From OMKAR Godbole (Unless otherwise explained)

The cryptocurrency market showed a stable sign, and Bitcoin was restored to $ 102,000, and positive signals related to Nasdaq are related to the futures. The leading recovery rate in major cryptocurrencies was XRP, an increase of 11 %, followed by SOL increased by 7 %. The release of AI coins violently on Monday was as high as 4 %.

The suspicion of the claims of Chinese technology startup DeepSeek may support risk emotions. The claim only costs $ 6 million to develop its competitors to participate in ChatGPT. Critics speculate that the figures are omitted with the costs related to the early research and experiment, algorithm and data experiments. In addition, one is rooted in Jiewenzong Paradox It shows that the improvement of efficiency usually leads to an increase in usage rather than reducing consumption, which leads to a positive growth of the industry.

This is good news for Bitcoin and a broader cryptocurrency industry, because they are consistent with our outstanding narrative narrative, especially considering President Trump’s friendly position on cryptocurrencies and plans to establish strategic digital assets reserve.

When it comes to strategic reserves, the Arizona MPs have proposed a bill, which will allow government entities or public funds to invest in 10 % of Capital of Bitcoin and other digital assets.

The broader prospects still rise, the data on the chain points to the lack of successes, and continue to accumulate large investors.

“According to encrypted data, the share of investors who purchase coins in the past 155 days have increased from 43 % to 60 %, which reflects the emergence of large -scale participants in optimism,” said Alex Kutsikevich. FXPRO’s market analyst.

QCP Capital is expected to test the correlation between BTC and stock this week, especially because the favorable regulatory environment provides potential support. Keep alert!

What to see

- encryption:

- January 28, 1:00 pm: Hedera (HBAR) network upgrade (V0.57.5).

- January 29: Cardano’s Plomin Hard Fork network upgradeEssence

- January 29: Ion network (ION) Mainnet launchEssence

- February 2nd, 8:00 pm: Core blockchain Athena hard fork network upgrade (V1.0.14)

- February 4: Micro (MSTR) Q4, 20024 fiscal revenueEssence

- February 4: Pepsi (PEPE) halvedEssence At 400,000 yuan, the reward will drop to 31,250 PEPE.

- February 5th, 3:00 pm: Boba Network’s new World hard fork network upgrade For L2 main network based on Ethereum.

- February 6, 8:00 am: SHENTU chain network upgrade (V2.14.0).

- February 12: Hut 8 Corp. (cabin) Q4 2024 returnsEssence

- February 15: Qtum (QTUM) Hard fork network upgrade In 4,590,000 neighborhoods.

- February 18 (after the market is closed): SEMLER Scientific (SMLR) Q4 2024 returnsEssence

- February 20: Coinbase Global (Coin) Q4 2024 returnsEssence

- Magnificent

Token

- Governing voting and telephone

- Morpho DAO votes in all assets and the network whether to reduce the Morpho reward by 30 % and set all assets as assets other than assets with ETH or USD factions to have the same reward rates with the same assets as BTC.

- Sky Dao voted on Sparklend Ethereum whether to reduce the WBTC clearing threshold from 55 % to 50 %.

- Yearn Dao is voting whether to fund and recognize Bearn. This is a new Subdao, which aims to build and launch products on Berachain.

- Unlock

- January 28: Tribl unlocked 14 % of its circular supply at $ 60 million.

- January 31: Optimism (OP) unlocked 2.32 % of cyclic supply, worth $ 52.9 million.

- January 31st: Jupiter (Jup) unlocked 41.5 % of cyclic supply at a value of $ 626 million.

- February 1: SUI (SUI) unlocked the circular supply of about 2.13 % for $ 226 million.

- Token list

- January 28th: Pudgy PENGUINS (PENGU) and Magic Eden (ME) will be listed on Kraken.

- January 29: Cronos (CRO), movement (mobile) and usually listed on Kraken (usually).

