothing factories, mainly exporting to the United States.

Doris Liew, an economist at the Malaysian Institute for Democracy and Economic Affairs, said Trump may have paused on these tariffs, but “the damage has been done.”

“This is a wake-up call for the region, not only to reduce dependence on the United States, but also to rebalance any single trade and export partner.”

China’s losses and Southeast Asia’s gains

During these uncertain times, Xi Jinping made a firm message: Let’s join hands, Resist “bullying” from the United States.

This is not an easy task, as Southeast Asia also has trade tensions with Beijing.

In Indonesia, business owner Isma Savitri fears Trump’s 145% tariff on China means more competition from Chinese competitors that can no longer be exported to the United States.

“Small businesses like us feel squeezed,” said the owner of pajama brand Helopopy. “We are struggling to deal with the fierce attacks of super cheap Chinese products.”

One of Helopopy’s popular pajamas costs $7.10 (119,000 Indonesian Indonesia). Isma said she has seen similar designs in China at about half the price.

“In nearby Southeast Asia, with open trading systems and fast-growing markets naturally become dumps,” said Nguyen Khac Giang, visiting researcher at the Iseas Yusof-Ishak Institute in Singapore. “Politically speaking, many countries are reluctant to face Beijing, which adds another layer of vulnerability.”

Getty Images

Getty ImagesWhile consumers welcome Chinese products that compete for price (from clothes to shoes to mobile phones), thousands of local businesses cannot match such low prices.

More than 100 factories in Thailand have closed monthly for the past two years, according to estimates by the Thai think tank. The local trade association said that during the same period in Indonesia, about 60 apparel manufacturers closed about 250,000 textile workers, including Sritex, which was once the largest textile manufacturer in the region.

“When we see the news, there are a lot of imported products that flood the domestic market, which puts our own market in a difficult situation,” Mujiati, a worker fired from Sritex in February, told the BBC.

“Maybe it’s not our luck,” the 50-year-old said, still looking for a job. “Who can we complain to? No one.”

The Southeast Asian government responded with a wave of trade protectionism as local businesses were asked to avoid the impact of Chinese imports.

Last year, Indonesia considered 200% tariffs on a range of Chinese goods and blocked the e-commerce website Temu, a popular among Chinese merchants. Thailand tightened inspections on imports and taxed goods worth less than 1,500 Thai baht ($45; £34).

This year, Vietnam imposed two temporary anti-dumping duties on Chinese steel products. Vietnam will reportedly crack down on Chinese goods transferred to the United States through its territory, following Trump’s latest tariff announcement.

Getty Images

Getty ImagesThese fears will be on this week’s agenda.

China is concerned about transferring its exports from Americans from the rest of the world to the rest of the world, and its trading partner David Rennie, former director of Beijing economist David Rennie, told the BBC’s Newshaw.

“If the tide waves of Chinese exports end up flooding these markets and hurting jobs and jobs… it’s a huge diplomatic and geopolitical headache for Chinese leaders.”

China does not always have a relaxed relationship with the region. Unless Laos, Cambodia and war-ridden Myanmar, others are wary of Beijing’s ambitions. Relations between southern China and the Philippines deteriorated. This is also a problem for others like Vietnam and Malaysia, but trade has always been a balance factor.

But that may change now, experts say.

Getty Images

Getty Images“Southeast Asia must consider whether they really want to offend China,” said Chong Ja-ian, associate professor at the National University of Singapore.

China’s losses may be the harvest of Southeast Asia.

Hall of Vietnam said he has seen a surge in inquiries from U.S. customers to search for new electronic suppliers outside China: “In the past, U.S. buyers will spend months converting suppliers. Today, these decisions are made within a few days.”

Malaysia has a vast rubber plantation and the world’s largest manufacturer of medical rubber gloves, with nearly half of the rubber glove market. But it is expected to gain a larger share from its main rival China.

Like most parts of the world, the region still faces a benchmark tariff of 10%. That’s bad news, said Oon Kim Hung, president of the Malaysian Rubber Glove Manufacturers Association.

But even if the suspended tariffs are launched, customers will find that the additional 24% paid on Malaysian gloves is preferable to 145% tax, and they will be tempted to cough up the gloves made in China.

“We are not very happy to jump, but it is likely to benefit our manufacturers as well as manufacturers in Thailand, Vietnam and Cambodia.”

Other reports by Bui Thu and Tessa Wong