Meeting:

Tokens

Shaurya Malwa

- The Venice AI (VVV) centered on artificial intelligence was zoomed in a market value of $ 1 billion on Monday. Its appeal was for personal personnel. Unconducting costs were provided with unchanged AI reasoning visits.

- Basic tokens are listed on Coinbase, which is one of the rare assets listed on the exchanges on the same day-this may help promote this move.

- The user interests VVV tokens to obtain the access permissions of the AI Stalwart Deepseek and get the continuous reward of token emissions.

Derivative

- On Monday, the opening interest of CME Bitcoin and Ether Futures on Monday fell, because traders developed their disease during the sharp slip of NVIDIA and other Nasdaq stocks.

- The permanent financing rate of major coins has stabilized within the range of 5 % -10 % of the year. Earlier on Monday, BTC’s funding rate briefly turned below zero.

- The call of BTC is higher than the dial -up in all timetables, and the front end of ETH makes the trade price higher, which reflects concerns about the decline in the next few days.

Market change:

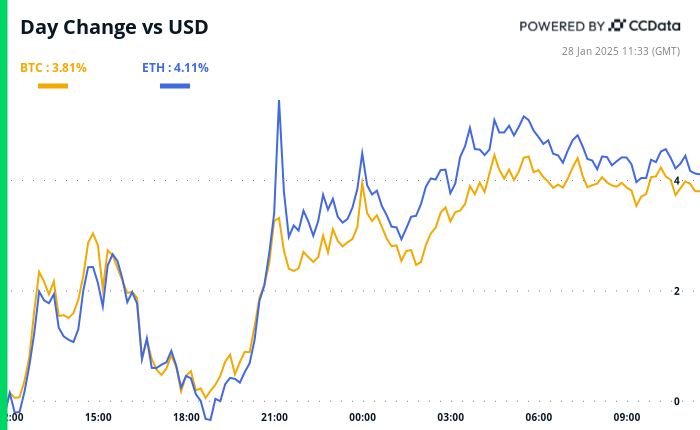

- BTC rose 1.32 % from 4 pm on Monday to $ 98,784.45 (24 hours: +4.07 %)

- ETH rose 1.62 %, $ 3,050.20 (24 hours: +4.52 %)

- Coindesk 20 rose 3.2 % to 3,536.28 (24 hours: +6.73 %)

- CESR comprehensive discharge rate rose 18 BPS to 3.19 %

- BTC’s financing rate is 0.0084 % (9.2221 % annualized) two people

- DXY rose 0.57 % at 107.95

- Gold rose 0.34 %, $ 2,743.59/ounce

- Silver rose 0.35 % to $ 30.16/ounce

- Nikkei 225 Close-1.39 %, accounting for 39,016.87

- HANG Seng Close+0.14 % to 20,225.11

- FTSE rose 0.58 % to 8,553.75

- Euro STOXX 50 rose 0.47 % to 5,212.71

- DJIA closed+0.65 % to 44,713.58 on Monday

- S & P 500 closed -1.46 %, accounting for 6,012.28

- Nasdaq closed -3.07 %, 19,341.83

- S & P/TSX Comprehensive Index closed -0.7 % on 25,289.15

- S & P 40 Latin America is closed+0.34 % to 2,330.61

- The 10 -year Treasury Department in the United States has increased 3 basis points to 4.57 %

- E-Mini S & P 500 futures rose 0.39 % at 6070.50

- E-Mini NASDAQ-100 futures rose 0.67 % to 21,400.25

- E-Mini Dow Jones Industrial Average Futures has not changed to 44,935.00

Bitcoin statistics:

- BTC advantage: 59.16 (0.15 %)

- Ethereum and Bitcoin ratio: 0.031 (-0.32 %)

- Hash (7 -day mobile average): 767 EH/S

- Hashprice (spot): $ 58.7

- Total expenses: 6.13 BTC/ $ 616,619

- CME Futures Opening interest: 170,240 BTC

- BTC price is gold: 37.6 ounces

- BTC and Gold Market Lottery: 10.68 %

Technical analysis

- ETH carved a candle, and the tail was long on Monday. This is usually regarded as a significant sign of the upcoming trend.

- However, the price is still trapped in the decline channel, indicating that the prospects of the drop are shown.

Encrypted stock

- MicroStrategy (MSTR): Closed on Monday at $ 347.92 (-1.63 %), down 0.36 %, and the price is $ 346.66.

- Coinbase Global: It closed at $ 277.99 (-6.71 %), and the $ 280.11 in the pre-market rose 0.76 %.

- Galaxy Digital Holdings (Glxy): Chable closed at 27.36 Canadian dollars (-15.87 %).

- Mara Holdings (MARA): It closed at $ 18.28 (-8.53 %), and $ 18.40 in the pre-market rose 0.63 %.

- Riot Platforms (RioT): The closing price was $ 11.45 (-15.44 %), a decrease of 6.87 %, and the price was $ 12.61.

- Core Science (CORZ): The closing price was $ 11.28 (-29.41 %), and the pre-sale sales rose 2.22 % to $ 11.53.

- Cleanspark (CLSK): $ 10.31 (-10.62 %) rose, and $ 10.43 on the market rose 1.21 %.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): It closed at $ 20.78 (-20.75 %), down 3.99 %, and priced at $ 21.61.

- SEMLER Scientific (SMLR): Closed at $ 50.43 (-9.07 %).

- Egyptian Movement (Out of Egypt): The closed price is $ 74 (+20.82 %) and has not changed in the pre -market.

ETF stream

ETF stream

Spot BTC ETF:

- Daily net traffic: -457.6 billion US dollars

- Cumulative net flow: $ 39.49 billion

- BTC’s total shares are about 1.157 billion.

Point ETH ETF

- Daily net traffic: -136.2 million US dollars

- Cumulative net flow: $ 2.67 billion

- ETH in total is about 3.59 million.

source: Farside investor

Overnight

Daily chart

- On January 18, when Trump’s token debut and triggered a commemorative factor crazy, the daily transaction volume of Diversified Exchange based on Solana had dropped sharply to $ 1 billion.

- However, the amount of activity in November and December still increases.

When you sleep

- Kucoin accused Doj after pleading guilty to pay nearly $ 300 million in fines (Coindesk): The cryptocurrency exchanges KUCOIN confession for the transfer of unlicensed currency transmission business, agreed to pay a fine of US $ 297 million and withdraw the United States for two years.

- Tuttle Capital (Tuttle Capital (Coindesk): Tuttle Capital Management proposed to SEC for 10 twice leverage encrypted ETF proposals, including people who track members of Trump and Melania.

- Crazy Jim Cramer (Coindesk): On Monday’s crazy money, Jim Cramer recognized Bitcoin and warned MicroStrategy, the largest company Bitcoin holder. Critics often explain his suggestions as indicators against the trend.

- Ripple’s CEO Brad Garlinghouse Bats are used for diversified US encryption reserves (Coindesk): Ripple CEO Brad GarlingHouse supports American digital asset reserves representing multiple tokens, not just Bitcoin, called BTC maximum “encrypted enemies”.

- Previous facade manufacturer said (Reuters): Makoto Sakurai, a member of the Bank of Japan, predicted that the bank will raise interest rates again in mid -2025, with a target of 1.5 % within two years.

- When Trump re -entered the agenda threatening, the US dollar climbed (Bloomberg): The US dollar redeem the main currency, and the yen rate has decreased by 0.9 %. President Trump and Treasury Minister Scott Bessent re -ignited the concerns of tariffs.

- As Chinese Deepseek destroys global races, Openai’s Altman vowed to “better model” (“Financial Times”): On Monday, OPENAI CEO Sam Altman responded to the production of Deepseek’s AI competitors by promised to accelerate the release of the product and provide excellent models.

Ether